A dangerously thin demand for risk

February 16, 2021 @ 11:57 +03:00

The Asian markets that continue to operate are mostly growing today, pointing to a 12th consecutive trading session of global equities gains.

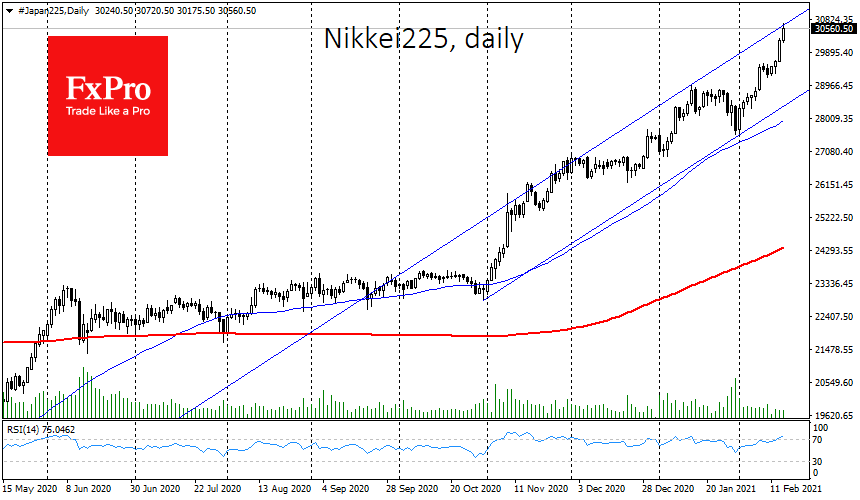

Asia’s Nikkei225 is moving further into the region of 31-year highs above 30,000. However, this is happening on ever-decreasing volumes. It could be a signal of buyer uncertainty or a just decrease in trading activity during Lunar New Year celebrations. Whatever the case, it looks that the ‘sell high’ strategy is the more reliable one in such a dynamic market.

In the forex market, the Australian and New Zealand dollars have almost recovered from the January correction. The pound is storming to multi-year highs almost daily and now trades at 1.3950, few steps away from a major milestone.

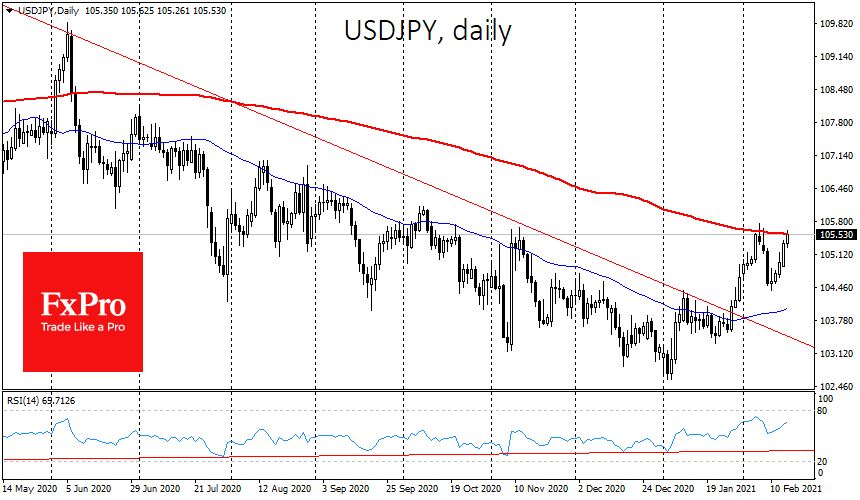

USDJPY pulled back last week as it tried to rise above the 200 daily moving average. Today it is testing that line again, rising to 105.50. Another pullback promises to signal that the large capitals still hesitate to switch from a ‘coronavirus trade’ to a ‘recovery trade’.

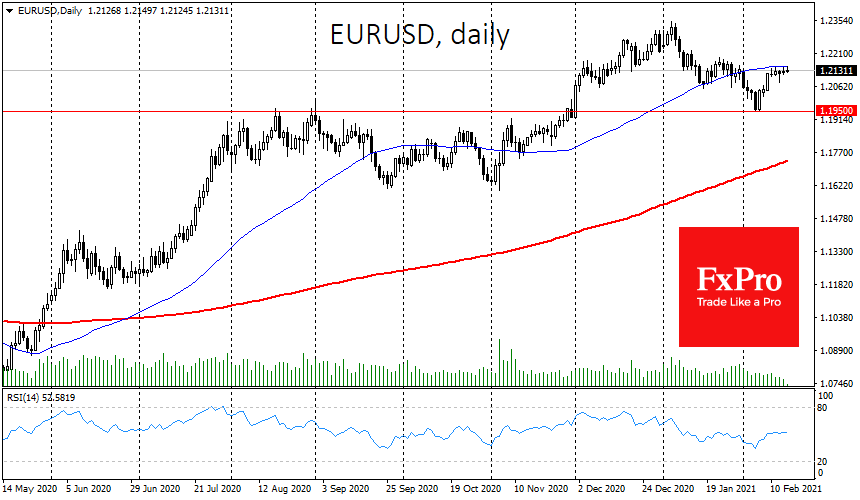

EURUSD, meanwhile, is hitting resistance near the 50-day average at 1.2150 due to the cooling economic recovery.

Yesterday industrial production data for December marked a decline of 1.6% m/m after earlier reports that business sentiment indices turned down. It sets the stage for a double-dip recession due to the winter pandemic outbreak and the ensuing lockdowns.

Business sentiment assessments from the ZEW may end the tug-of-war between the bulls and the bears today. The index is expected to fall slightly from 61.8 to 60.0. However, the chances of a sharp divergence from expectations in either direction are high, which could cause increased volatility.

Separate from continental Europe, the markets are more optimistic with news of the success of mass vaccination in the USA and the UK, providing increased demand for the dollar and pound relative to foreign competitors.

This same hypothesis of a return of correlation between markets and virus dynamics at home raises questions about emerging markets’ interest later in the year. After all, vaccination is a real concern for emerging markets, which promises to hold back these economies’ recovery for many more months. But it could also prevent a full lifting of restrictions in developed countries and stifle further growth in global equities, which now look severely overheated.

More positive factors are needed to push risk demand further up without a corrective pullback. At record highs and after such a prolonged upturn, it will be easy for markets to stumble.

The FxPro Analyst Team