Bitcoin suddenly slides 4% as BofA predicts a 20% stock market crash

October 30, 2020 @ 13:15 +03:00

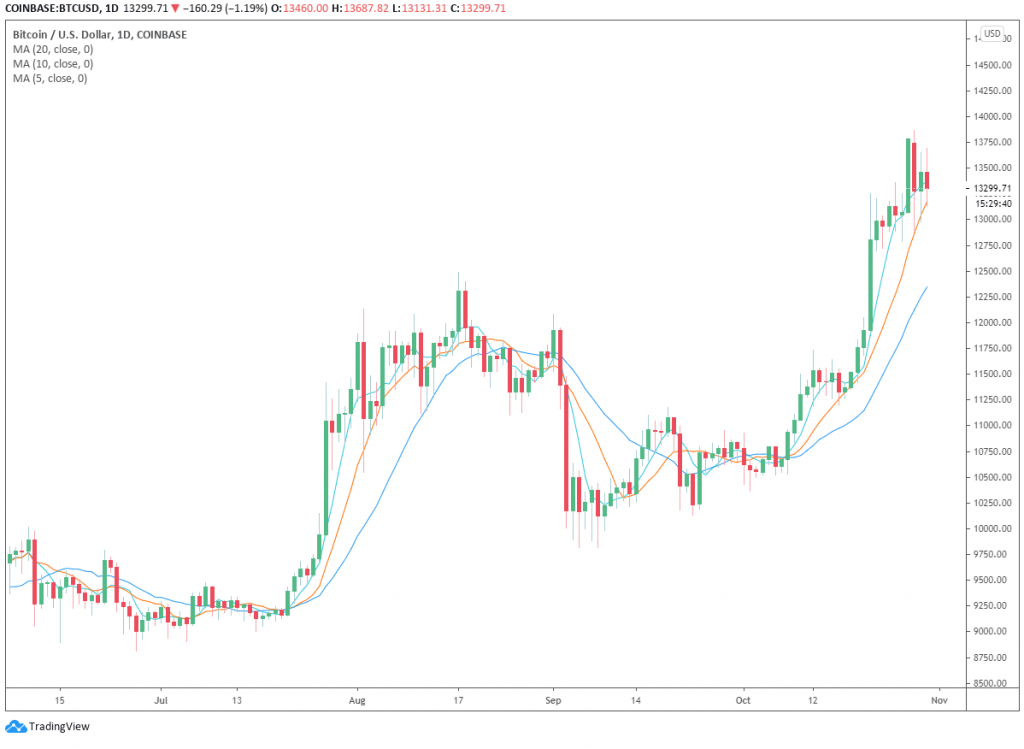

The price of Bitcoin (BTC) abruptly dropped 4% from the day’s peak on Oct. 30 as the uncertainty in the stock market intensified. With five days left to the U.S. presidential election, Bank of America, or BofA, suggested a 20% drop is possible. The Dow Jones Industrial Average declined 7.55% since Oct. 12. Tech-heavy stock indices performed slightly better in the same three weeks as the Nasdaq dropped 5.8%.

While the correlation between Bitcoin and stocks has declined in recent weeks, the slump of risk-on assets could negatively affect cryptocurrencies. According to BofA economists led by Michelle Meyer, the election result is not the biggest threat to equities.

Rather, it is whether a contested election occurs that could cause the markets to rattle due to uncertainty. The markets could still rally regardless of who wins the election, but a contested election may lead to a market slump. The economists wrote:

Since Oct. 12, while U.S. stock market indices declined by 5% to 6%, Bitcoin rallied by nearly 16%. In the last 18 days, BTC rose from $11,167 to $13,290, massively outperforming gold, stocks and the U.S. dollar. But the confluence of Bitcoin facing a multiyear resistance level at $14,000 and the lack of certainty around risk-on assets could slow BTC’s momentum.

In the near term, as Cointelegraph reported, $13,000 serves as a large whale cluster. This means high-net-worth buyers would likely protect $13,000 as a key support area. Since $14,000 was the previous top for Bitcoin in mid-2019, the new range would likely be found $13,000 to $13,900.

If the market uncertainty persists after the election, there is a higher probability that it would place BTC in the low $13,000 region for a prolonged period, which wouldn’t necessarily be unhealthy.

Bitcoin suddenly slides 4% as BofA predicts a 20% stock market crash, CoinTelegraph, Oct 30