Euro collapsed to 20 months minimum on ECB

March 07, 2019 @ 20:55 +03:00

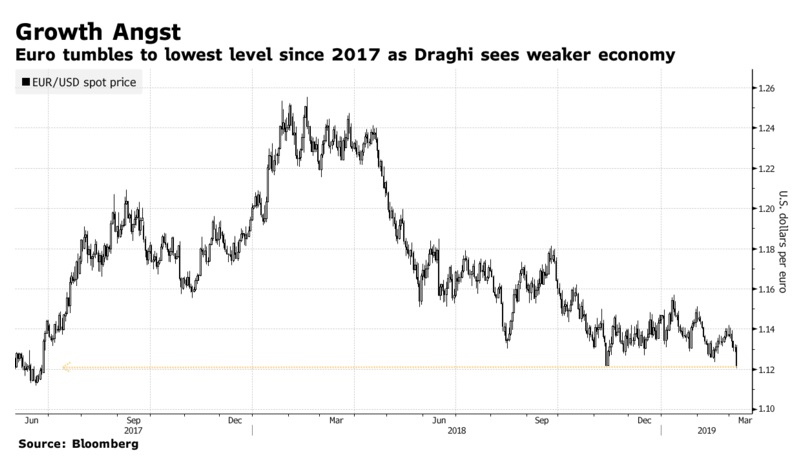

The euro fell to its weakest level versus the greenback since June 2017 after European Central Bank President Mario Draghi downgraded the outlook for the region’s economy and promised more support, while the dollar surged to its highest level this year.

The ECB’s decision to deliver fresh stimulus comes a day after the Bank of Canada dialed back its expectations for policy tightening, and Draghi is part of a growing chorus of central bankers around the globe pivoting toward more accommodative policy. While the Federal Reserve has also shifted to a less hawkish stance, bond yields in the U.S. remain higher than in other developed markets, maintaining the dollar’s allure.

The euro plunged as much as 0.9 percent to 1.1206, the weakest level since June 2017. The U.S. currency rose against most of its Group-of-10 counterparts Thursday and the Bloomberg Dollar Index climbed as much as 0.5 percent to its highest level since December.

With market volatility still relatively low, the dollar has proven to be one of the favored destinations for investors doing carry trades, which involve borrowing in a lower yielding currency and putting those funds to work in a market that has higher yields. On the flip side, the euro is seen by many as a good source of funding for those kinds of trades, and stimulatory moves by the ECB could provide ongoing support for that dynamic.

The yield on the 10-year Treasury was around 2.65 percent Thursday, compared with 1.78 percent for similar Canadian debt and 0.07 percent for equivalent German bunds. Draghi said on Thursday that the euro-zone economy will now expand only 1.1 percent this year, a drop of 0.6 percentage point from the forecast given out just three months ago. A package of assistance from new loans for banks to a longer pledge on record-low rates is intended to expand the institution’s existing stimulus, he said.

Euro Plunges to 20-Month Low on ECB, Bloomberg, Mar 07