Bank of Canada keeps rate unchanged, warns of possible cut

July 30, 2025 @ 17:42 +03:00

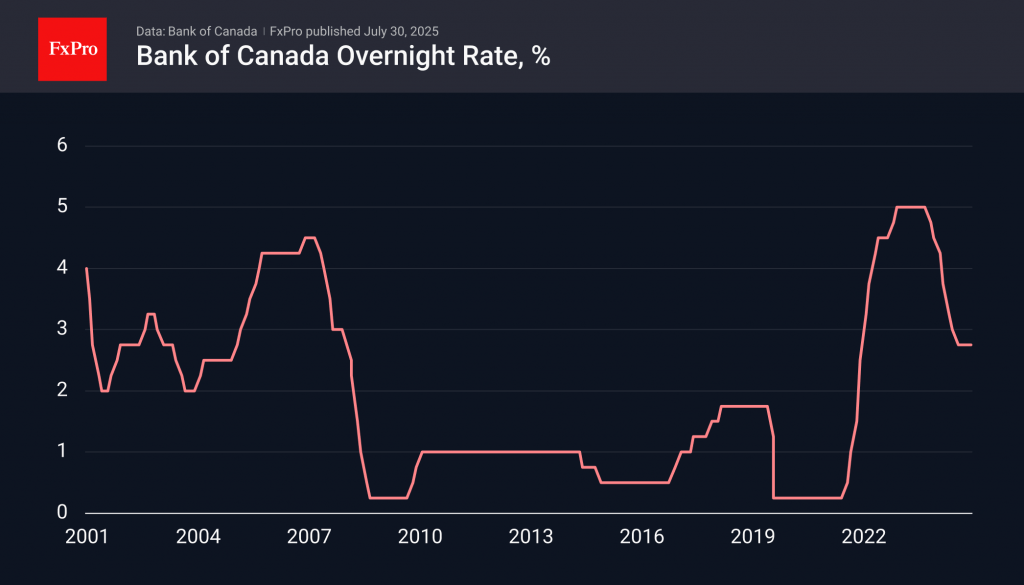

The Bank of Canada kept its key rate unchanged at 2.75% for the fourth consecutive meeting. This is a pause after an aggressive cut from 5% between June last year and March this year. The uncertainty caused by tariff disputes with the US remains a central issue for Canada and its central bank, dominating the official commentary on the rate.

At the same time, the commentary warned that they are ready to consider lowering the key rate if the upward pressure on prices from tariffs is moderate and economic activity slows down, creating downside risks for inflation.

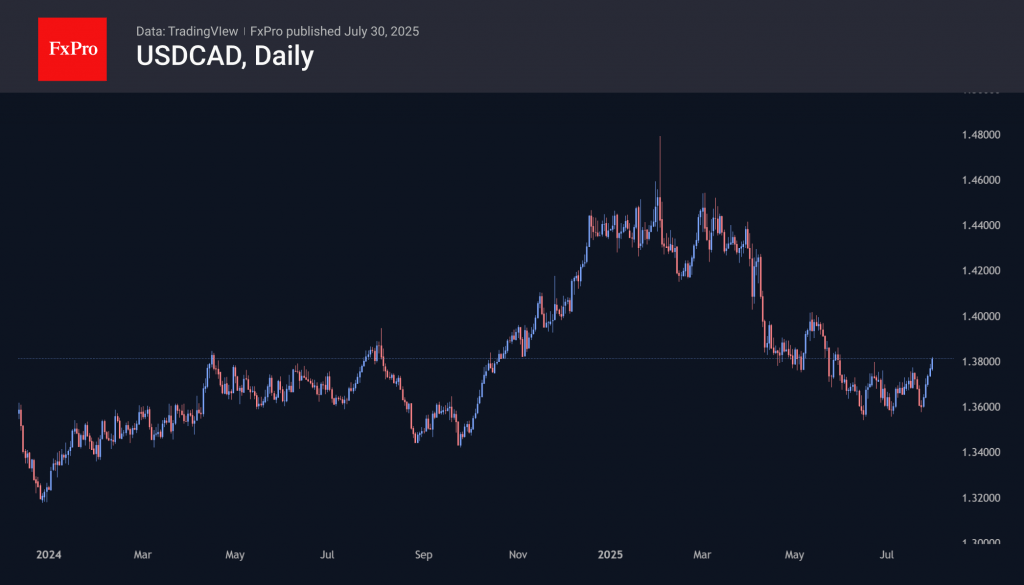

USDCAD turned to growth last Thursday, adding a fifth consecutive trading session, which is explained by the wave of growth in the dollar. The pair rebounded from strong support in the 1.36000 area, rising 200 points during this time. Further upward movement of the pair will confirm its reversal to long-term growth from the support area that has been in place since the beginning of last year.

The FxPro Analyst Team