Anticipation Grows for March Interest Rate Cut

January 12, 2024 @ 18:29 +03:00

Inflation is still on the agenda, and global markets are playing up signs that it is easing. Chinese inflation and US PPI were the focus of traders on Friday.

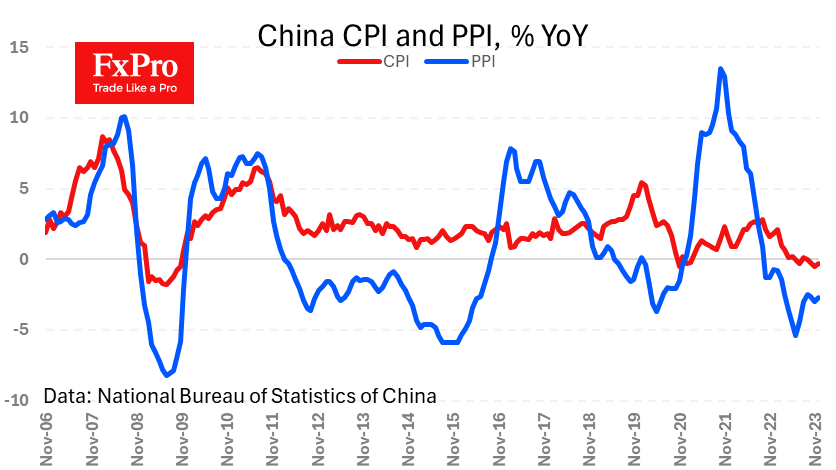

Consumer prices in China fell 0.3% y/y versus -0.5% in the previous month, beating expectations of -0.4%. However, traders note that this is the longest streak of price declines since 2009. It is also worth remembering that China did not experience excessive price rises like the US or Europe a year ago, so commentators are focusing on deflation and the need for fresh stimulus to support demand.

China’s producer prices were 2.7% lower in December than a year earlier, having been negative for 14 months. This dynamic has revived the old narrative that China is exporting deflation around the world.

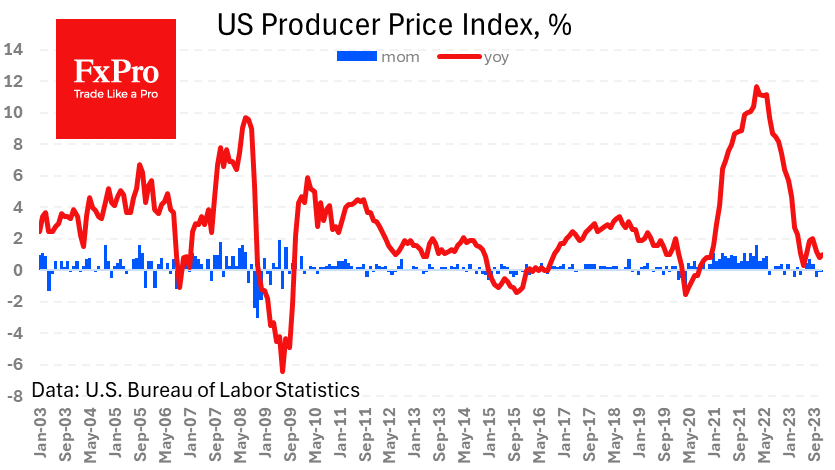

US producer prices fell 0.1% on the month and are 1.0% higher than a year earlier. This is much weaker than the expected 0.1% m/m and 1.3% y/y rise.

Friday’s news is a strong argument for a rate cut. But interestingly, despite Thursday’s more robust CPI data, markets have continued to increase the odds of a March rate cut: 83% now versus 73% a day earlier and 68% a week earlier.

This is in stark contrast to comments from FOMC members, with Meister, Bostic and Williams all noting that March is too early for a cut.

The FxPro Analyst Team