FxPro: Dollar grows for 7th session, supported by strong data and hawkish Fed rhetoric

October 04, 2018 @ 11:24 +03:00

The fire around the budget of Italy have gone away, but it does not spare the common currency from weakening against strong U.S. data. The agreement of the Government of Italy to reduce the budget target to 2.0% in 2020-2021 has returned a cautious demand for this country’s bonds, has supported the shares of eurozone banks, and provided temporary support for the single currency. The EURUSD pair initially has tried to return above 1.1600. However, macroeconomic trends have been stronger than a short-term impulse. The U.S. economy continues to show a strong growth and receives cheering comments from FOMC policymakers, including its chairman Powell.

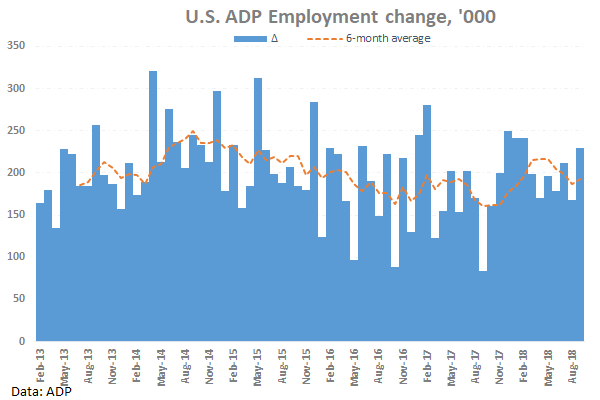

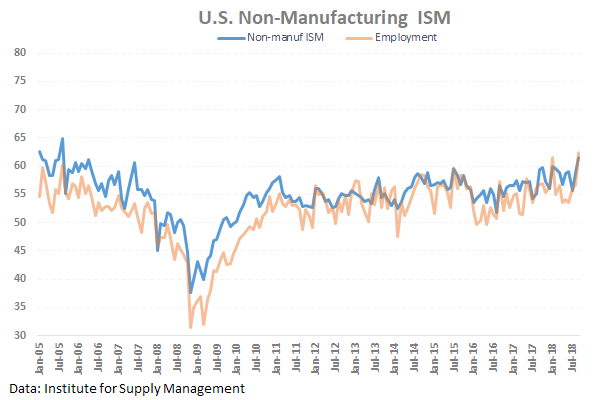

ADP published data on the employment in the private sector that showed the job growth by 230K, to 6-month maximum. In September, ISM services survey has noted the strongest growth of the sector since 1997 . The indicator of the manufacturing industries activity has slightly moved away from its perennial highs achieved last month.

As a result, the US dollar went into growth in the afternoon, adding to the most of major currencies. The dollar index added 0.7% on Wednesday despite the initial weakness in the first hours of trading. As a result, the dollar index is rising for the seventh consecutive session, rising to the maximum since August 20th.

The common currency slipped into the 1.1470 area, the fall accelerated at night after having taken a significant psychological mark of 1.1500. Another statement by Fed’s Powell supported the dollar at the end of the day on Wednesday. He noted that Fomc was ready to raise the rate above the neutral level if the U.S. economy would continue to grow steadily.

These comments are considered as hawkish by markets participants, calling for the strengthening of the American currency purchases and the yield growth for the USA bonds.

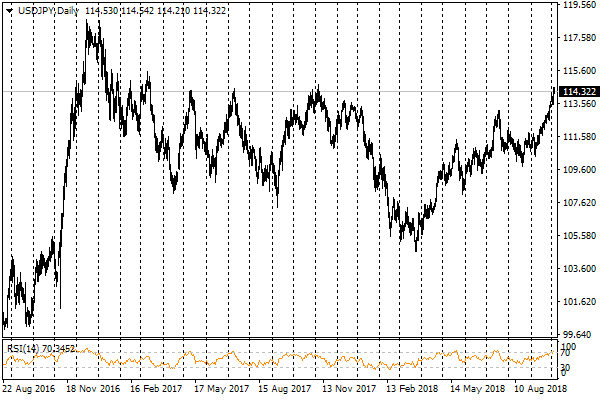

The growth of the dollar and positive sentiments in the markets due to strong data have caused a USDJPY growth to fresh 11-month highs near 114.50. It should also be noted that this area served as an important resistance in the period from March to November 2017, which increases the interest in the development of events in the pair at these levels.