FxPro: Aussie as an indicator of China’s problems along with U.S. yields rise

October 05, 2018 @ 10:29 +03:00

Stock markets declined on Thursday amid U.S. bond yields, but it is also worth paying attention to a sale-off of currencies in Australia and New Zealand as a sign of problems with the demand in China.

Last year was marked by a period of simultaneous growth of different regions all over the world, but this year the U.S. economy has been experiencing a rise, in contrast with a deceleration in other parts of the world. The U.S. data points to the years of high business activity in both production and service sectors, encouraging expectations of a further tightening of the Fed’s policy to avoid overheating of the economy and contain inflationary risks.

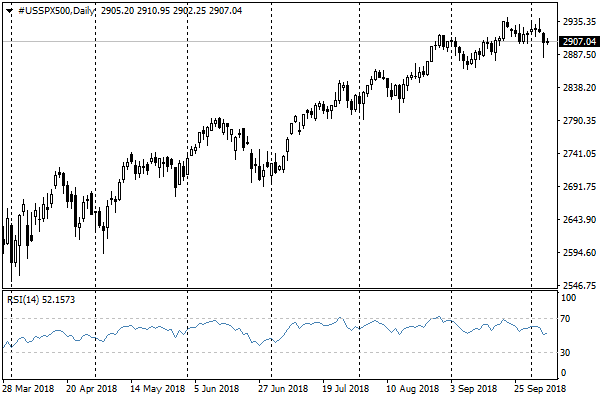

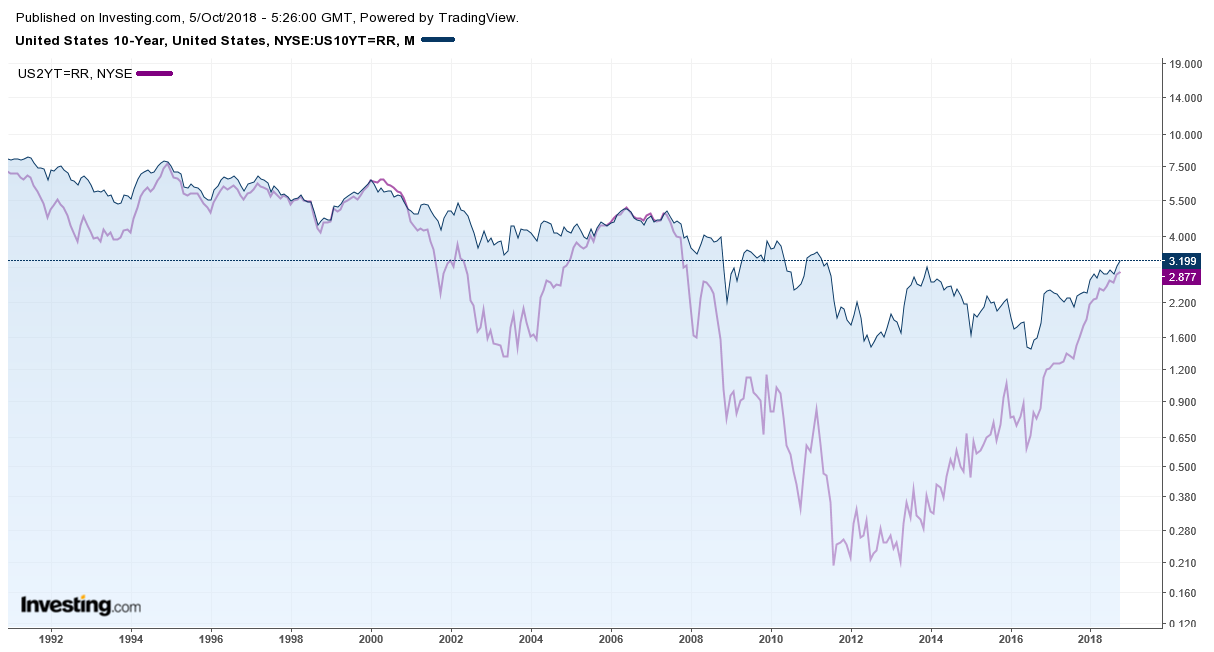

As a result, 10-year U.S. Treasury bond yield rose to the highest level in 7 years, making 3.2%. The yield of 2-year notes grew to 2.9%, the highest level for the last 10 years. The yield growth is a direct market response to the increase in the Fed’s rates and the expectation of further similar steps in the future, but it also puts pressure on the stock markets around the world, as it reduces the attractiveness of investments in shares in comparison to relatively safe bonds. S&P 500 and DJI lost 0.8% on Thursday, Nasdaq fell by 1.8%.

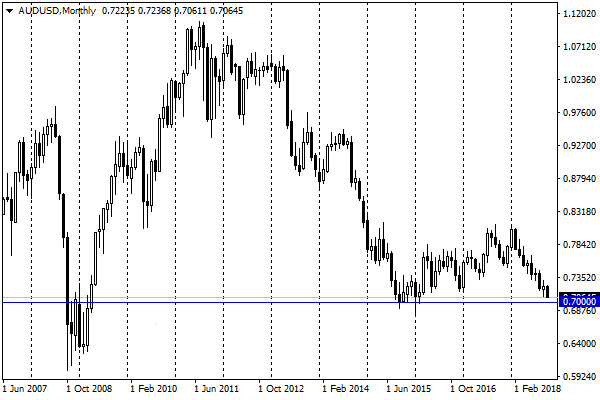

The currencies of Australia and New Zealand have accelerated their decline since the beginning of the month. The economies of these countries are heavily tied to the exports to China, so they are often a good indicator of the demand in this country. And now, it flashes red, which indicates a slowdown. AUDUSD and NZDUSD lost about 4.5% in just over a week, dropping to the lows of more than two years to the US dollar, despite the positive dynamics of raw material prices.

The wider downward trend in these currencies has been observed since April – from the aggravation phase of trade disputes between the USA and China. If we consider the Australian currency as an indicator of the Chinese demand health, now, at levels near 0.7050, it enters the crisis zone. The Aussie briefly fell below 0.7000 in the midst of fears around the “hard landing” of China in 2015/2016, and it had been below this mark in the period of panic sales from October 2008 to March 2009.