Euro took advantage of the US market sell-off

February 26, 2020 @ 12:27 +03:00

The world market could not resist the new wave of sell-off on Tuesday. Major U.S. indices showed the second consecutive trading session with a 3% decline. European indices also received a mighty blow at the end of the European trading session.

However, the dynamics of Asian markets look calming again. Indices have been rising at the start of the day. However, it appears more like a fluctuation near the bottom than a reversal towards growth. On this basis, it is worth paying particular attention to the dynamics of the currency market, in particular its central pair – EURUSD.

The euro rose against the dollar following the results of the previous three trading sessions, gaining the support of buyers after the drop below 1.08. On Wednesday morning, the euro traded at $1.0870. However, it is worth noting a cautious reversal of intraday highs around 1.0890 last evening.

Since the beginning of the month, concerns around the coronavirus were associated with increased demand for dollars against the euro as the European economy seemed more vulnerable to the slowdown of China. So what has changed?

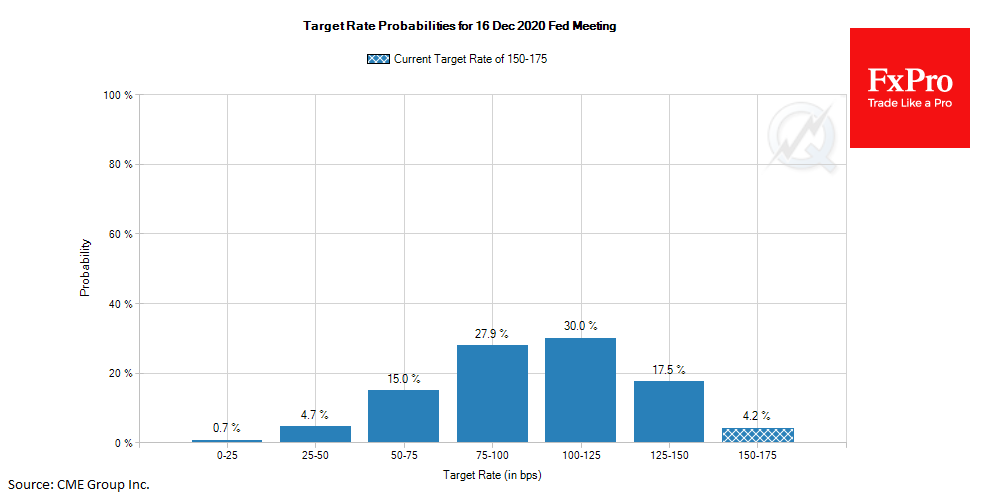

The prospects for interest rates. Since last week, markets aggressively priced in the Fed’s rate cuts later this year. According to FedWatch from CME, there is a near certainty probability of the rate cuts in the coming months.

As a result, the yield of 10-year Treasuries updated historic lows at 1.31%. 30-year bonds have been updating their yield lows for several days now. Extremely low yields for long-term bonds reduce the demand for the dollar. Yields on European government bonds, for example, German government bonds, are also declining but still above their lows of last year, avoiding a serious revaluation.

Besides, it is not yet expected that the ECB will make the same rapid transition to policy easing as the Fed. This makes EURUSD temporarily attractive for buyers amid weakening world markets.

It won’t be wise to call the euro a safe-haven these days. However, as long as the U.S. debt market is experiencing significant revaluation of long-term expectations, the euro has a chance to form a rebound from recent extremums with potential to recover to 1.10 this week and 1.11 by the end of March.

This rebound will continue to fit into the long-term downtrend of the pair, so it may not encounter much resistance in the early stages.

The FxPro Analyst Team