Rising dollar vs markets: what will be the primary trend of 2021

February 23, 2021 @ 12:44 +03:00

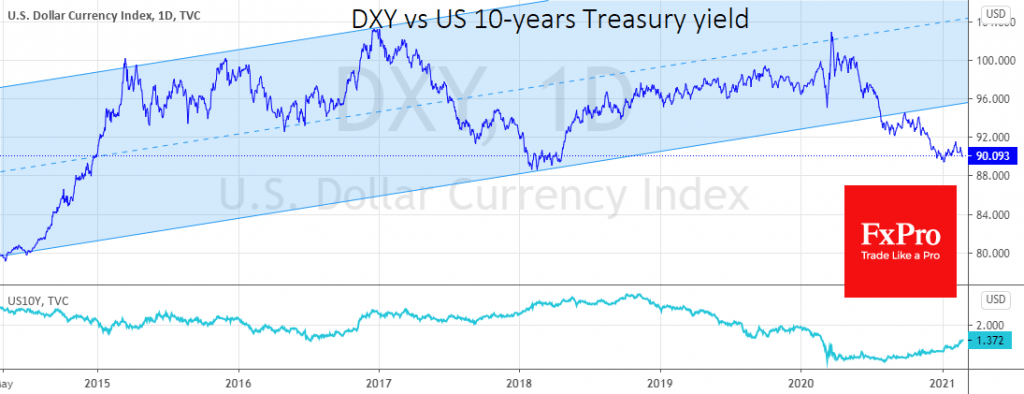

The US dollar is retreating, sending the DXY index below the 90-significant circular level and the 50-day moving average. The dollar’s corrective recovery proved short-lived.

The US is trying even harder than during the global financial crisis to solve the problems with money, preparing a second 2-trillion-dollar economic support package since the pandemic began. In contrast, Europe is making it clear that the $750bn coronavirus package passed last summer is more than enough.

Vaccination and severe restrictions in the US have reduced new infections: The 7-day average of new infections is already less than 70,000, down from 250,000 at the start of the year. And the markets see this as a signal of rapidly improving economic conditions. Combined with a plentiful stimulus, this sets the stage for accelerating inflation by tightening borrowing conditions in the markets.

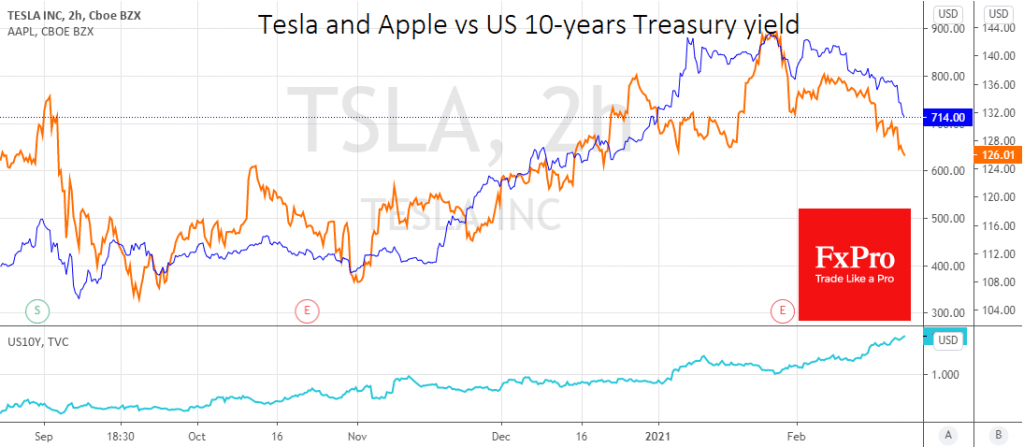

So-called “growth” companies, which rely on cheap borrowing to finance their operations, suffer as a result. With higher interest rates, it is harder for them to access easy financing. It seems paradoxical at first glance that improving macroeconomic conditions are putting pressure on growth companies.

This is visible in the decline of Tesla by 20% and Apple by 15% from their peaks at the end of January. And that decline is gaining momentum, causing the Nasdaq Composite to drop 2.5% on Monday with 5% losses over five trading sessions of decline in a row.

Long-term interest rates are far from normalising, and expectations of accelerating inflation risk push them even higher than pre-pandemic levels. This creates the potential for significant pressure on growth stocks. Because they carry considerable weight in equity indices, this situation runs the risk of leading to strong pressure on markets.

In theory, the Fed could correct this situation. The QE programme has put pressure on government bond yields because there has always been a big buyer in the markets via the Central Bank’s agents. Further increase in market volatility may force the Fed to come to the rescue by expanding the bond purchases programme. Powell even laid the groundwork for such a move, previously claiming that real unemployment in the US is close to 10%, versus the official 6.3%.

But such moves carry reputational risks for the Fed, which could be accused of losing its independence and funding the government. And this would be disastrous news for the dollar. Later today, the Fed governor delivers his semi-annual address to Congress. His speech could hint at which path the Fed will take: supporting the dollar or low rates and markets. This could potentially be the primary trend for the whole of 2021.

The FxPro Analyst Team