ECB tries to draw a line under the euro weakening

September 09, 2022 @ 10:34 +03:00

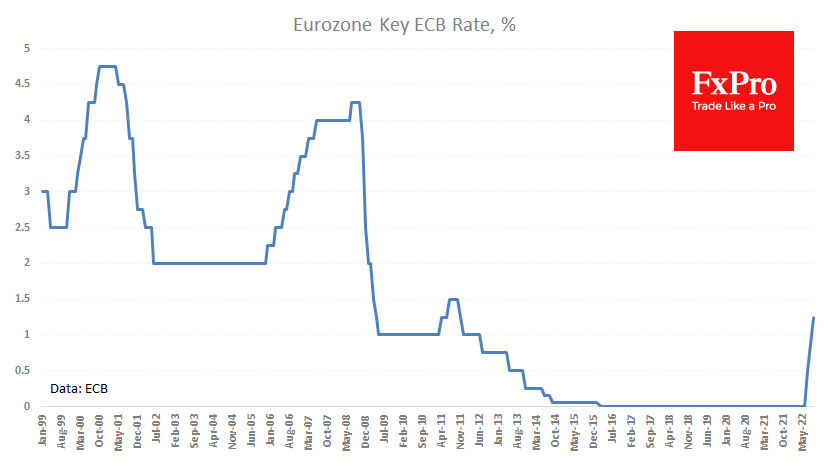

The European Central Bank, at the end of its regular meeting, raised the interest rate by a record 75 points after increasing it by 50 in July. The move was almost entirely priced into the debt market, as Bank officials have been pushing expectations in that direction for the last couple of weeks.

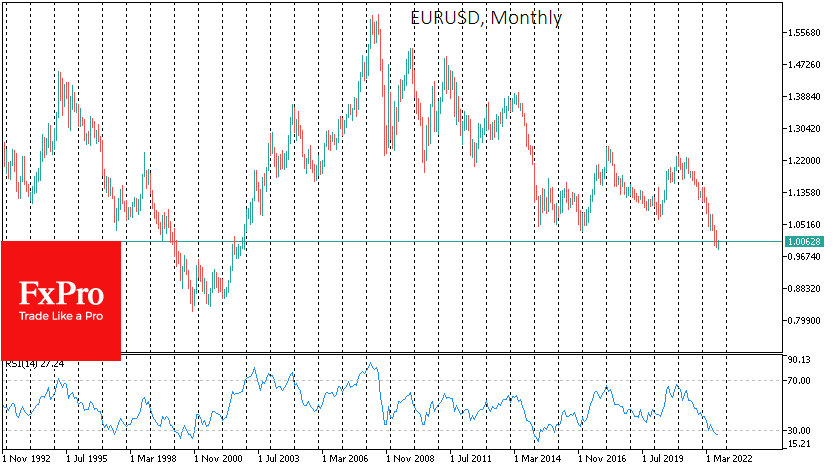

Perhaps that’s why the historic move for the ECB triggered merely a short-term “sell the facts” reaction, taking EURUSD shortly 1% off the intraday highs. As a result, the pair is back below 1.0, although it has regained just under half of its rally from yesterday’s lows.

But one should not underestimate the hawkishness of the regulator’s tone that could bring back support for the single currency. At the very least, cushion its fall.

ECB president Christine Lagarde announced that the weak euro is pushing up inflation, which is the most direct statement on the FX subject. She also warned that even sharper rate hikes are possible in the future.

Amongst the signals of ECB expectation management, there is an indication that the rate could rise at the following five meetings and that the next two meetings will end with rate hikes.

It may be too early to tell, but the ECB may have unambiguously switched to vigilance mode regarding inflation, as was the case before Draghi’s reign in the ECB’s top position. Perhaps correctly, it should have been done about a year ago. By moving too late, the ECB will have to cope with more considerable tail effects and be forced to raise the rate higher than would have been necessary with timely measures.

Either way, we are seeing clear attempts to draw a line under the weakening of the euro. It cannot be ruled out that this will take the bears out of the rhythm who have managed to push the EURUSD down almost every month since June 2021. The very close case we saw in 2000, and then the ECB managed to win a couple or three months but not reverse the trend. There was a need for significant FX intervention to make the trend reverse.

The FxPro Analyst Team