Elections and coronavirus fears are driving away investors from the US

October 20, 2020 @ 11:57 +03:00

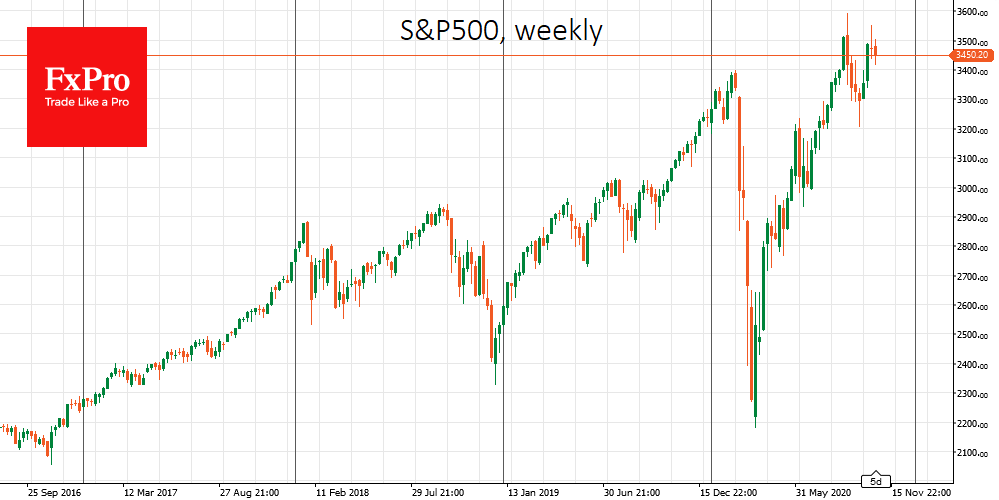

Asian indices are under pressure on Tuesday morning, markets continue to pull into safety assets after the S&P500 fell 1.6% on Monday, the biggest fall in the last two weeks. Futures on the S&P500 declined further in the last five trading sessions, losing momentum after the September correction.

It seems that investors are already beginning to prepare for market volatility before the elections, trying to move into protective financial instruments. These same forces are supporting the weakening of the dollar.

Trump lags behind Biden in the polls, but this gap was also present four years ago, so the outcome is still uncertain. However, there are a couple more reasons to be careful with stocks now.

Firstly, there are growing fears that the medical system may stall again due to the second wave of coronavirus, leading to a sharp rise in death outcomes and forcing the governments to close economies again. This promises to spill over into market turbulence, which could overwhelm investors’ pre-election anxiety.

Secondly, one Fed representative, Rafael Bostick, noted that recovery is weak or non-existent in some parts of the economy. He said that some of the labour market losses would never be recovered and economic stratification will increase due to the uneven recovery.

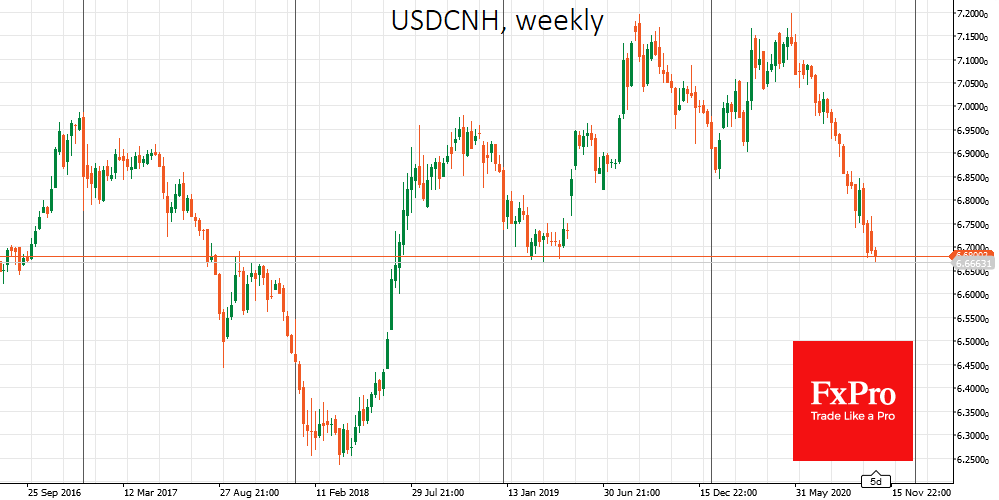

Under these circumstances, we get a relatively rare combination of simultaneously softening dollar US stock markets. Often, the weakening USD spurred demand for equities as insurance against the loss of capital. However, we cannot rule out that we will see a simultaneous outflow of US assets in favour of Asia again and again.

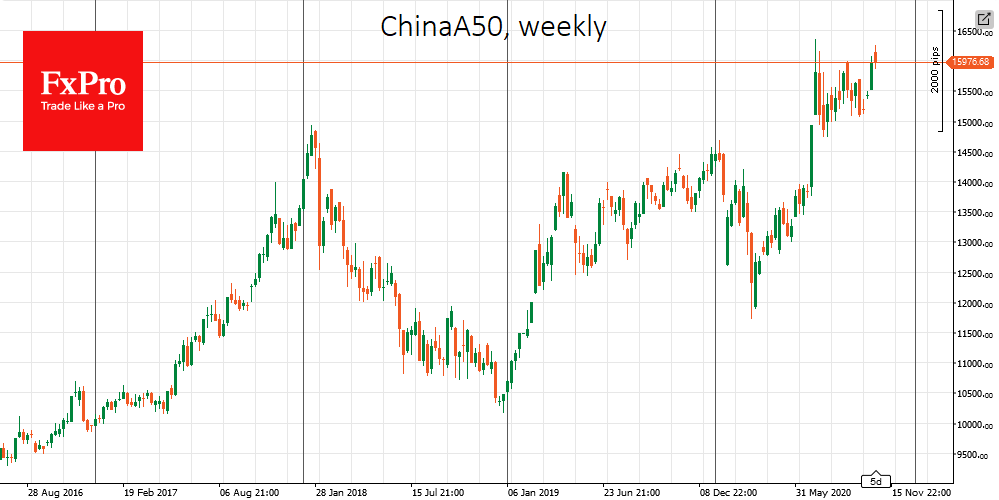

It is easy to see that despite a whole week of weakening US indices and the easing of the monetary policy of the People’s Bank of China, the USDCNH continues to look to the bottom. Earlier this morning, the dollar was down to 6,665, its lowest value since July 2018, developing a five-month RMB rally. It is noteworthy that this does not harm the Chinese stock market, where the China A50 blue-chip index rose 25% in addition to the 7% increase in the renminbi. Hence, in USD terms, it is more than 32% over this period.

The difference is due to the great success of China and Asia in the fight against coronavirus, leading to a faster recovery of domestic demand and industry. Besides, China and several developing countries have a lower debt burden, i.e. they retain more space to stimulate the economy, which attracts investors.

If so, we are already seeing the first signs of tectonic shifts in financial markets in favour of developing countries and countries with strict fiscal discipline, which will trigger a new multi-year wave of weakening dollars and rising commodity prices.

The FxPro Analyst Team