Where is Bitcoin’s bottom?

January 18, 2022 @ 21:20 +03:00

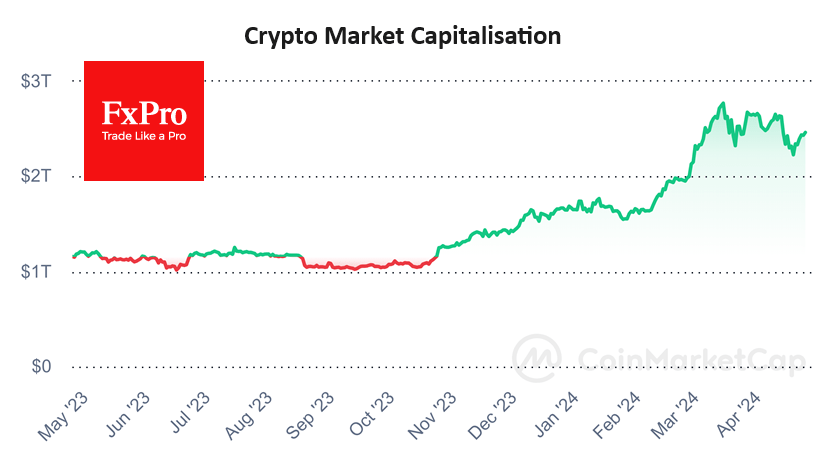

The cryptocurrency market lost 2% of its capitalisation in the past day to $2.0trn. Buyers stepped up in the market between 8-11 January, soon after a dip to this round level. But as we can see, the bulls’ strength was not prolonged enough.

The Crypto Fear and Greed Index added 2 points to 24. The 18th of November was the last time we saw levels above 50. Since then, the cryptocurrency market has been steadily in a downtrend, with the overall crypto market capitalisation down 30%.

