Ethereum fundamentals signal $2,000 ETH price is closer than it seems

February 16, 2021 @ 14:56 +03:00

In the early hours of Feb. 15, Ether (ETH) price plunged to $1,660, followed by a 9% recovery within 10 hours. The move triggered $280 million in futures contracts liquidations, indicating excessive leverage from longs. Although the initial anxiety regarding CME’s ETH futures launch on Feb. 8 seems to have faded, sustained excessive transaction fees might have undermined investors’ confidence. Nevertheless, the fundamentals behind Ethereum remain solid, indicating ETH price should promptly recover from eventual dips.

Even though the above metric might be interpreted positively, not every user can afford a $12 fee. A simple token swap on decentralized exchanges (DEX) can cost hundreds of dollars in gas fees, leaving small traders no choice but to abandon the network. Multiple proponents are testing sharding and layer-two solutions to circumvent this issue, including Skale and Optimistic Network. Eth2 will use sharding to split the blockchain into several parts and increase the number of transactions the network can process at once.

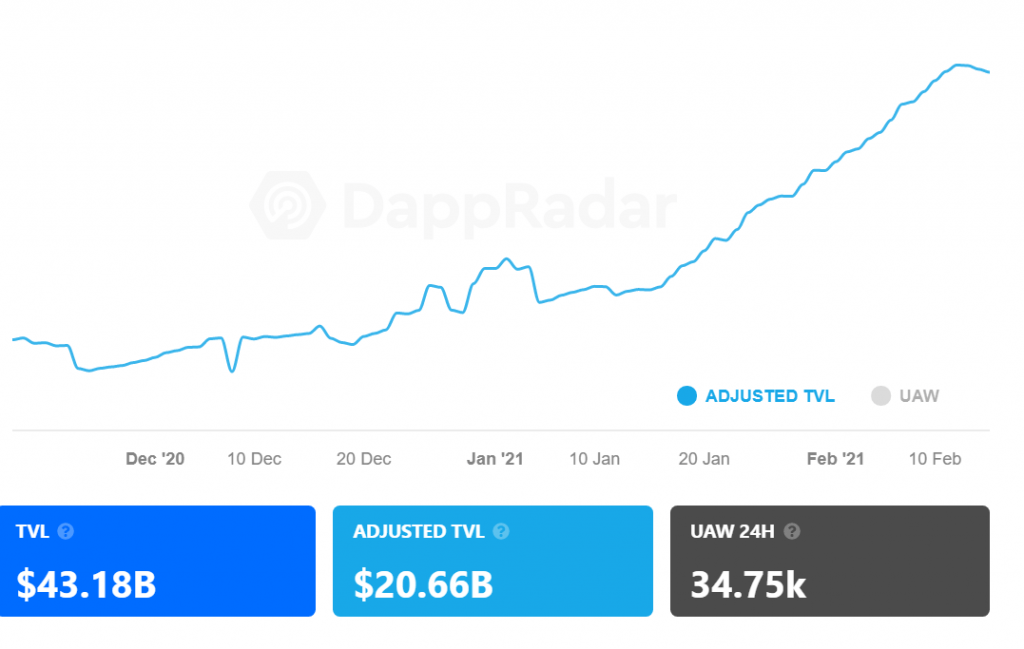

The phenomenal growth of total value locked (TVL) in decentralized finance projects can’t be disregarded. The adjusted metric attempts to clean readings from ETH price increases, therefore providing more reliable data.

As depicted above, the 34% increase over the past 30 days falls in line with ETH’s 38% gain in February. Regardless of the transaction fees, there is still value created by automated market-making pools and staking mechanisms.

To better understand whether the recent crash reflects a potential local top and subsequent downtrend movement, one needs further data. Besides price action and technical analysis, investors should also gauge on-chain metrics such as network use. An excellent place to start is analyzing transactions and transfer value. Coin Metrics data shows the 14-day average transactions and transfers rallying above $9 billion in daily transactions, a 32% increase from the previous month. This significant increase in transaction and transfer value signals strength and suggests that Ether’s price is sustainable at the current levels.

Ethereum fundamentals signal $2,000 ETH price is closer than it seems, Cointelegraph, Feb 16