Crude Oil: not a one-way street, but bulls still in charge

March 29, 2022 @ 12:49 +03:00

Brent lost 7.7% to $106.4 on Monday on fears of a drop in demand due to a lockdown in Shanghai, China’s financial hub. In addition, the Saudi and Yemeni cease-fire and the upcoming Ukraine-Russia talks in Turkey helped reduce the heat on the energy market.

However, Monday’s decline looks like only a temporary respite, and all these factors are still too weak to break the momentum that has been sustained since December.

Brent has gained 2% since Tuesday morning to $108.5, with buyers buoyed by reports that Saudi Arabia might raise the selling price of its Oil by as much as 5% in May. The pipeline accident in the Caspian Sea and falling exports from Russia are also on the side of oil bulls right now.

OPEC has denied plans to accelerate quota increases at its next monthly meeting on the 31st of March. Cartel officials also note that it is not yet possible to replace Oil from Russia entirely.

Meanwhile, Iran’s nuclear programme talks have taken a few steps back, removing hopes of a supply surge from the market. US oil producers are in no hurry to exploit market conditions. The number of working rigs is increasing, but no production increase has taken place so far, which has averaged 11.6 million barrels per day over the last six months. US commercial oil inventories are now 17.8% lower than a year ago.

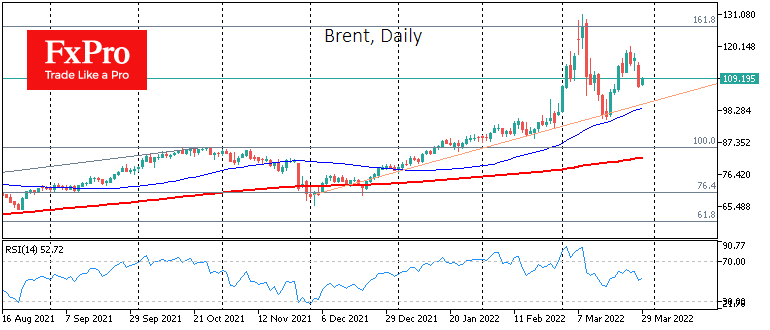

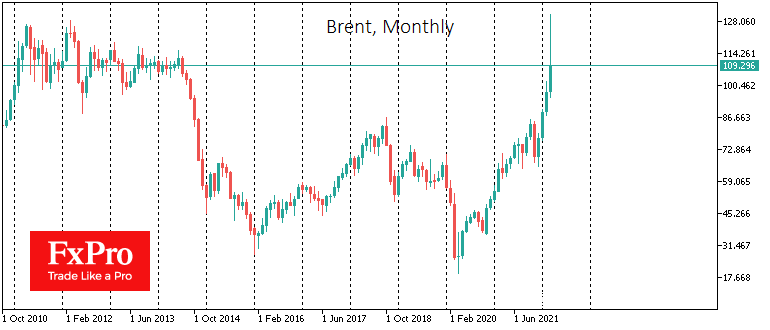

Oil has remained in a bull market even though its movements are no longer unidirectional. From a state of panic buying in early March, Oil has become more pragmatic. Its price now looks high compared with levels a year and two years ago, but from 2011 to 2014, it traded around current levels, with demand being notably weaker. A period of heightened geopolitical uncertainty is setting up a $100-120 Brent range in the coming weeks. A break in the upward trend will only occur with a final turn towards détente.

The FxPro Analyst Team