After surpassing $30, silver may aim for $50

May 17, 2024 @ 12:23 +03:00

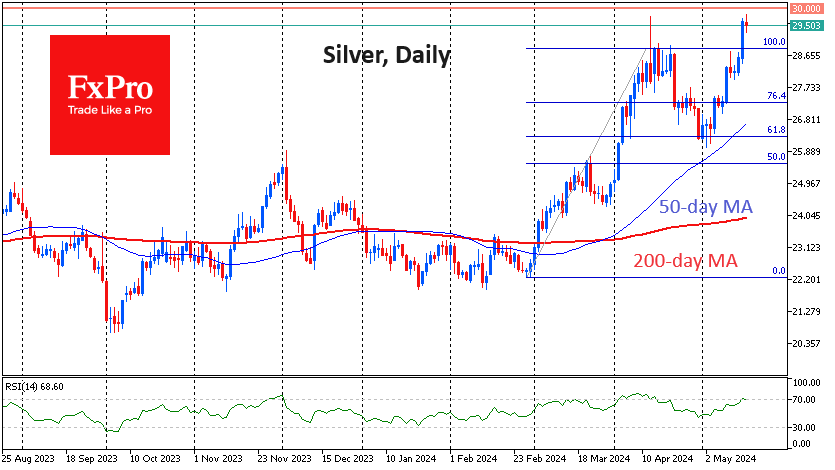

Silver climbed above $29.8, rewriting the highs from January 2021, but once again faced selling intensification from that level for the first time in four years and has pulled back to $29.40 at the time of writing.

Silver does not look overheated, as it is only now entering overbought territory on the RSI on the daily timeframes. Last month, silver was actively added for another three weeks after the RSI entered levels above 70. A two-week pullback in the second half of April later removed that overbought area. Technically, this clears the way up.

The upside potential after the pullback is also indicated by the April correction fitting into a classic Fibonacci pattern with a pullback to 61.8% of the initial rally from late February, followed by a quick recovery. A strong rise above the recent peaks will be an important confirmation of the growth extension and will make the $33 level a likely target for a new impulse.

We also note that the fresh assault on the 30 level came just a month after the previous one, and this rally started from a higher level than what we saw in March or 3-4 years ago.

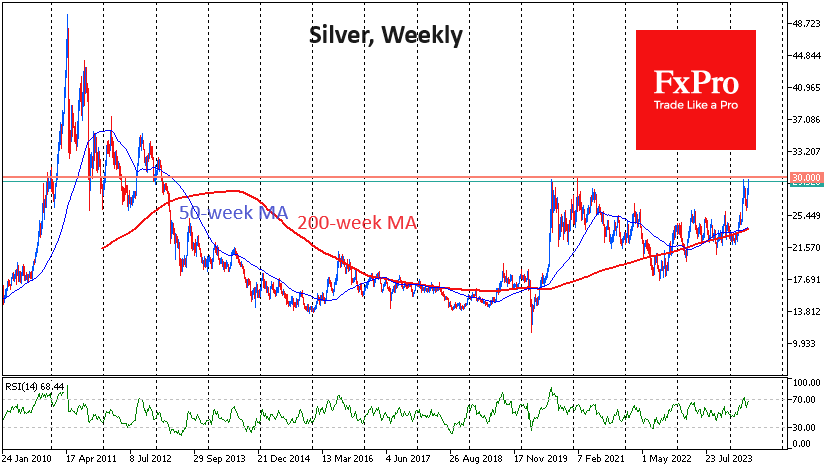

Long-term trends are also on the bulls’ side. In the last two years, they have been able to quickly turn the price to the upside after dips under the 200-week moving average. This year, the price is successfully pulling away from that line, but the most furious part of the rally may be ahead.

Silver could be ready to repeat the growth spurt it showed in 2010-2011. Back then, the multi-year resistance was at the $20 level, and the acceleration came after the 50-week moving average exceeded the 200-week moving average, and the price took that important round level. We have already gotten the first signal, so we must wait for the overcoming of $30 at the end of the week to confirm the bullish sentiment.

A move above $30 will make us seriously consider levels above $50/oz as a long-term target, repeating the 2011 and 1980 peaks.

The FxPro Analyst Team