Currency markets are calling for caution

July 07, 2020 @ 11:25 +03:00

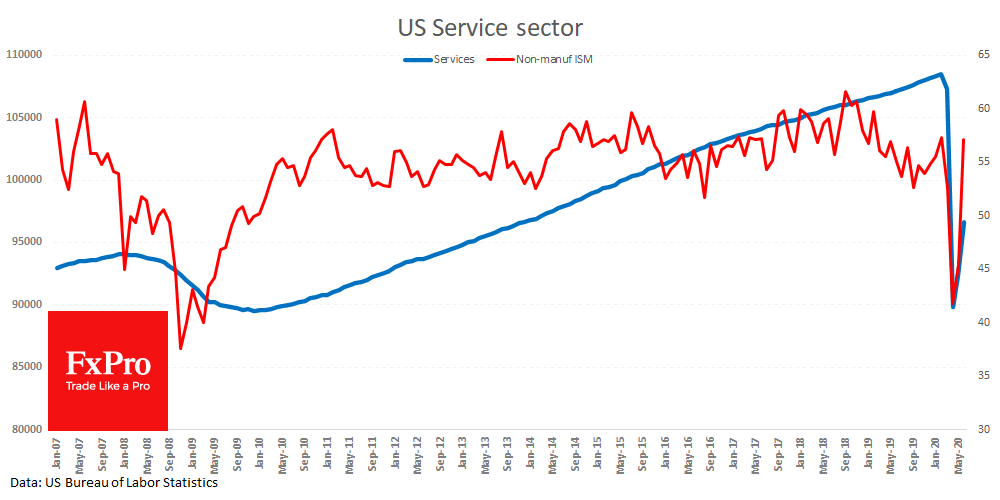

Economic indicators one after another are exceeding expectations, fuelling market growth after a series of strong macro reports were supported by the United States on Monday. The ISM Non-Manufacturing Index rose to 57.1 in June, which is much stronger than the expected level of 50.0. A value significantly above 50 reflects higher business activity compared to the previous month, demonstrating the beginning of a recovery.

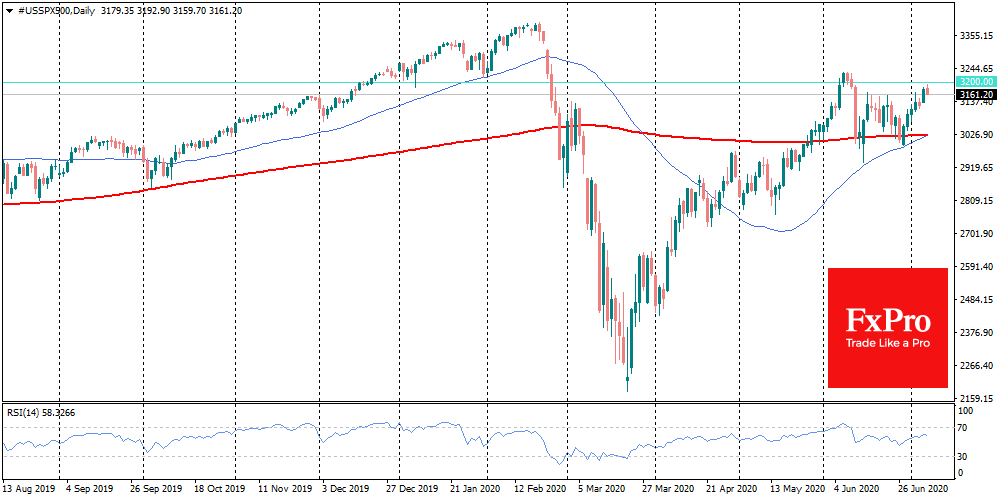

Against this backdrop, S&P 500 added 1.6% and Dow Jones added 1.8%. Chinese markets picked up the baton on Tuesday morning, another 1.8% to the 6.7% spike on China A50 yesterday.

The currency market dynamic also reflects the positive mood of traders although it is important to note that they act with much more caution. EURUSD trades close to 1.13000 in the morning, having added 0.6% yesterday. The dollar’s decline is slightly more restrained against other major currencies, which often occurs in periods of strengthening investor sentiment against risk assets.

However, you should not dismiss the warning signs. Bear in mind that PMI indices reflect the relative dynamics of industries, so it is worth paying attention to employment data. The U.S. service sector still creates jobs (+4.63 mln in June), but this is 11% less than in February. This suggests that the initial V-shaped rebound may be followed by a long period of difficult and uneven economicrecovery, as the number of unemployed has jumped by more than 10%, affecting consumer sentiment.

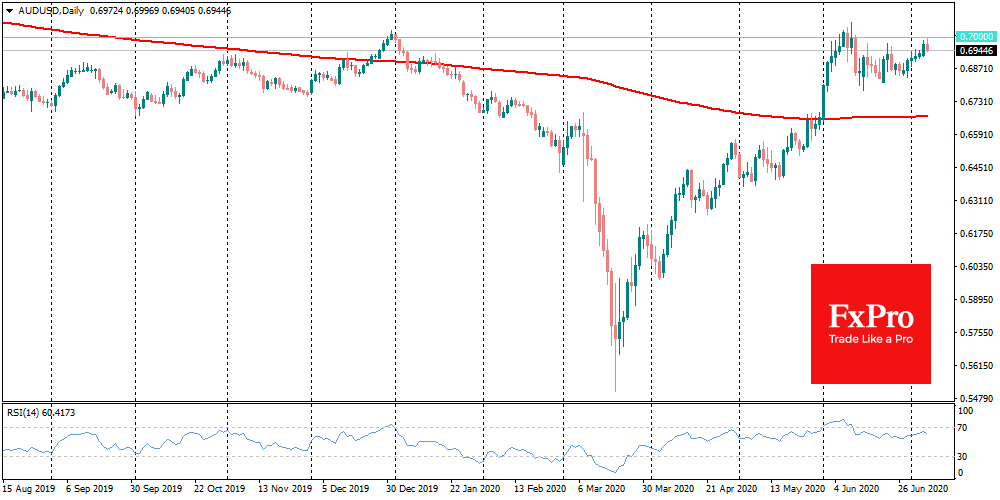

Caution can also be heard among central bankers with the most recent example today from RBA. The Australian central bank noted an improvement in financial conditions but said it is ready to further increase incentives for the economy. This cautiousness caused market participants to slow down and AUDUSD once again failed to overcome the 0.700 level. In addition, the USDCNH pair failed to take 7.0, which is also a sign of a fragile rally. In such conditions, one should not be surprised by sudden index drops, similar to the one that occurred about a month ago, when the S&P500 lost more than 5.5% in one day, after an unsuccessful attempt to gain a foothold above 3200. This morning, another attempt to get higher came across a fierce resistance of the bears.

The FxPro Analyst Team