Bitcoin at $100,000 in 2021? Outrageous to some, a no-brainer for backers

November 24, 2020 @ 12:53 +03:00

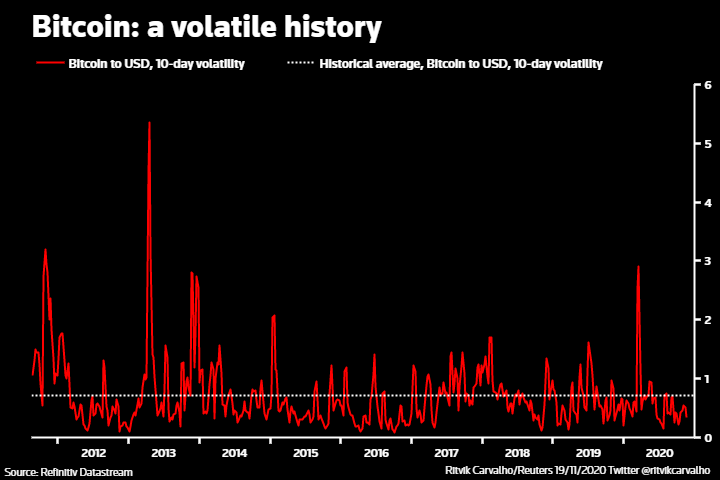

Bitcoin investors, which include top hedge funds and money managers, are betting the virtual currency could more than quintuple to as high as $100,000 in a year. It’s a wager that has drawn eye-rolls from skeptics who believe the volatile cryptocurrency is a speculative asset rather than a store of value like gold.

Since January, bitcoin has gained 160%, bolstered by strong institutional demand as well as scarcity as payment companies such as Square and Paypal buy it on behalf of customers. Bitcoin is within sight of its all-time peak of just under $20,000 hit in December 2017. It debuted in 2011 at zero and was last trading at $18,415.

Going from $18,000 to $100,000 in one year is not a stretch, Brian Estes, chief investment officer at hedge fund Off the Chain Capital, said. “I have seen bitcoin go up 10X, 20X, 30X in a year. So going up 5X is not a big deal.”

Estes predicts bitcoin could hit between $100,000 and $288,000 by end-2021, based on a model that utilizes the stock-to-flow ratio measuring the scarcity of commodities like gold. That model, he said, has a 94% correlation with the price of bitcoin. Citi technical analyst Tom Fitzpatrick said in a note last week that bitcoin could climb as high as $318,000 by the end of next year, citing its limited supply, ease of movement across borders, and opaque ownership.

The so-called whale index, which counts addresses or wallets holding at least 1,000 bitcoins, is at an all-time high, said Phil Bonello, research director at digital asset manager Grayscale. Bonello said more than 2,200 addresses were linked to large bitcoin holders, up 37% from 1,600 in 2018, suggesting that institutional money has stormed in.

Bitcoin at $100,000 in 2021? Outrageous to some, a no-brainer for backers, Reuters, Nov 24