Copper’s fall is an early signal of a global slowdown

February 09, 2024 @ 13:46 +03:00

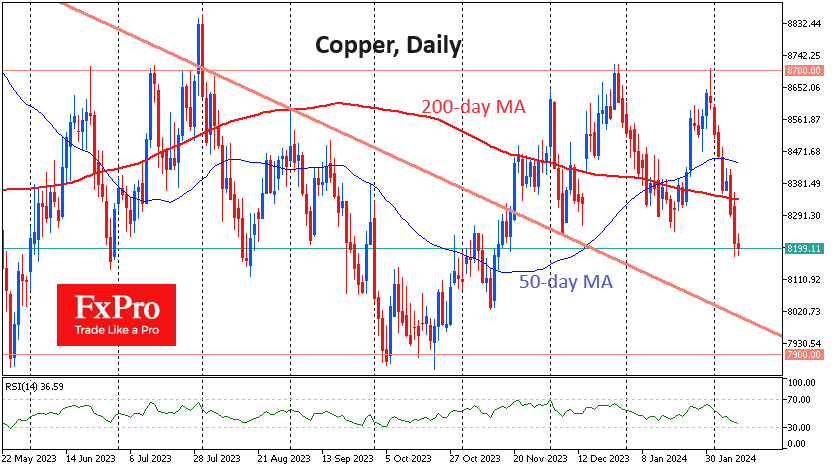

Copper exchange prices on Thursday fell to their lowest since November, approaching $8200 a tonne and breaking out of the broad consolidation range of the past two months.

A move out of the $8250-8700 range technically leaves copper vulnerable to a quick fall into the $7900 region, where the lows of November 2022 and May and October 2023 are centred. The Relative Strength Index (RSI) is temporarily on the bears’ side as it has recorded three consecutive declining local peaks at relatively similar highs over the past two months.

Earlier in the week, the price dipped under its 200-day moving average, and the sell-off has only gained momentum since then.

Copper has sold off almost every trading session since the end of last month, losing around 6% in that time. The selloffs at the start of December and January were almost as persistent but had less amplitude.

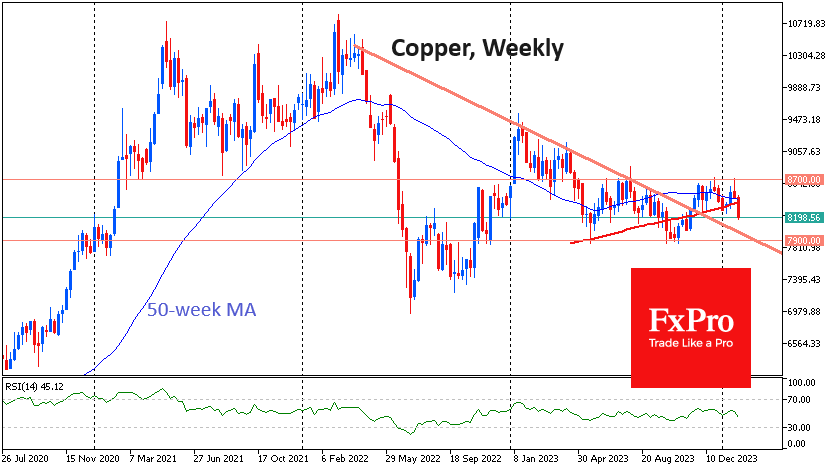

Copper broke above a vital downtrend resistance level in November and is now set to test its strength as support. By the end of February, it will be just around $7900, which will further strengthen interest in testing this line.

Copper dynamics are essential not only for traders who hold it but also as a manifestation of global production dynamics. This is a signal of slowing global production despite the optimism of stock markets, where global, US, and European indices are storming new highs.

Further declines in the price of copper could attract more bears to global markets. Markets are receiving a similar bearish signal from the global economy in the form of falling natural gas prices. The price of US futures has fallen into the 2020 bottom area.

The FxPro Analyst Team