Chinese economy slowdown spooks markets and presses CNY

August 15, 2022 @ 16:08 +03:00

The statistics released from China today raise concerns about the economy’s near-term prospects, preventing the USDCNH from bucking the uptrend.

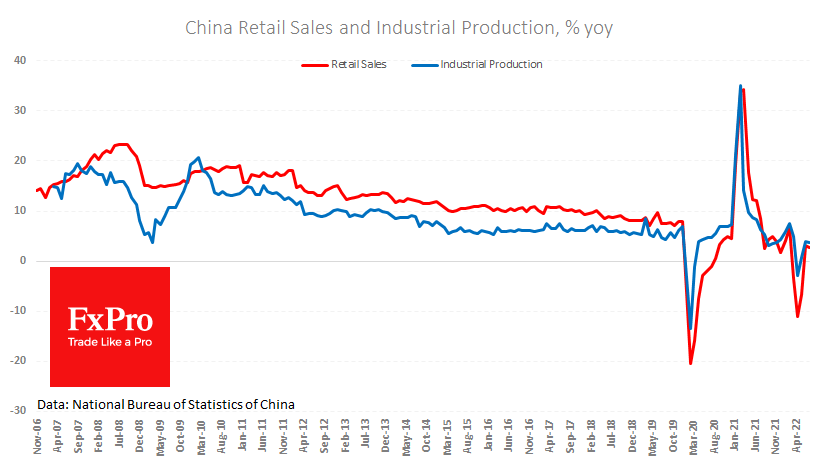

July data showed a slowdown in retail sales growth from 3.1% y/y to 2.7%, in stark contrast to the average forecasted acceleration to 5.0%. Industrial growth slowed from 3.9% YoY to 3.8% vs 4.5% expected. Fixed-asset investment slowed from 6.1% YoY to 5.7% YoY.

The People’s Bank of China reacted quickly to the statistics by reducing its annual lending rate by 0.1 percentage point to 2.75%. More remarkable, though, is the speed of the reaction, not its scale.

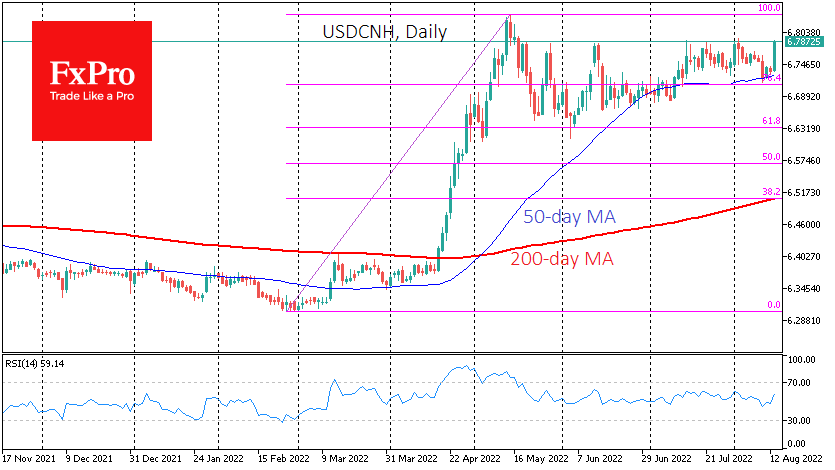

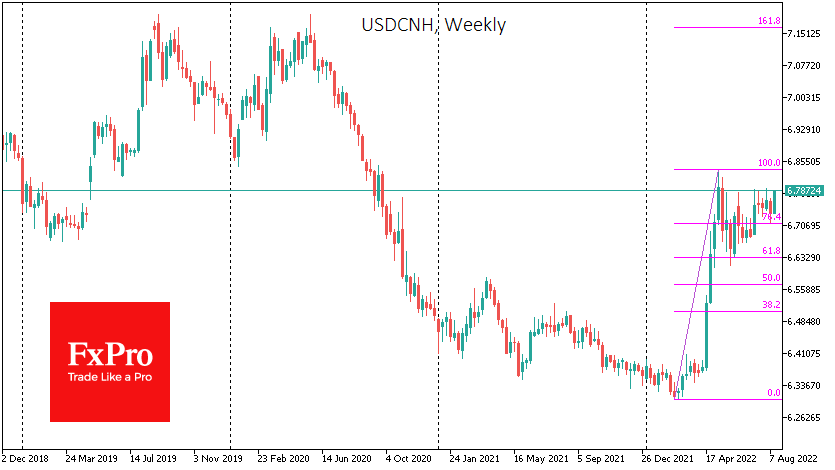

The short-term technical picture of the yuan is now on the sellers’ side. The USDCNH got support from the buyers last week on the way down to the 50-day moving average, which was just above the 76.4% Fibonacci retracement of the February-May rally.

The intraday rise of 0.8% that we see today indicates the determination of the yuan sellers and could signal the second act of growth with a potential target at 7.16, near where the 161.8% levels of the said rally and the multi-year highs of the pair set in 2019 and 2020 are concentrated.

The FxPro Analyst Team