Alarming UK labour market data

June 11, 2024 @ 13:42 +03:00

Unexpected weakness in the UK labour market could signal an important turnaround in the economy and raise the urgency of monetary easing. The short-term impact on the Pound has been relatively limited, but the currency market has now adopted a wait-and-see approach ahead of Wednesday’s US news.

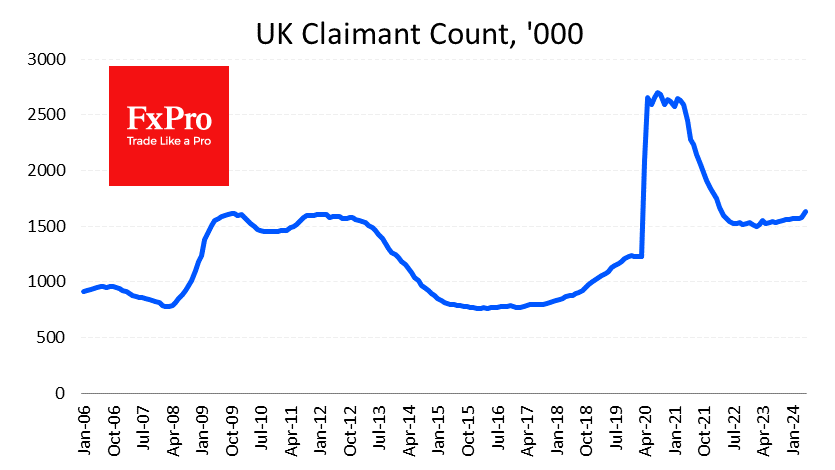

This morning’s batch of data from the UK saw a 50.4K jump in Claimant Count in May after 8.4K a month earlier. This is the biggest monthly increase since the first COVID lockdowns, and before that, the last time there was such a jump was in the depths of the 2009 recession. A frightening acceleration of the upward trend in the indicator has been seen since March last year.

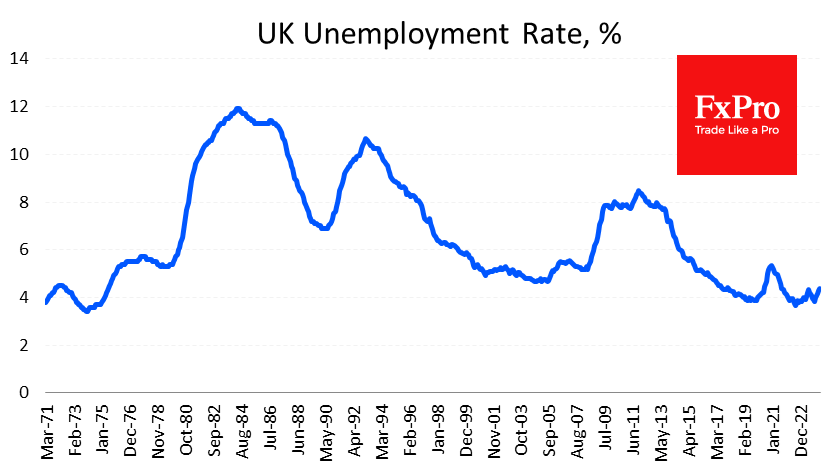

In a separate indicator, the Unemployment Rate for the February-April period climbed to 4.4%. This is still low by historical standards, but it is a three-year high and 0.6 percentage points above the one we saw in January last year. More actual Claimant claims are points to accelerate the unemployment growth.

Wage growth remained at an impressive 5.9% y/y, including bonuses (above the expected 5.7%). However, this is the typical acceleration in wages that we see in the early stages of mass layoffs when the lowest-paid employees are given the chop.

A fresh labour market report has every chance of shifting the Bank of England’s focus from fighting inflation to supporting the economy. This is even more so because, at this stage, reducing the tightness of monetary policy will only be necessary. If this process is delayed, the situation could easily lead to a repeat of the abnormal stimulus we saw in 2008/09 or 2020/21.

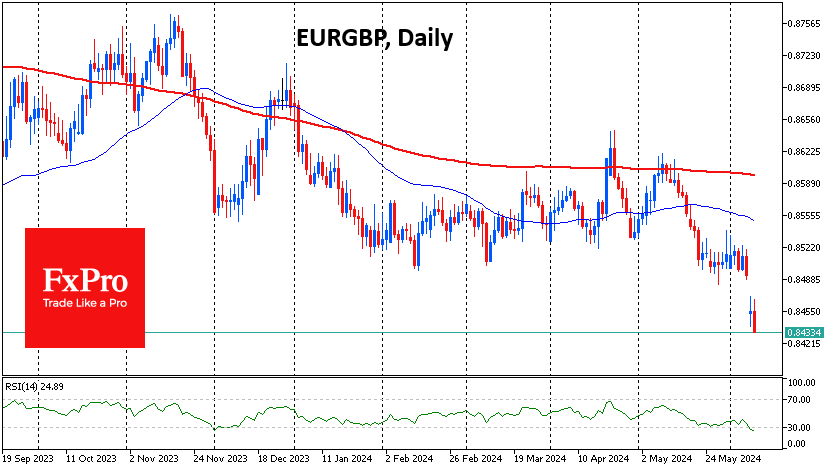

Reacting to the news, the GBP initially lost 0.15% against the USD and EUR but soon recovered almost completely. GBPUSD is dominated by a wait-and-see mood as all attention and volatility are deferred to inflation figures and monetary policy assessments from the FOMC on Wednesday. EURGBP remains under pressure due to the uncertainty surrounding the unexpected French elections and the disappointing (market-side) results of the European Parliament elections.

UK labour market data is already digging a hole for the Pound, and it remains a matter of days before it could fall into it.

The FxPro Analyst Team