Central Bank meetings this week are a reason for volatility

July 29, 2024 @ 17:46 +03:00

The week ahead will be packed with significant economic events, so the market behaviour could turn into quite a bumpy ride this week.

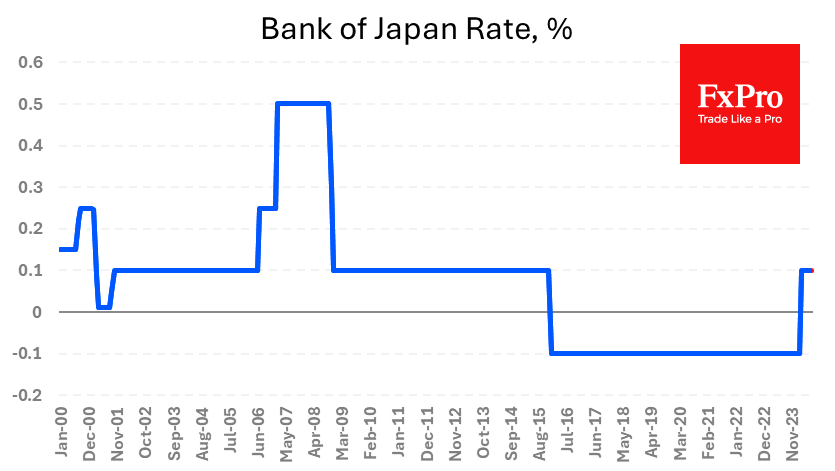

On Wednesday morning, the Bank of Japan will announce its rate decision and the parameters of its balance sheet asset purchase programme. On average, the purchases are expected to be halved, but the key rate is not expected to change. At the same time, the central bank may go for a second rate hike to 0.25% after the March hike from -0.1% to +0.1%. Sharper cuts in balance sheet buying are not ruled out. This is a potentially positive turn of events for the yen. In previous months, the Bank of Japan has been criticised for its loose policy weakening the yen, leading to currency intervention. Tightening monetary policy is a less costly way to support the currency without selling off international reserves.

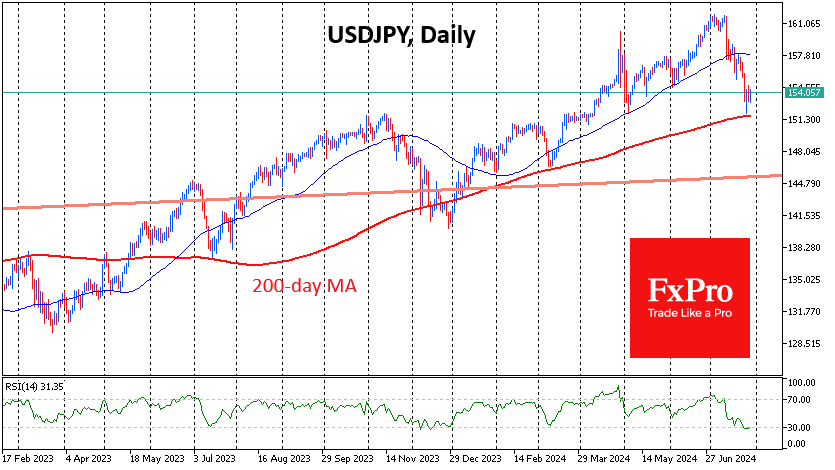

USDJPY retreated below 152 last week, approaching the 200-day average and the area of the highs of October 2022 and November 2023. The Bank of Japan’s actions will determine whether the former resistance has become support or if the Yen bears will finally have their backbone broken.

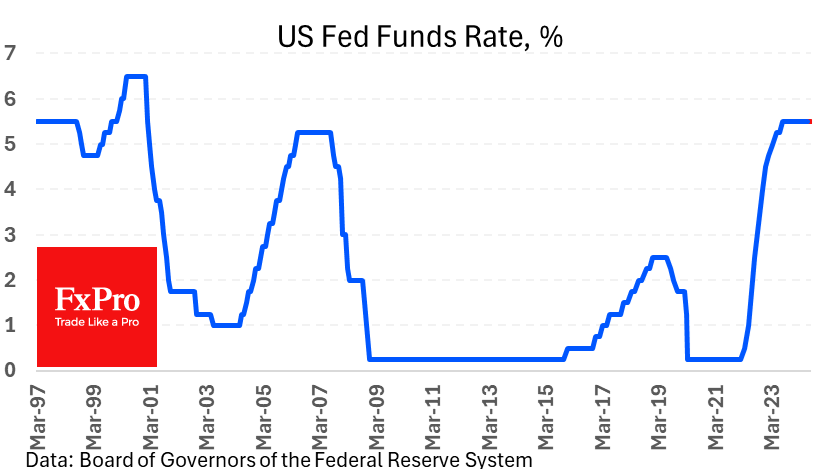

No actual policy changes are expected from Wednesday night’s Fed rate decision. Still, observers will dive into studying the accompanying commentary changes to gauge the chances of a rate cut in September and the number of those cuts before the end of the year. Rate futures give a 10% chance that the rate will be 50 basis points lower in September than it is now, which is excessive.

Slightly less excessive is the market’s estimate of a 63.5% chance of 3 or more rate cuts before the end of the year. Approaching that probability to 100% or moving to expectations of two cuts promises to be a major field for Fed “expectations management”. A shift to soft sentiment is a market risk: bearish for the dollar and bullish for equities. A surprise tighter rate approach has the potential to set off a spiral of dollar gains and a sell-off in risk assets.

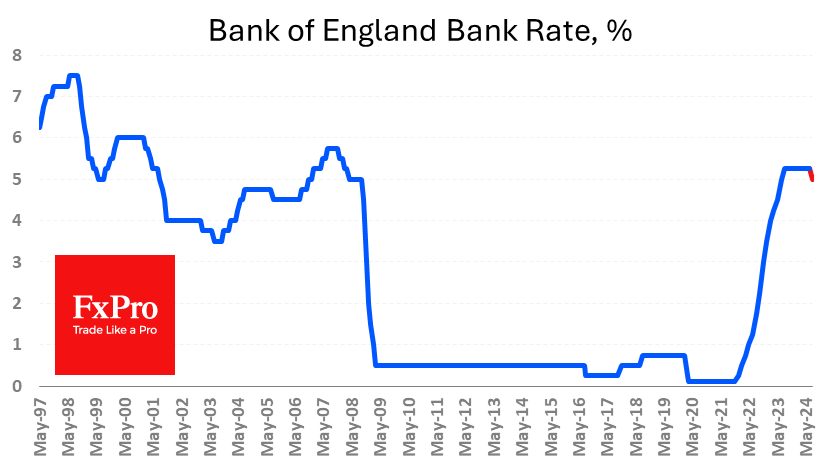

On Thursday, all eyes are on the Bank of England rate decision. The chances of a cut are barely over 50%. If it stays this way until Thursday, any outcome will cause a surge of volatility in the markets of England and pairs with the pound. GBPUSD has added over 3% since the start of the month to 17 July but has squandered half of that gain since then. This could well be a tactical retreat before a fresh attempt to break 1.30, which failed in mid-July. Bank of England’s softness has the potential to erase last month’s gains in GBPUSD rather quickly, pushing the pair back to 1.26.

The FxPro Analyst Team