The worst-case scenario for Bitcoin

December 07, 2021 @ 11:41 +03:00

On Monday, along with rising risk appetite in global markets, buying interest in cryptocurrencies returned. The cryptocurrency fear and greed index added 9 points to 25 overnight. This is still an area of extreme fear, but recent dynamics of the largest coins indicate that this is now the moment for investors with increased risk appetite to enter.

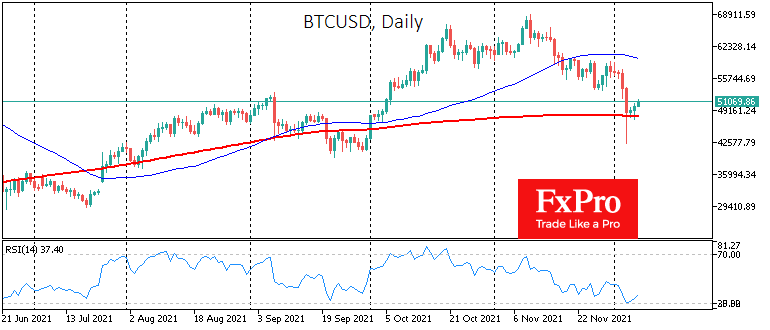

BTCUSD has added 4.9% in the last 24 hours, trading just above the $51K level.

The RSI on the daily candlestick charts has retreated from below 30 (oversold area). The price has found support from buyers at the important 200-day moving average. This is a strong signal for many participants that the whole market stays in a long-term bullish phase.

But so far, we see very cautious buying, which is creating doubts. A better signal would be a sharp move up, crossing this line, as in July and October this year and before that in April 2020.

This is quite an optimistic scenario for bitcoin, where it gets sustained bullish support, preventing it from descending into an uncontrollable fall.

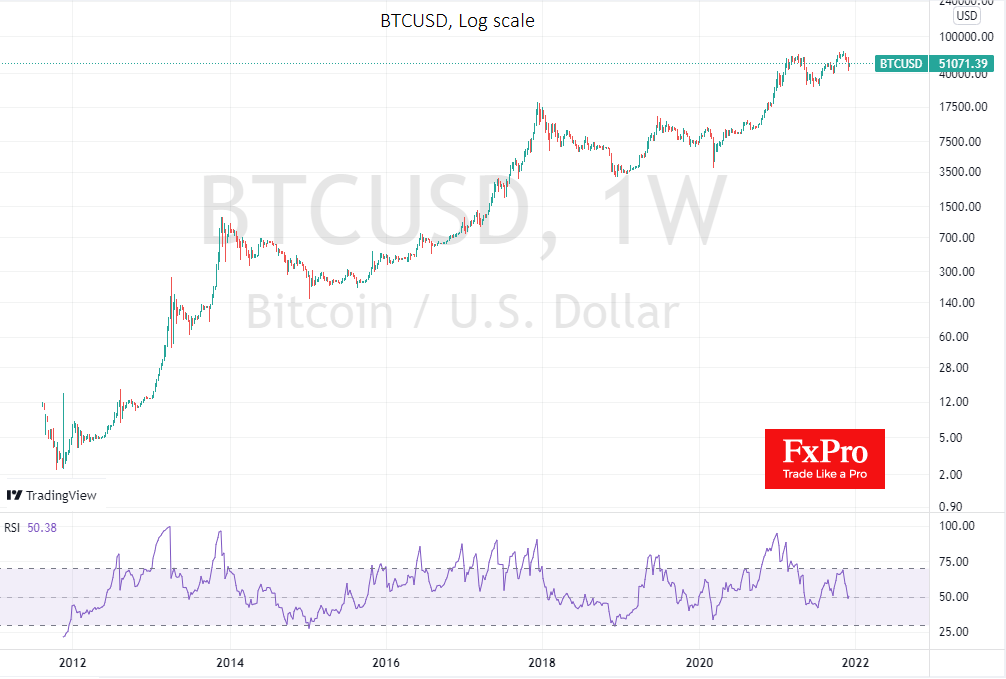

The pessimistic scenario for bitcoin, and the entire cryptocurrency market, assume a bullish/bearish sentiment tied to 4-year halving cycles. The previous two bear markets came in 2014 and 2018, giving speculators a good shake out of that train and leaving only the most resilient crypto enthusiasts.

A sharp reversal to the downside after a dizzying rise came in late 2013 and 2017 and lasted about a year. This suggests a high risk of reversal at the end of 2021. From peak to bottom in 2013-2014, BTC lost more than 70%, and in 2017-2018 – 85%.

A repetition of these scales sets BTCUSD up for a pullback in the 10-20k range. In our view, even a decline to 20k – the highs of the previous cycle – looks like a very pessimistic scenario for now. But it may well materialise under a negative set of circumstances, though it is bound to attract the interest of long-term buyers.

Bitcoin needs to pass several checkpoints before we seriously consider such a scenario. The first one is the 200-day moving average (currently at 48k). Confirmation we will get on the decline under $40K, the level of previous local lows.

The FxPro Analyst Team