S&P500 fails to cross Rubicon on its first attempt

May 27, 2020 @ 11:53 +03:00

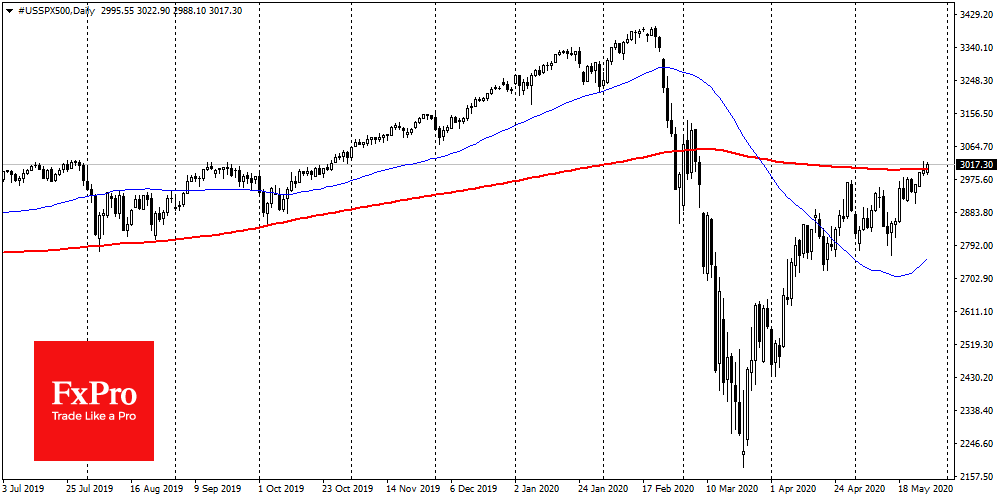

American indices were unable to stay above critical psychological levels after the end of trading on Tuesday, and this is an important sign for markets.

The S&P500 index exceeded 3000, while the Dow Jones index rose above 25000 on Tuesday during the day. As the close of the trading approached, both indices failed to stay above these psychological levels. The S&P500 found itself under increased pressure in the last trading hours of Tuesday. The most closely monitored index in the world end Tuesday at 2991.8 and below the 200-day average.

It is worth paying more attention to investors’ activity as the closing of trades approaches. Hence, we take it as a signal that the “sell on growth” approach is still in place. Close the day below the 200-DMA is a signal that participants were not ready to switch to buying just two months after the huge collapse.

On Wednesday morning, futures on S&P 500 returned to growth, adding 0.5% and trading above 3000 again. However, Asian indices are no longer following this growth, citing increased concerns around protests in Hong Kong.

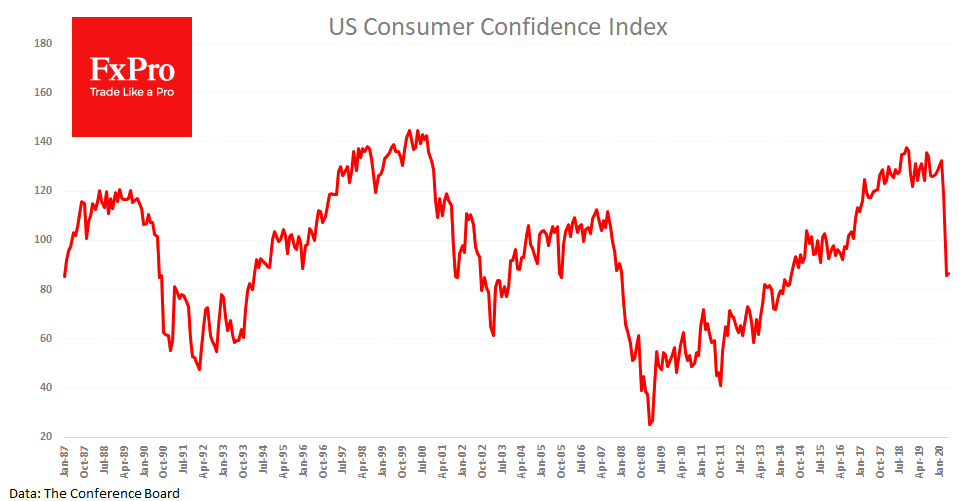

Professional investors in the US, whose activity prevails at the close of trading, seem to have paid more attention to the alarming signals of consumer activity as Consumer confidence index rose just to 86.6 in May from 85.7 a month earlier, still sharply lower than its recent peak in February on 132.6. Business activity indices are recovering much faster, but consumers remain in “crisis mode”, which is a worrying signal for future spending.

A Beige Book, the Fed’s regional economic review, is expected to be released tonight. The attention of investors and traders will focus on how business in the states assesses the current situation and looks to the future. This publication may finally trigger the reversal of the markets to decline or eventually consolidate above key levels and provoke further growth.

The FxPro Analyst Team