Hunger for risk pulls markets up

January 13, 2020 @ 12:58 +03:00

Global markets are showing growth amid growing interest in yielding assets in the hope of signing the China-US Phase One of the trade deal on January 15. This move is noticeable both in stock indices, as Asian platforms touched 19-month highs earlier this morning and in the currency market, where high-yielding currencies from the Chinese yuan and the Russian ruble to the South African rand and Turkish lira have strengthened.

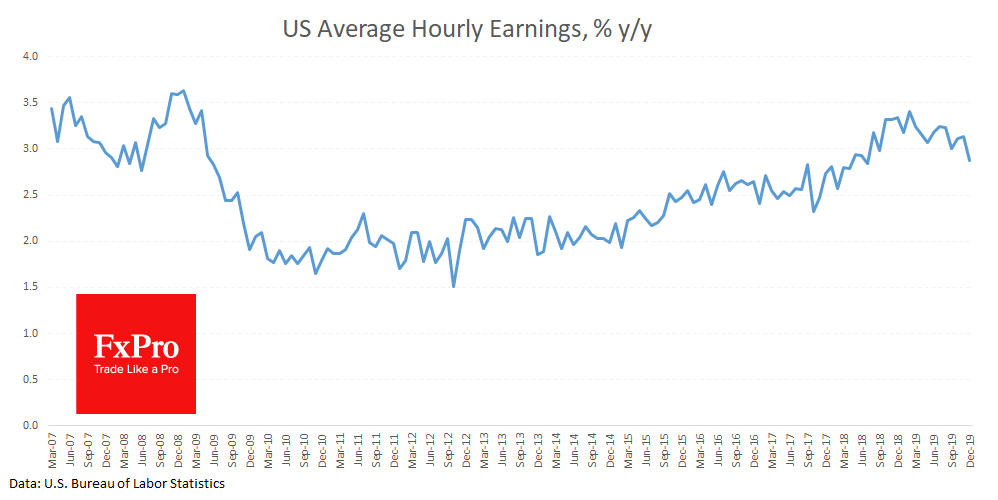

The US employment data released on Friday was able to maintain an optimistic sentiment in the markets, managing to catch the necessary balance to keep the positive trend. Employment growth was in line with the multi-year trend, noting healthy growth in new jobs and promising the same consumer demand. At the same time, there is still no inflationary threat on the horizon, as the rate of wage growth has somewhat decreased in recent months despite the historically low unemployment rate. Subdued wage growth removes the risk of an unexpected surge in inflation, which could force the Fed to tighten its policy tone.

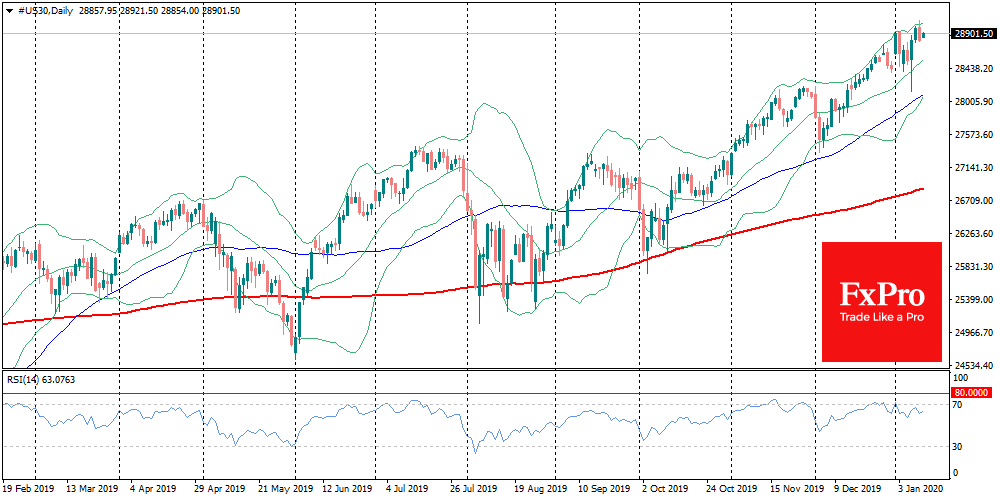

Against the background of such a goldilocks employment report, it was somewhat unusual to note the weakening of the US stock indices at the end of trading on Friday. It was like a corrective pullback after touching significant round levels on the Dow Jones and Nasdaq. The former index rose above 29,000 at some point, while the latest overcame 9,000. The indices’ quick return to growth on Monday morning already suggests that it was nothing more than a pit stop before the rally attempt to 30,000 and 10,000, respectively.

The pull of US indices to the round levels may absorb all the attention of investors on the stock market. However, on the currency market, we may observe a departure from the round levels. EURUSD increases from 1.11, in response to expectations that the Eurozone economy will accelerate. The progress in trade negotiations also puts at risk the downtrend of the pair, formed with the first “shots” of trade wars.

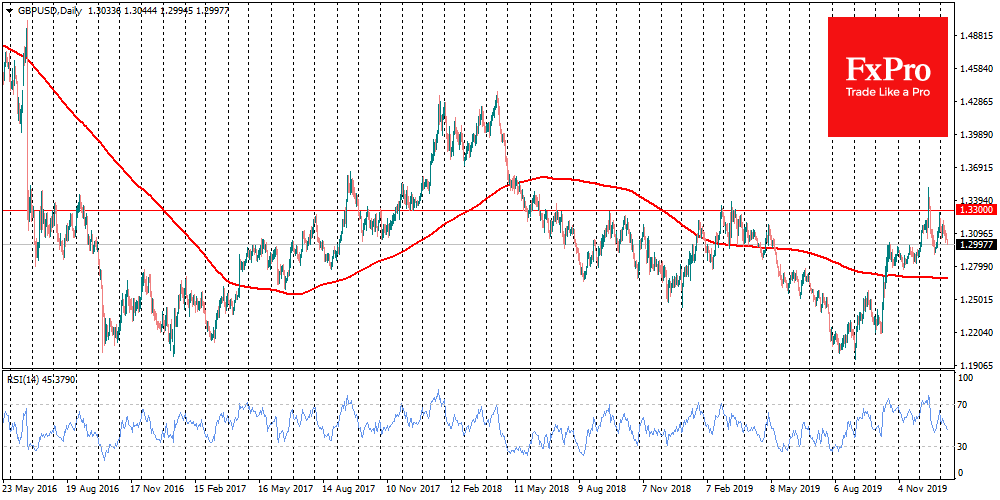

GBPUSD trades near 1.30, declining since the beginning of the year due to investors’ awareness of Brexit’s severity for the economy. The outgoing Head of Bank of England Carney also poured some oil into the fire, warning about possible rate cuts later this year. It turns out that the area 1.30-1.33 is considered by investors as a severe resistance area, from where the pair has repeatedly turned to decline over the last year and a half.

The FxPro Analyst Team