Dollar consolidates expecting possible rally

August 08, 2018 @ 10:40 +03:00

Financial markets rise on positive sentiments about earnings and China’s fiscal stimulus. That pushed down the demand for USD, but more likely it is just a step back before the jump.

American indices added yesterday on strong earnings reports, where tax cuts were favourable for profit. Asian indices in the morning add on speculation that China will protect local companies from the trade conflict with the U.S. through fiscal stimulus. Besides, the restrictions on speculation introduced by Beijing a few days ago had a positive impact on Chinese bourses and the yuan. As a result, The Renminbi increased by more than 1% to U.S. Dollar.

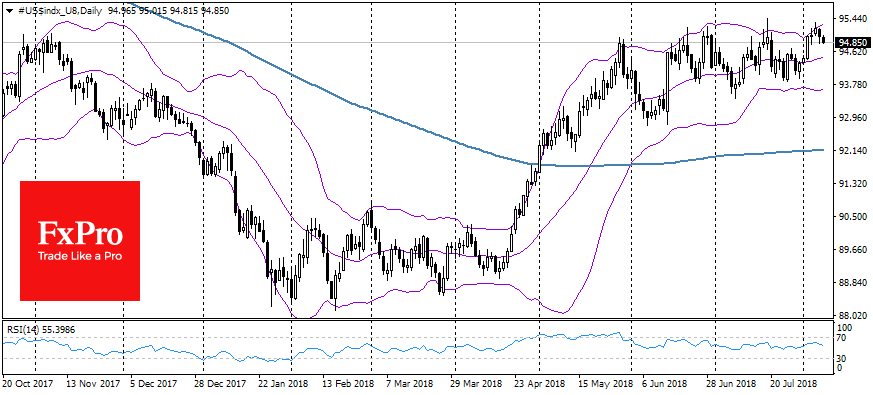

Globally, the dollar recedes this week and turns lower from the important resistance levels. The dollar index has turned to a decline, failing to gain a foothold above 95, and this morning it loses another 0.2%, increasingly receding in the middle of the three-months trading range. The important resistance has once again shown its strength. Often, after an unsuccessful testing of extremums, it is necessary to expect a rollback in the middle of the trading range (-0.5% to 94.4) or to its bottom (-1.3% to 93.60).

However, it should be noted that global risks are still offset in favour of the dollar: the fears of trade wars and a slowdown in the growth of the global economy.

In these circumstances, beyond short-term fluctuations, the American currency still retains the potential to strengthen and exit the trading range of the recent months. August is considered to be a quiet month with low activity in capital markets, but at this time usually the basis for the rally builds up for the next few months.

The period of trading in the channel can quickly be changed by the rise of volatility, as it was in April after the consolidation in January-April, when DXY had added 6% for a month and a half with almost no adjustments. A similar scope of movement this time will allow the dollar index to return to the psychologically important boundary of 100.

As we note yesterday, in the short-term the dollar growth can reduce inflationary pressure in the US and deter the Fed from excessive tightening of monetary policy.