Asia-Pacific has more billionaires than any other region, as pandemic boosts wealth

October 08, 2020 @ 13:16 +03:00

There are now 2,189 billionaires globally with a combined wealth of $10.2 trillion, as the pandemic-induced stock market rally catapulted the net worth of the world’s uber wealthy to a new high. As of July 2020, Asia-Pacific accounted for the highest number of ultra-high net worth individuals, with 831 (38%) of the super rich residing in the region, where billionaire wealth now totals $3.3 trillion, according to Swiss bank UBS’ new Billionaires Insights Report 2020. That compares to 762 (35%) across the Americas and 596 (27%) in Europe, the Middle East and Africa (EMEA).

The findings, based on interviews and data from 2,000 billionaires across 43 markets, saw Asia-Pacific retain its global position as “the engine of wealth growth,” UBS Global Wealth Management’s Anurag Mahesh said at the report’s launch Wednesday.

Mainland China emerged as the region’s top market for wealth creation, with 415 billionaires, followed by India (114), Hong King (65) Taiwan (40) and Australia (39). The U.S. is home to 636 billionaires, the study found.

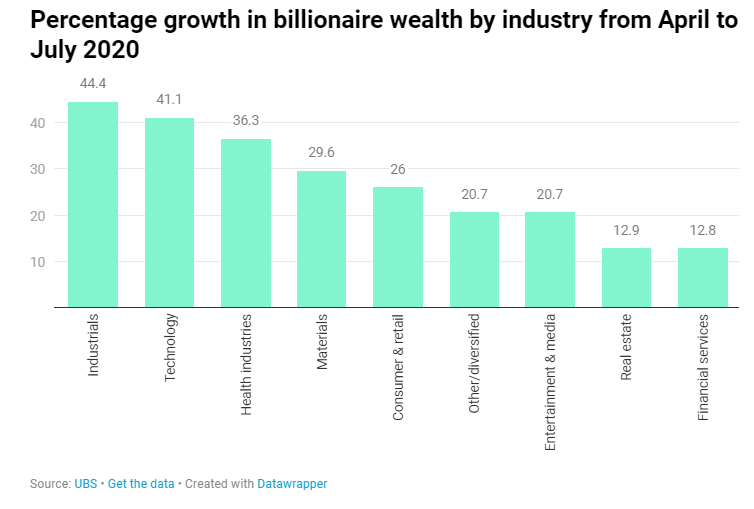

Much of the billionaire wealth growth seen this year was closely correlated to the market recovery staged since April’s dramatic sell-off, since the assets of the ultra wealthy are typically tied up in the public companies they run or invest in. However, from 2019 to the peak of the downturn in April 2020, Asian billionaire wealth emerged relatively unscathed, dropping 2.1% compared to 10.1% in EMEA and 7.4% in the Americas.

Asia-Pacific is home to the world’s highest share of tech and health-care billionaires, accounting for 181 (8%) of the total billionaire population, compared to 153 (7%) in the Americas and 88 (4%) in EMEA. Meanwhile, a growing emphasis on disruption and innovation in both sectors have helped them forge ahead against their more traditional peers, the report found.

Asia-Pacific has more billionaires than any other region, as pandemic boosts wealth, CNBC, Oct 8