A strong US labour market clears the way for more dollar growth

July 08, 2022 @ 16:59 +03:00

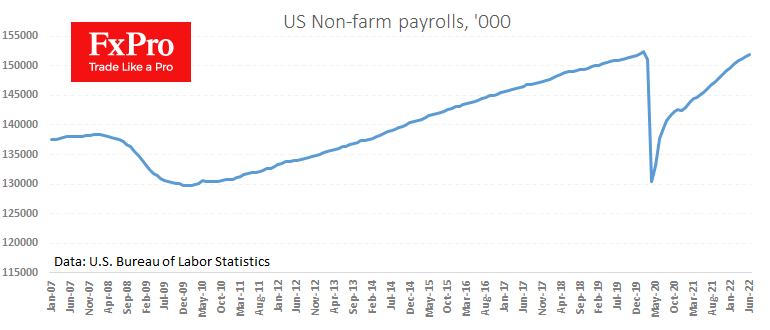

The US labour market created 372K new jobs in June, close to the rate of growth in the previous three months when growth was 398K, 368K and 384K. The data came out better than expectations, which suggested a slowdown to 260K–290K.

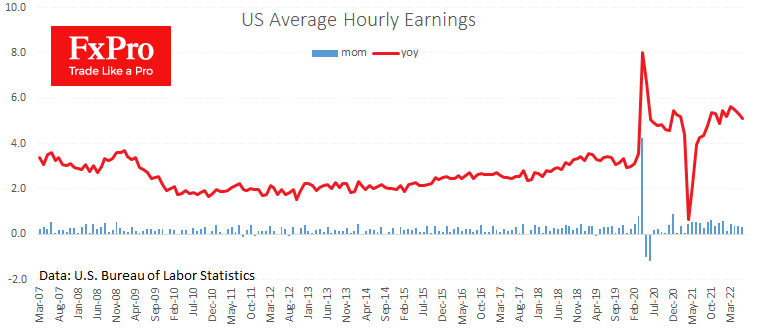

The rate of wage growth in the same month a year earlier slowed to 5.1% in June after peaking at 5.6% in March.

Fed officials in the last couple of days have hinted to markets that the rate could be raised again by 75 points at the end of July, as monetary officials prefer to bring the gap between projected inflation and the Fed Funds rate closer to zero before the end of the year.

A strong labour market is likely to strengthen the Fed in its intentions. At least that is what the market thinks, having priced in a rate hike of 75 points later this month.

Interestingly, the stronger-than-expected report did not cause the Dollar to strengthen. It is more likely that the markets are “selling the fact” as the Dollar has already broken several records this week.

At the same time, investors and traders should be prepared that market participants may soon return to active Dollar buying due to carry-trade and a more optimistic outlook for the US economy than most developed countries.

The FxPro Analyst Team