Ethereum (ETH) Price Hits 2-Year High

September 01, 2020 @ 15:23 +03:00

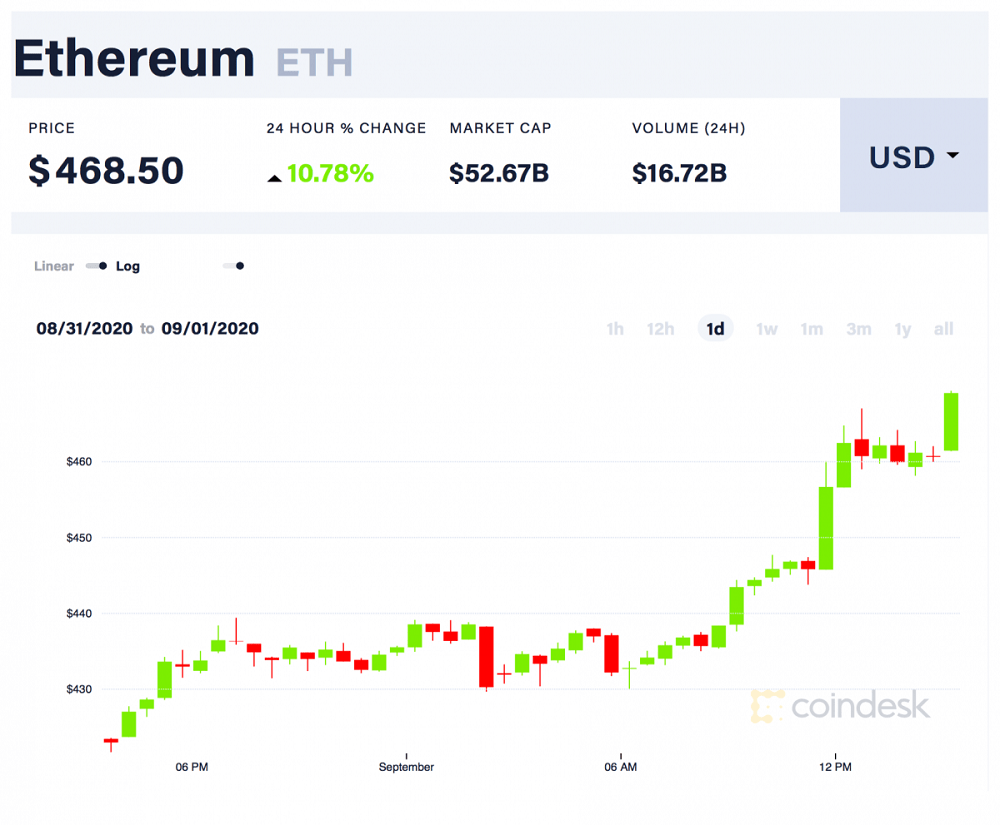

The native cryptocurrency of the Ethereum blockchain, ETH was trading at $470 at press time – a level last seen in July 2018. Prices are up more than 100% this quarter alone, according to CoinDesk’s ether price index. As ether rose by 10% in the past 24 hours, bitcoin added 3% and is currently trading near $11,940. Other prominent coins from the CoinDesk 20, like XRP, Stellar XLM, litecoin, bitcoin cash, and Chainlink’s LINK token, have all rallied by 2%-5% in the past 24 hours.

Investors may be entering the crypto market via ether and decentralized finance protocols rather than bitcoin, which served as a gateway to crypto markets during the 2017 bull run, Peters said. On-chain metrics suggest ether’s price rally has legs. To start with, exchange deposits – the number of coins held in exchange addresses – declined to 17.99 million ETH on Monday, the lowest level since March 11, according to data source Glassnode.

Exchange balances have also reduced by over 5% in the past four weeks. Investors typically move coins off exchanges to their own wallets when they expect prices to rally. Additionally, the recent price gains look to have been fueled by strong hands.

The options market, too, is biased bullish on ether with the one-, three- and six-month put-call skews hovering below zero, according to data provided by the crypto derivatives research firm Skew. That’s a sign of call options, or bullish bets, drawing higher prices than puts, or bearish bets.

Put-call skews have declined sharply today with ether’s rise to fresh two-year highs above $450. Markets now expect ether to face increased volatility over the next four weeks, with one-month implied volatility increasing from 77% to 91% early Tuesday.

Ether Price Hits 2-Year High, CoinDesk, Sep 1