China slows sharper than expected

November 30, 2022 @ 15:26 +03:00

In addition to the riots against tight covid restrictions since the weekend, China is also facing broader adverse effects of the strict anti-Covenant policy, PMI data shows.

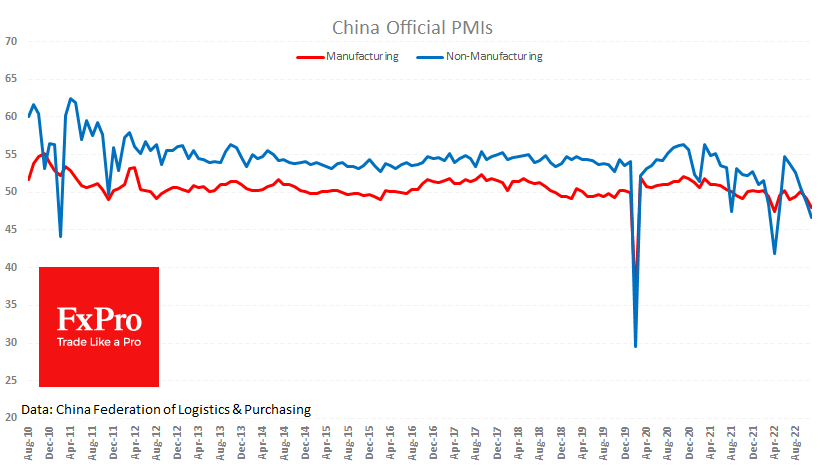

The official survey showed the manufacturing index falling from 49.2 to 48.0 – well below the median forecast of 49.0. The non-manufacturing sector activity index fell from 48.7 to 46.7 against the expected 48.8. This is the lowest level since April when the fall was also due to covid restrictions.

We recall that values below 50 indicate a contraction in activity, and Chinese manufacturing activity indices have marginally and sporadically exceeded this waterline since August 2021. The service sector is more energetic, but the PMI is also more volatile. The latest dip in the indices signals that the economy is choking on excessive austerity policies.

At the same time, markets are betting that the government has picked up on this signal by announcing small relaxations in regulations time after time since the start of the week.

Separately, the Chinese government is trying to cautiously improve the investment climate by allowing distressed developers to raise capital via equity issues and lowering the reserve requirement rate last week. So, while the IMF warns that it will reduce China’s GDP forecasts, markets are waving off hopes for a turnaround after more than a year and a half of negativity.

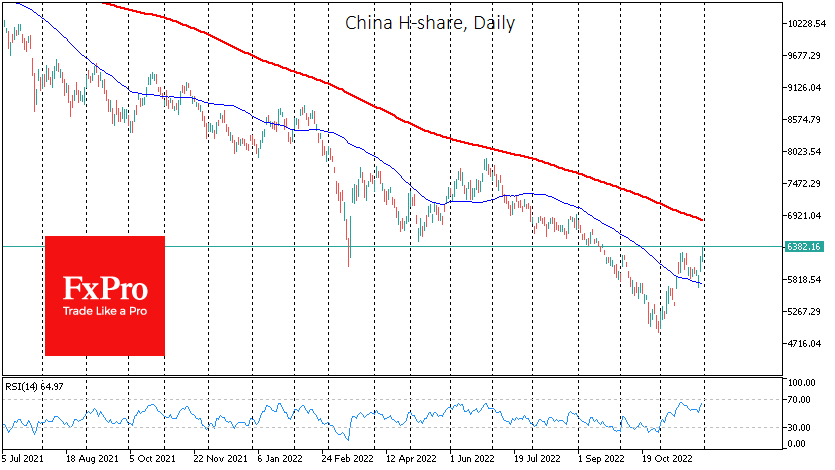

China’s equity markets posted their most substantial monthly gain in years in November, turning strictly to the upside on the first day of November. An upbeat end to the month, with the Hang Seng and H-share indices rallying more than 10% from the opening week and recovering to September levels, sets a positive tone. The strong rally after 20 months of a down-trend suggests that the beginning of the new month will also be bullish. From here on, however, China will have to provide demand from investors with improved data or progress in policy.

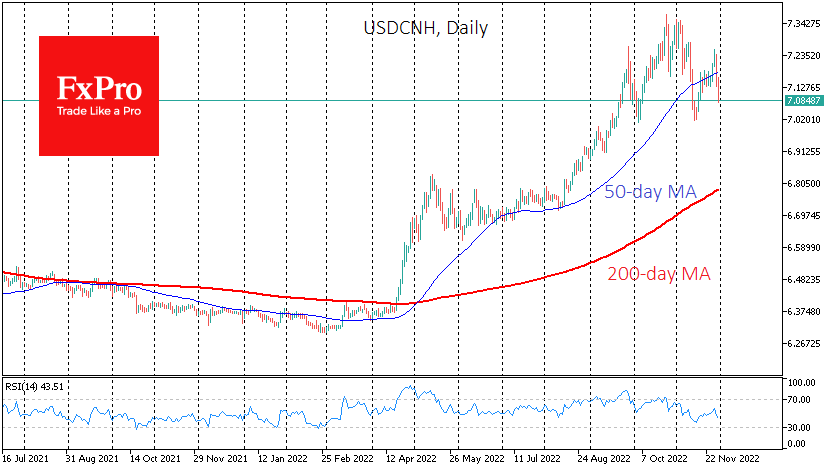

The Chinese renminbi has gained over 2.4% against the dollar in the last two days, indicating further capital inflows into domestic assets. Interestingly, the dollar has generally strengthened in the global market these days. The performance of the renminbi reinforces expectations of a worldwide change in the dollar trend from bullish to bearish.

However, a longer-term view of PMI trends clearly shows how the Middle Kingdom’s economy is fading with the start of trade wars in 2018. With a solution for this issue, China is likely to accelerate sharply.

The FxPro Analyst Team