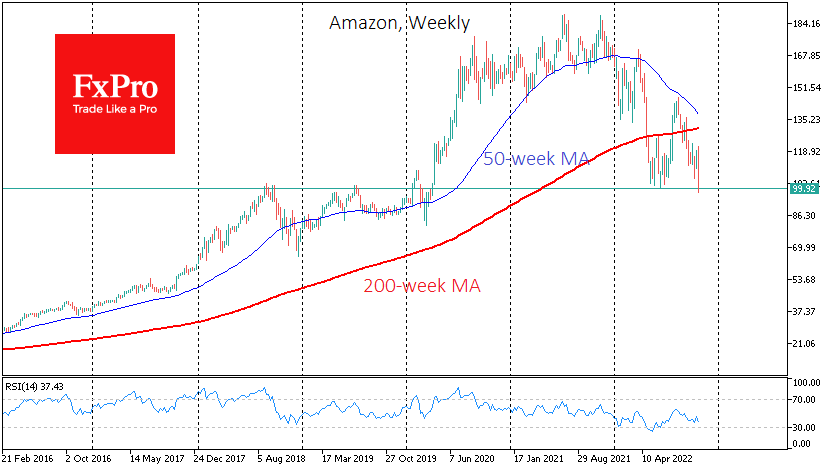

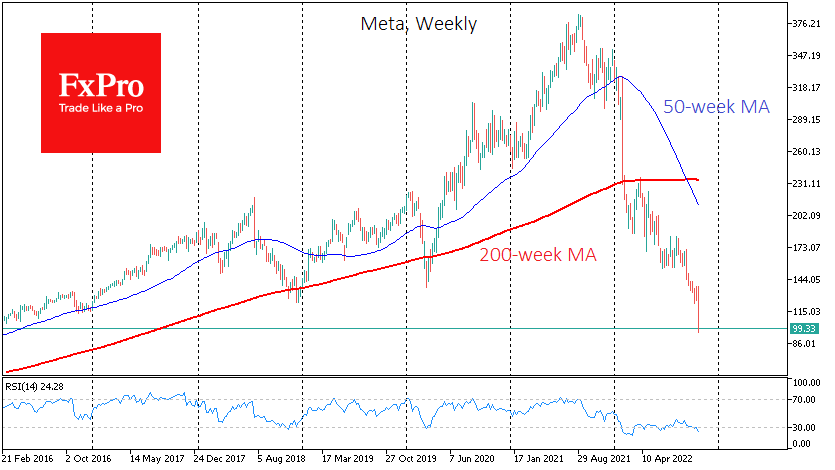

Be ready for an L-shaped rather than a V-shaped FAAMG trajectory

October 28, 2022 @ 17:22 +03:00

Markets will likely remember this week as uncrowning of Techs. On Friday, the failures of Meta, Google, Alphabet and Microsoft were joined by Amazon, whose shares lost more than 20% at one point after the quarterly report.

The only bright spot out of the FAAMG that has shined in the past ten years is Apple, whose report satisfied investors and whose shares gained 0.5% after the official closing of the session.

With such heavyweight momentum, it is surprising that the S&P500 is near last week’s closing levels by Friday rather than significantly lower. Broad indices are pulling “value” companies upwards.

With its fastest tightening in 40 years, current monetary policy deflates tech capitalisation very quickly, limiting the most critical growth driver for companies: comparative economic abundance. At the funding level, companies found it easier to raise money for promising projects and enjoyed higher consumer demand at the consumption level.

Applied to traders, this means that trying to buy back market stars on their downside right now can be rushed. Instead of a V-shaped rebound, FAAMG stocks risk laying low (L-shape) – until monetary policy becomes stimulative again. And the Fed is now reassuring us that we should not count on that before the end of next year, as a rate hike will be followed by an extended period of high rates.

The FxPro Analyst Team