Deceptive oil growth

January 24, 2023 @ 14:27 +03:00

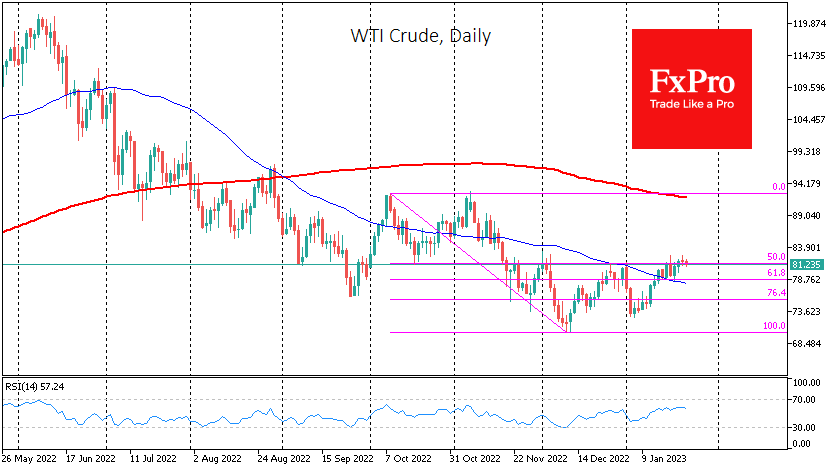

Oil briefly topped $82.50 per barrel WTI on Monday, testing the highs seen in the second half of November. The bulls are betting that China’s lifting of restrictions will boost global demand for commodities and energy.

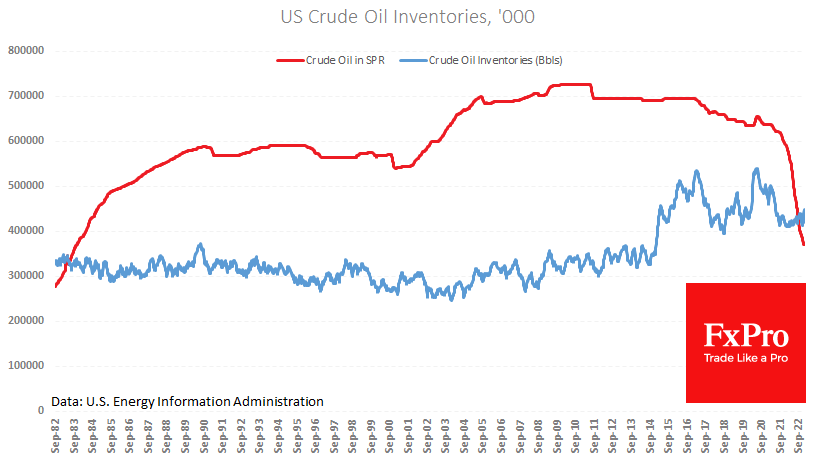

Although the US became the largest oil exporter at the end of last year, commercial inventories were 8.3% higher last week than a year earlier. Production growth over the same period was barely above 5%.

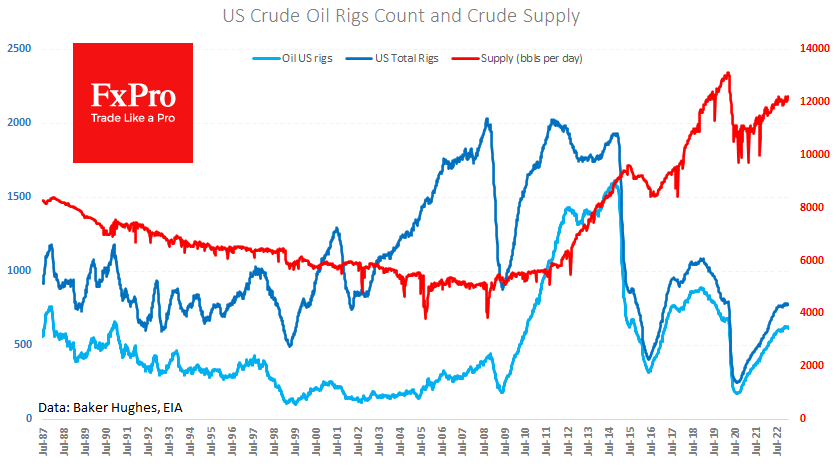

Drilling activity data released on Friday evening showed a further decline in the number of oil wells to 613, down from a peak of 627 just over a month ago. This is a slight dip but an apparent stagnation from the lower levels we saw at the peaks in early 2019 (just under 900) or late 2014 (around 1600).

On the other hand, this could be evidence of increasing efficiency, both on the upstream, getting more out of a well, and on the consumption side. More and more electric cars are being sold, and internal combustion engines are becoming more economical. And this is reflected in the growth in petrol inventories at the same time as the economy is growing and production is stagnating.

The chart also shows that new highs in oil are becoming harder to come by. WTI has stalled for the third time since early December and is approaching $81.50. Near that level is a 50% retracement of the decline from the October and November highs. This is the same area where oil reversed lower in October 2021. It rallied on fears that Russian Crude would be removed from the global energy market. So, a dip lower looks like a return to normal.

The Fed meeting, and the speculation surrounding it, could be an essential turning point for oil, determining whether it can continue to rise above $81.50 or reverses course. If the Fed not only reduces the pace of rate hikes but also hints that they may stop sooner than previously promised, this will boost global demand for risk assets, including oil. If the committee confirms its plans, it could deflate much of the positivity that has been pumped into the markets since the beginning of the year.

The FxPro Analyst Team