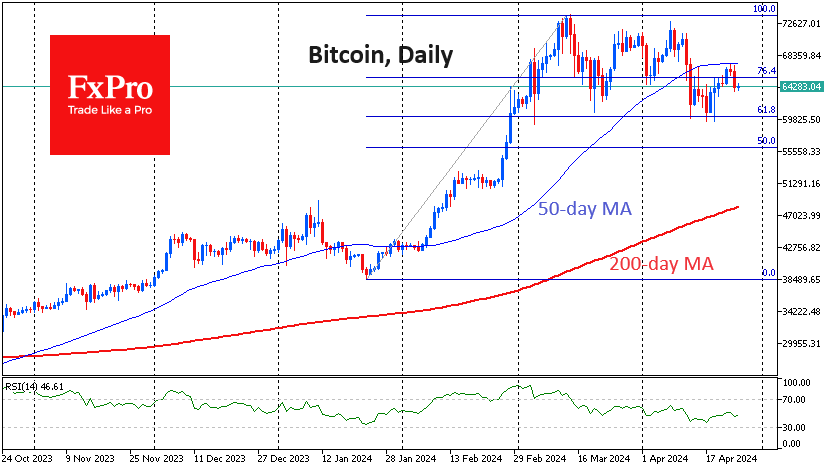

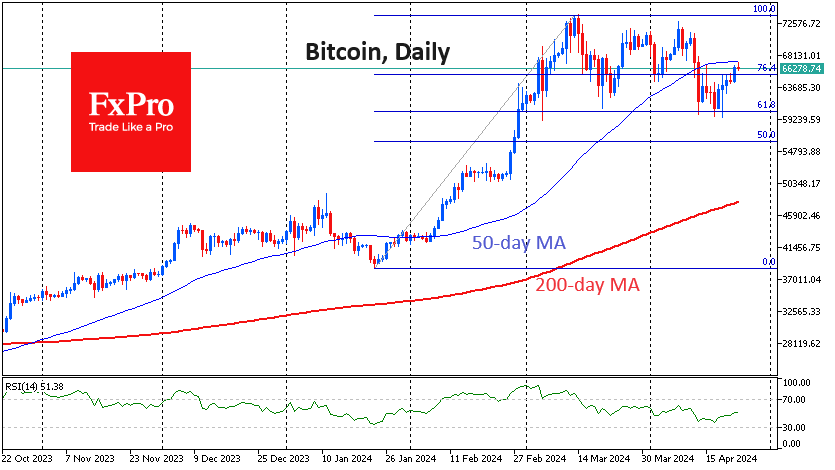

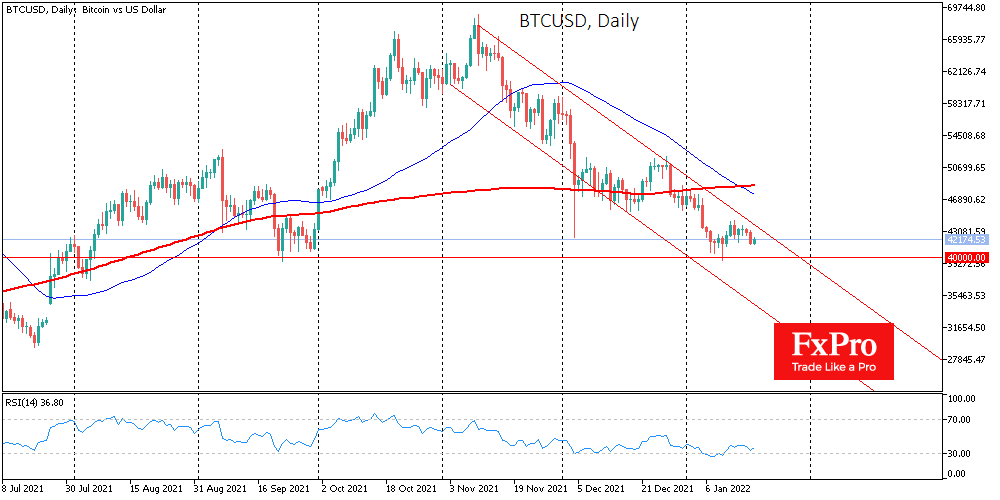

Bitcoin is losing 2% overnight, retreating to the $42K mark, returning to an area of local lows before last week’s rebound. Wariness prevails in traditional financial markets on Tuesday morning, so a fall under $42K could quickly turn into a test of the $40K level.

The bitcoin chart is increasingly clearly showing a downward reversal with a continuation within the three-month down channel. The RSI index on the daily charts remains in neutral territory, meaning there is still room for a decline. The 50-day moving average is deeper under the 200-day moving average, indicating that the pair is in a bearish trend.

Ether pulled back to $3180 from the region of $3500, and it is sinking under the bears’ pressure.

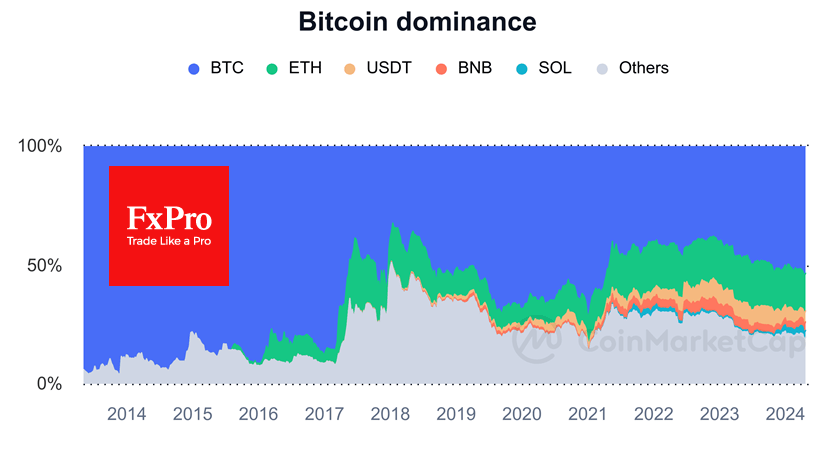

The methodical selloffs are exhausting market participants, where the feedback loop is solid: price increases spur purchases, pushing prices up even more. Downturns or a prolonged period of sideways trading causes disappointment and waning interest. After all, many people come to cryptocurrencies looking for a quick buck. They are willing to take high risks, but the lack of momentum dampens the excitement. After rapid growth in 2020 and 2021, we should not be surprised to see the market cool down.

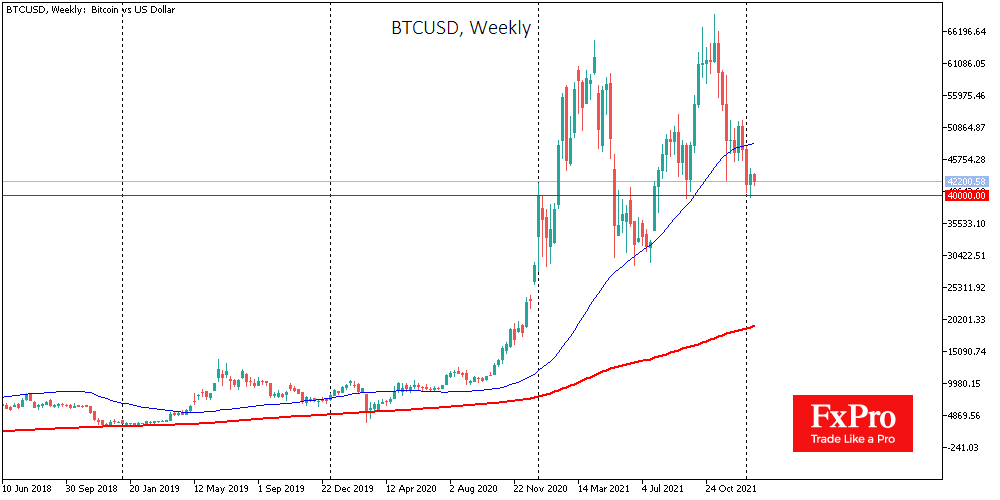

The long-term weekly candlestick chart of Bitcoin shows that over the past seven years, support turns the market around, even during a depression, it passes through the 200-week moving average. This line is now near 19k, and by the end of the year, it will be slightly above 20K.

A bear market development for cryptocurrencies could push Bitcoin back to 20 before the end of 2022 in a pessimistic scenario. These levels could be the best prices to buy, although experience suggests it could take another year of sluggish growth before seeing a new powerful uptrend and FOMO.

The FxPro Analyst Team