Will there be a rebound development in Bitcoin?

June 26, 2024 @ 11:59 +03:00

Market picture

Crypto market capitalisation added 1.2%, recovering to Monday’s levels of $2.28 trillion.

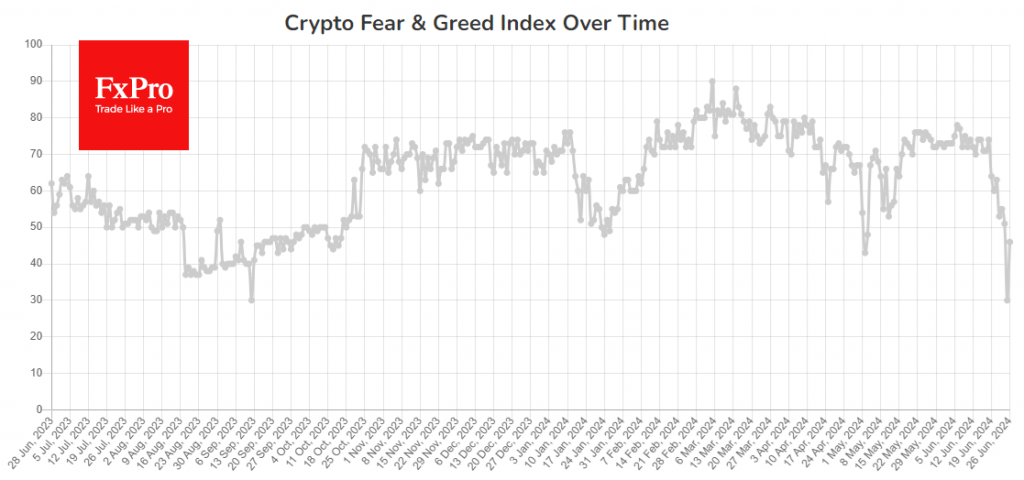

On 25 June, the Crypto Fear and Greed Index fell into “fear” territory at 30 points, the lowest since September 2023. On 26 June, the index recovered to 46. Both in September and now, the price and index’s sudden drop out of a range has attracted buyers, laying the groundwork for gains after a prolonged slide.

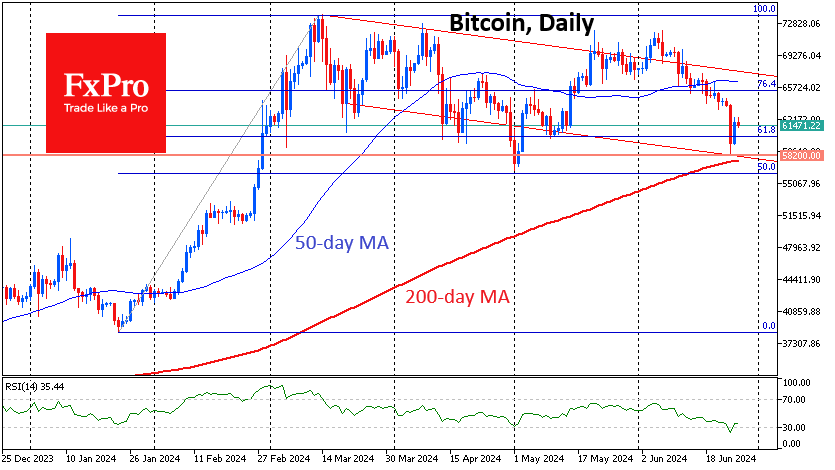

However, the recovery momentum paused Wednesday morning, raising the question of whether we’ll see a renewed selloff. Such a turn of events risks breaking the multi-month bullish view on Bitcoin and, with it, the entire cryptocurrency market.

However, the base case scenario now remains the development of a rebound and the preservation of the long-term bull trend.

News background

According to SoSoValue, outflows from the bitcoin-ETF continue for the seventh consecutive day. On 24 June, holders of BTC-ETF shares reduced their positions by $174.5 million. The trigger for the drop in quotations was the news about Mt.Gox’s preparation for compensation payments in early July.

Despite the correction, derivatives market indicators suggest a steady bullish sentiment towards bitcoin ahead of the expiration of weekly, monthly and quarterly positions on 28 June, The Block reported. According to analysts at QCP Capital, the options market is not expecting increased volatility in July following the announcement of a payout to Mt.Gox creditors on Monday.

German authorities transferred 400 BTC (~$24.34 million) to Coinbase and Kraken exchanges on 25 June and 500 BTC to a separate address. Arkham tracked the transactions. The German government currently holds 46,359 BTC (~$2.83bn).

Bitcoin mining revenue indicator, the Bitcoin Hash Price Index, has approached an all-time low. Mining profitability is falling due to the decline in the BTC exchange rate and the rising cost of mining the first cryptocurrency.

Commissions in the Ethereum network fell to the lowest values since April 2020. This was largely fuelled by so-called second-tier solutions and technical updates to the network.

The FxPro Analyst Team