A jump in eurozone PPI won’t stop ECB easing

September 04, 2024 @ 17:16 +03:00

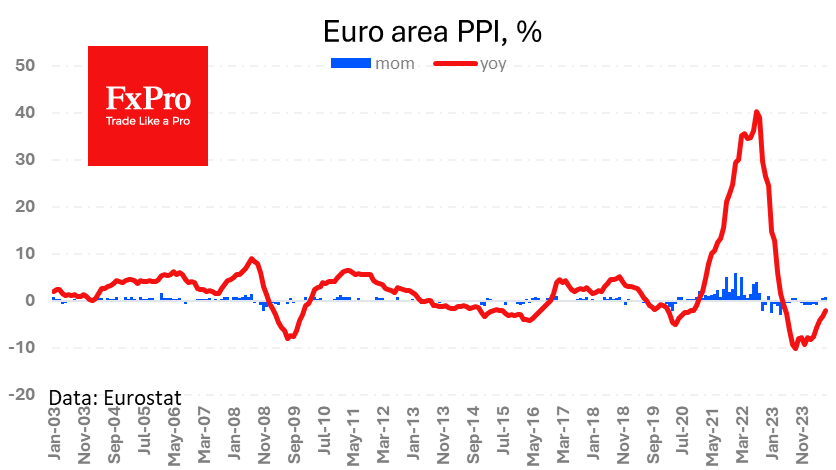

Perhaps disinflationary trends in the eurozone are giving way to pro-inflationary ones. The eurozone’s producer price index rose 0.8% in July after rising 0.6% in the previous month. Prices are still lower year-on-year for the fifteenth month, with a reading of -2.1% after -3.3% the previous month. Nevertheless, the jump over the past two months is worth watching as it promises to be a leading indicator of a turnaround in consumer inflation.

Although the ECB only talks about consumer inflation and wages, the sharp reversal in PPI promises to complicate the picture for forecasting inflation trends in the coming months.

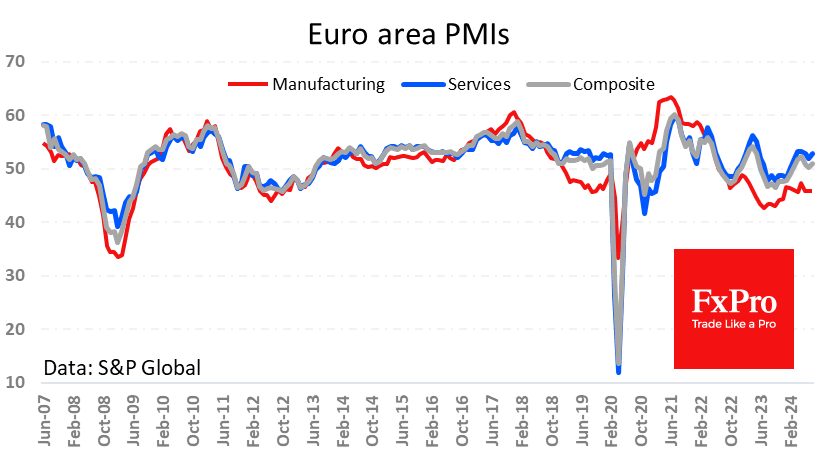

At the same time, business activity (excluding France) did not shine last month. The final composite PMI reading was revised down to 51.0, with the services sector driving growth, while manufacturing activity has been below the waterline for 26 months.

The decline in manufacturing has been attributed to tariff disputes with China, something we last saw in 2019. Tariffs may also be behind the momentum in producer prices. If so, this is no reason for the ECB to refrain from easing monetary policy, as loose monetary conditions and a low exchange rate could help manufacturing.

The FxPro Analyst Team