A promising gold trend

May 03, 2023 @ 15:48 +03:00

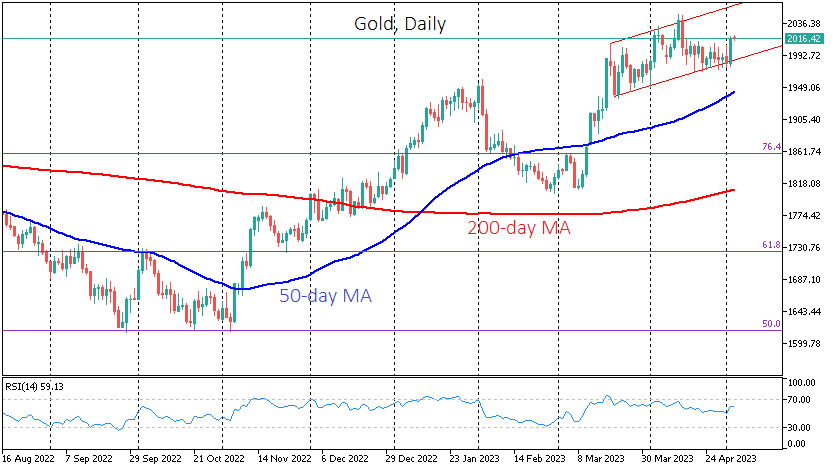

The price of gold rose by almost 2% on Tuesday after reports of another round of regional bank problems in the US. Quite quickly, the price stabilised around $2015. This surge allowed gold to bounce back from the lower end of the uptrend range, within which the price has been moving since March 22. However, it is a less significant reaction compared to what we have seen since March 9, as it is uncommon for the financial markets to experience an equally strong surge in response to the same cause twice.

Before that, since the end of April, we have seen very persistent buying of gold on declines into the $1975 area. Yesterday’s move brought the price back to the middle of the upside range, which has existed since March 22. Yesterday’s momentum took the price to almost four-week highs, above several local highs in recent days.

The upper boundary of that range is now near $2065, which brings it very close to a third test of the all-time highs above $2070. But there is an important difference between the way the price has behaved the previous two times and now.

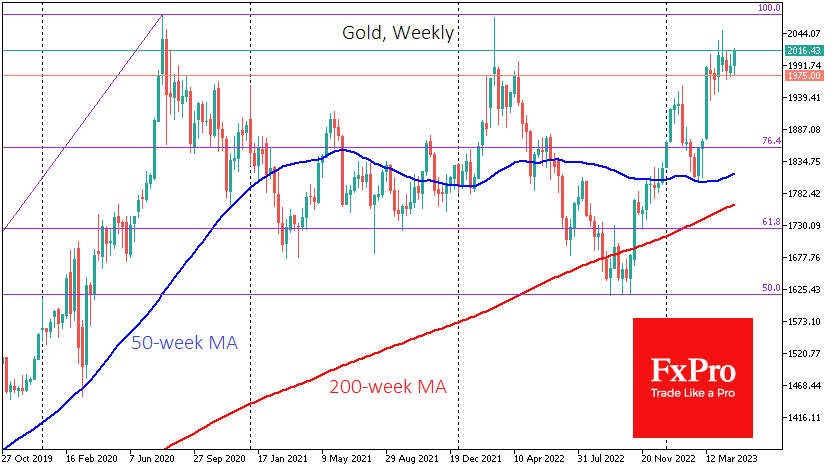

In July 2020 and February 2022, gold entered the most violent phase of its rally from levels just above $1800. This acceleration is often the last phase of the rally when the market is driven by extreme greed and bearish capitulation. In both cases, the price declined for a long time after that, pulling back below $1700.

This year’s rally started from roughly the same levels near $1800, but that was preceded by a prolonged correction after a failed attempt to take $2000 in January. In addition, since the end of March, the gold movement has become more cautious, and in April, it added just over 1%. Thus, the upward momentum in gold is not bearish capitulation but investor and speculator demand.

Notably, the buying boundary on declines – near $1975 – runs near a critical resistance level seen in August 2020 and April 2022, when sellers prevented gold from rallying again after the surge. The market dynamics suggest that the recent retreat to the $2000 level is a prologue to further gains rather than the end of an extended rally, as was previously the case. This suggests we will soon see prices above $2050 (previous high area) and increased chances of going above $2075 with a renewal of historical highs in the coming weeks.

The FxPro Analyst Team