Tight crypto market range as compressed spring

September 14, 2021 @ 13:48 +03:00

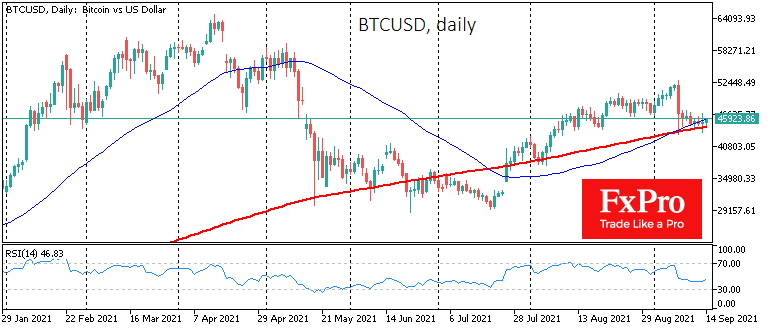

The crypto market remains in limbo and resembles a compressed spring at the same time. Bitcoin is trading slightly below $46,000 on Tuesday morning, ending the sluggish slide of the previous six days.

Strictly speaking, the cryptocurrency market does not look over-sold to be unequivocally attractive for short- and medium-term buying, but it does show signs of buyer interest.

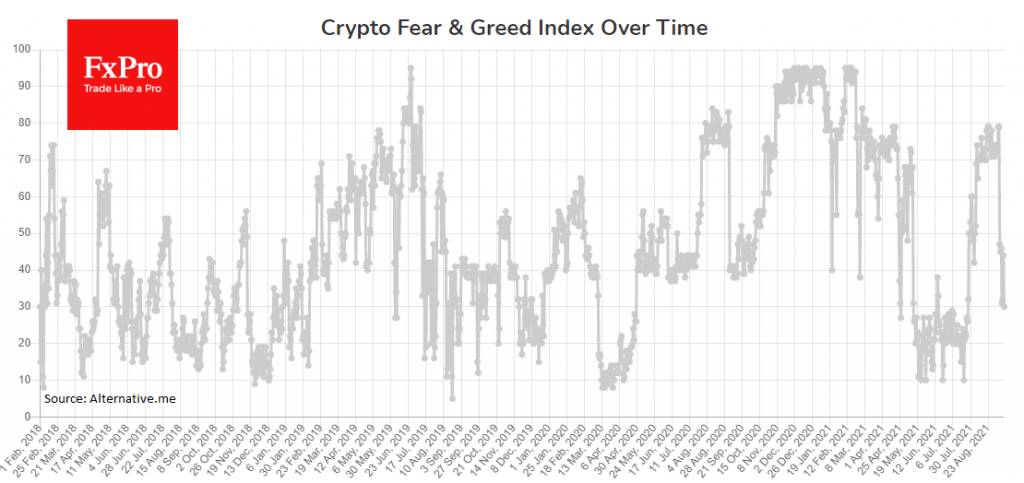

The Cryptocurrency Greed and Fear Index has fallen to the 30, i.e., “Fear”. From these levels, the index began the most active sell-off phase of the crypto market in May. Historically, buying cryptocurrencies was most attractive when the index reversed to a rise from around 10 (with extreme fear).

However, caution is not yet a vital trait for crypto investors. Bitcoin has been methodically gaining support this month on the downside of a simple 200-day moving average, which now passes near $44300. In early August, the rise from this curve has kick-started a 40% rise over the next five weeks.

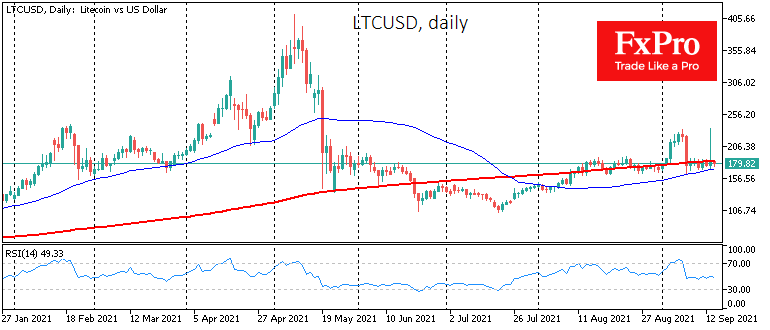

Yesterday’s Litecoin momentum illustrates just how fast and strong the move can be on big news.

Yesterday, a moment of euphoria was experienced by Litecoin, whose quotations soared by a third to $235 on the news that Walmart would accept the coin as payment. The news turned fake, and the coin quickly returned to previous levels near $173. However, the positive momentum in the coin is worth noting, which has been steadily finding buy support on dips below $170 over the past week, stuck between the 50- and 200-day moving averages.

In recent days, altcoins have generally looked weaker than bitcoin, allowing the latter to regain some of its lost ground in the overall crypto market capitalisation. And that’s not such a bad sign, as bitcoin is often the first to see a change in trend. The presence of steady buying in the coming days will allow markets to shake off pessimistic expectations from the crypto market and revive positive price momentum amid a protracted lull after the downturn.

The FxPro Analyst Team