Asian markets buoyant as U.S. stimulus package debate looms

February 02, 2021 @ 10:05 +03:00

Asian stock markets gained for a second day on Tuesday on increased optimism about economic stimulus and global recovery, while retail investors retreated from GameStop and their new-found interest in silver. The momentum looked set to carry through into European trade, with FTSE futures up 0.66% and E-mini futures for the S&P 500 index rising 0.52%.

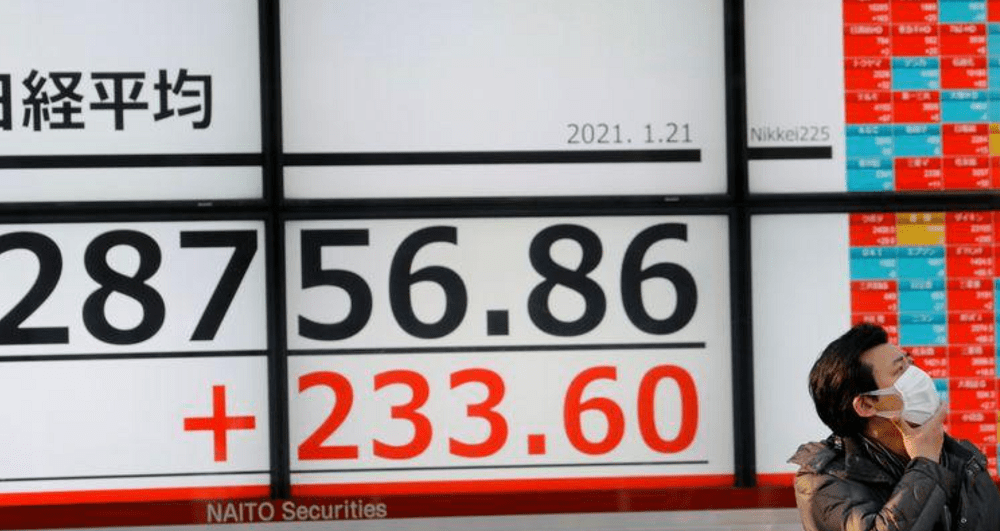

MSCI’s gauge of Asia Pacific stocks outside Japan rose 1.49%, building on Monday’s 2.3% gain. Hong Kong’s Hang Seng Index and China’s benchmark CSI300 Index jumped 1.37% and 1.1% respectively, helped by easing concerns about tight liquidity and falling cases of new coronavirus infections. Japan’s Nikkei 225 added 0.78%.

Markets were buoyant ahead of negotiations Tuesday between U.S. President Joe Biden and Republican senators on a new COVID support bill. The GOP’s $618bn stimulus plan released early Monday was about a third the size of the President’s proposal. Top Democrats later on Monday filed a joint $1.9 trillion budget measure in a step toward bypassing Republicans.

The dollar hovered near a seven-week high, benefiting from a euro selloff overnight after coronavirus lockdowns choked consumer spending in Germany, and on short-covering in over-crowded dollar-selling positions. Australia’s S&P/ASX 200 benchmark extended gains, up 1.49% after its central bank held rates at near-zero in a widely expected decision on Tuesday. The Reserve Bank of Australia’s pledge to buy more bonds saw yields on 10-year paper drop back to 1.08%, after touching a 10-month top of 1.19% early in the session.

South Korea’s KOSPI jumped as much as 2.7% to a one-week high, lifted by chipmakers and foreign buying, as the country’s ruling party readies another round of COVID-19 cash handouts and an extra budget. Institutional investors are still digesting the retail trading frenzy that boosted GameStop Corp and other so-called meme stocks in recent sessions against their financial fundamentals but have made cautious moves to protect their positions.

Spot silver prices fell nearly 2% on Tuesday, as investors locked in profits after the precious metal touched a near eight-year peak in the previous session driven by retail investors. Spot gold also fell 0.3% Tuesday to $1,854.56 per ounce. U.S. gold futures slumped 0.34% to settle at $1,854.5 per ounce.

Brent crude was up 0.98% at $56.90 a barrel. U.S. crude gained 1.06% to $54.12 as falling inventories and rising fuel demand due to a massive snow storm in the Northeast United States propped up prices.

Asian markets buoyant as U.S. stimulus package debate looms, Reuters, Feb 2