Aussie knocked after RBA doubles its QE

February 02, 2021 @ 17:56 +03:00

AUD is losing to a wide range of competitors today after the Reserve Bank of Australia’s somewhat unexpected decision to extend its QE programme beyond mid-April. The RBA has announced its intention to buy another A$100bn in national bonds, continuing to buy at a rate of 5bn a week (roughly 22.2bn a month).

Australia’s economy is 15 times smaller than that of the US, making the RBA’s bond-buying more than twice as aggressive as the Fed’s. So it would not be surprising to see further Aussie weakness in the wake of such drastic action Down-under in the coming days.

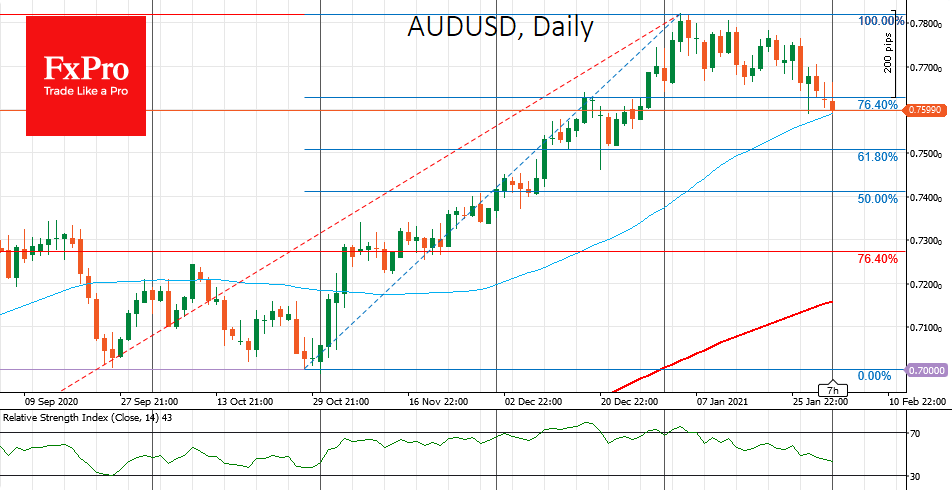

Technically, AUDUSD is now testing the support at the 0.7600 level, which is also the 50-day moving average and the Fibonacci retracement level of the October-January momentum. A decline below this line opens a direct path to 0.7500. Lower targets are at the 76.4% Fibonacci retracement from the April-January rally at 0.7250, where the 200-day average will approach by the end of February.

The FxPro Analyst Team