Bitcoin May Have Hit Wall of Profit Takers Around $19,500: Analyst

December 16, 2020 @ 10:31 +03:00

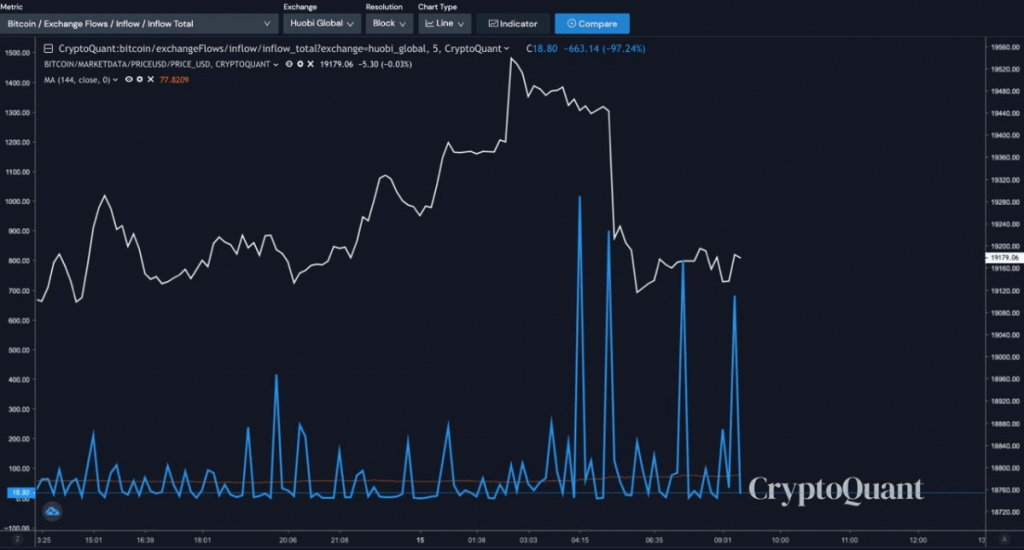

Bitcoin’s ascent above $19,500 was cut short early on Tuesday, possibly due to profit taking by large Asia-based investors, according to one analyst. The top cryptocurrency fell from $19,555 to $19,035, with most of the drop unfolding during the two hours to 06:00 UTC, according to CoinDesk 20 data. “I think Asian whales sold around $19,500 causing prices to drop,” Ki Young Ju, CEO of South Korea-based blockchain analytics firm CryptoQuant, told CoinDesk, referring to those with big crypto holdings. He highlighted an increased inflow of coins onto crypto exchange heavyweight Huobi Global, which has a Hong Kong presence, soon before prices began falling.

“A total of 2,013 coins were transferred to Huobi in blocks 661,425 to 661,430 just 15 minutes before the price dip,” Ju said, adding that block number 661,425 carried 1,017 coins, the highest single-block inflow on Huobi since Nov. 30. Monday saw 8,836 BTC arrive on Huobi in total, with a mean transaction of 4.5 BTC, the highest since March 2018, according to CryptoQuant. The uptick in the average size of exchange deposits indicates that larger investors were transferring their coins to Huobi and may have liquidated their holdings around $19,500, a level which has acted as stiff resistance of late.

Bitcoin has failed multiple times to establish a foothold above that point since Nov. 25, thought to be largely due to some investors booking profits on fears of a near-term sell-off. At press time, bitcoin has rebounded to near $19,300 and the path of least resistance for the cryptocurrency remains to the higher side, according to analysts. The options market sees a 35% probability of bitcoin ending December above $20,000, according to data source Skew. That’s significantly higher than the single-digit probability seen three months ago when bitcoin was trading near $10,000. Some investors look to have bought call options at the $20,000 strike price on Monday.

Skew data shows the open interest or the number of open positions in the bullish $20,000 call rose by 1,054 contracts on Deribit, the world’s largest crypto options exchange by volume and open interest.

However, forcing a breakout above $20,000 in the short term may prove to be an uphill task for the bulls, as there are sizable sell orders open in the approach to a new record high spot price.

Bitcoin May Have Hit Wall of Profit Takers Around $19,500: Analyst, CoinDesk, Dec 16