The stock market has helped crypto

May 18, 2023 @ 13:03 +03:00

Market picture

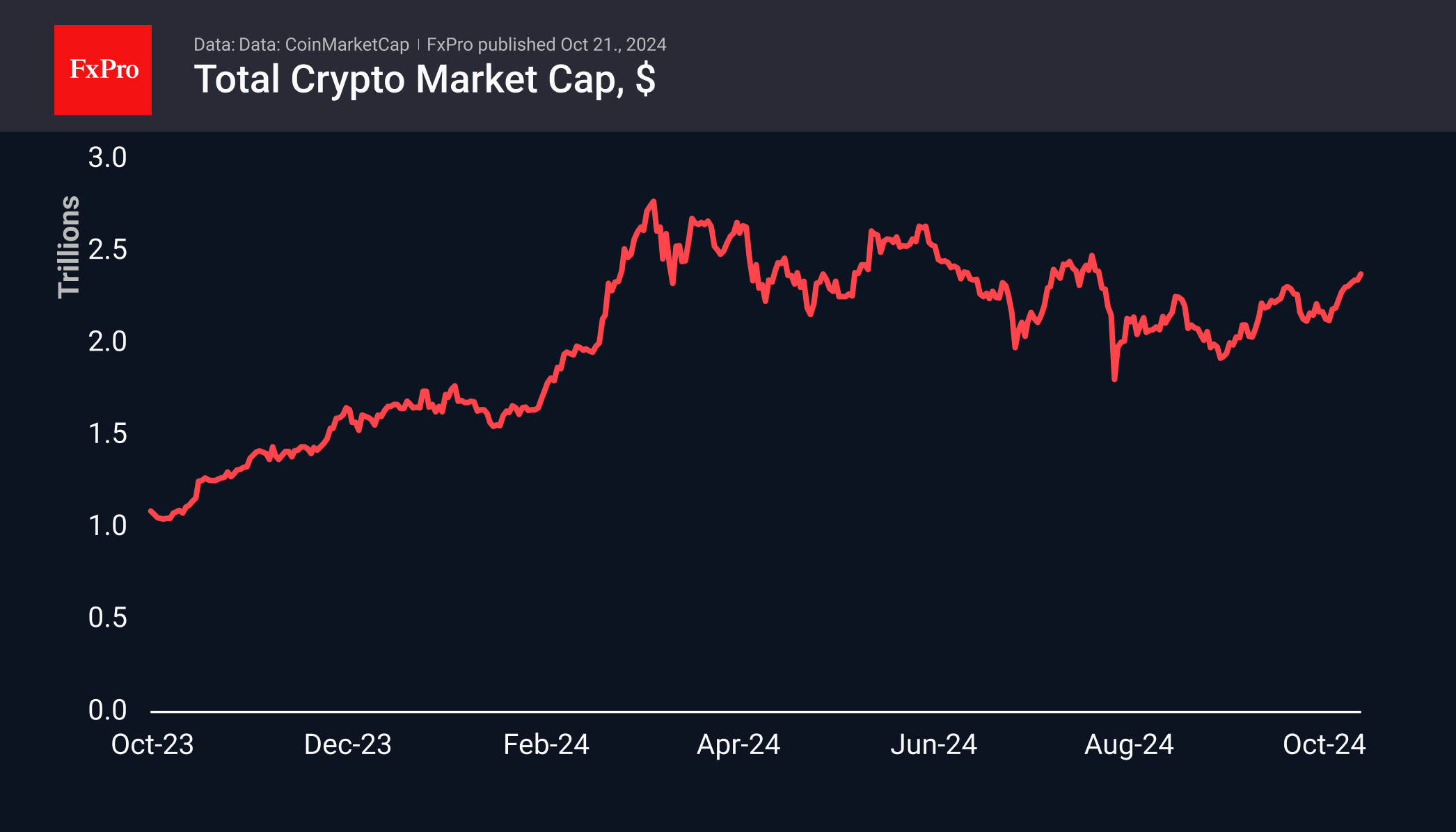

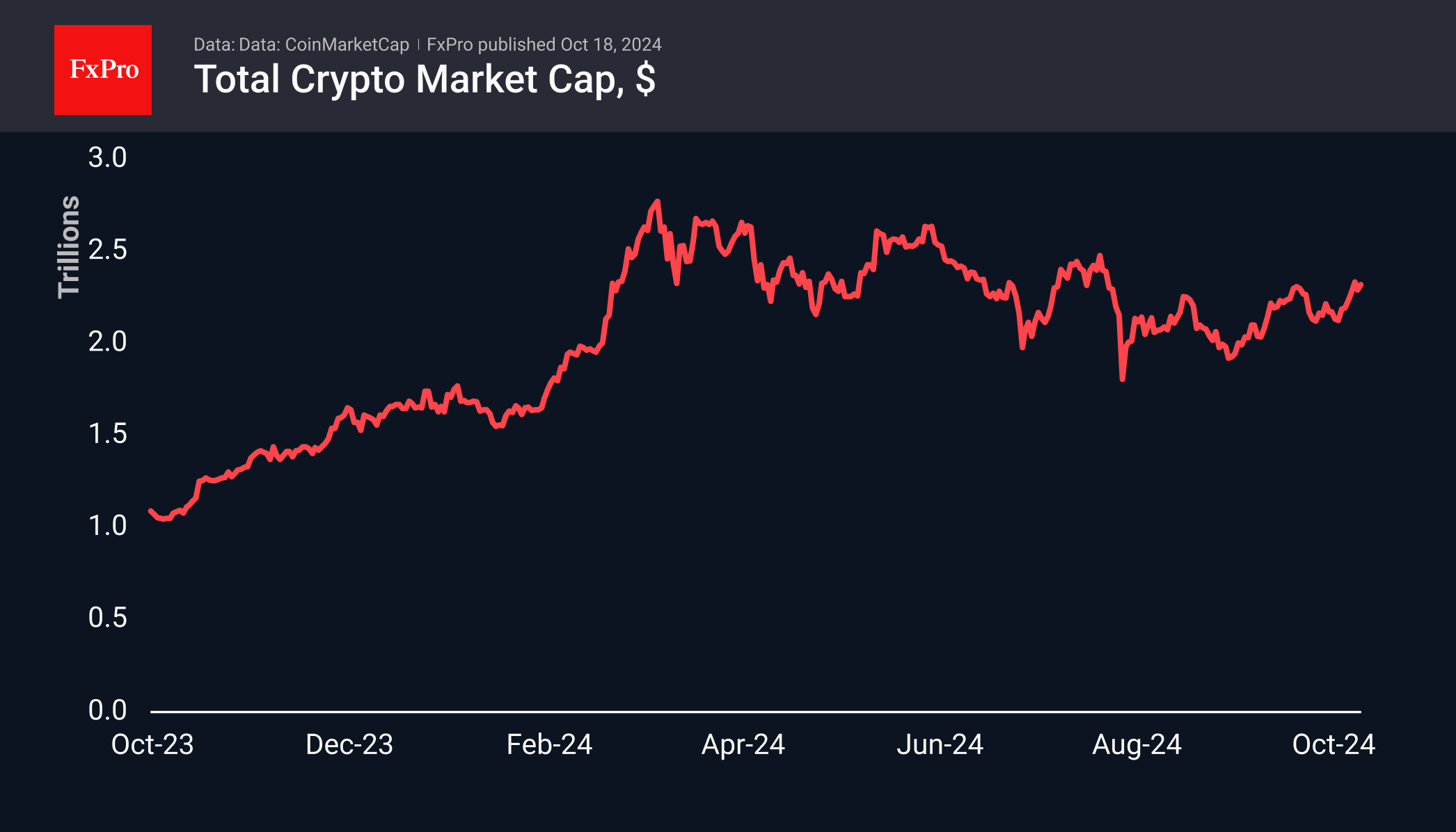

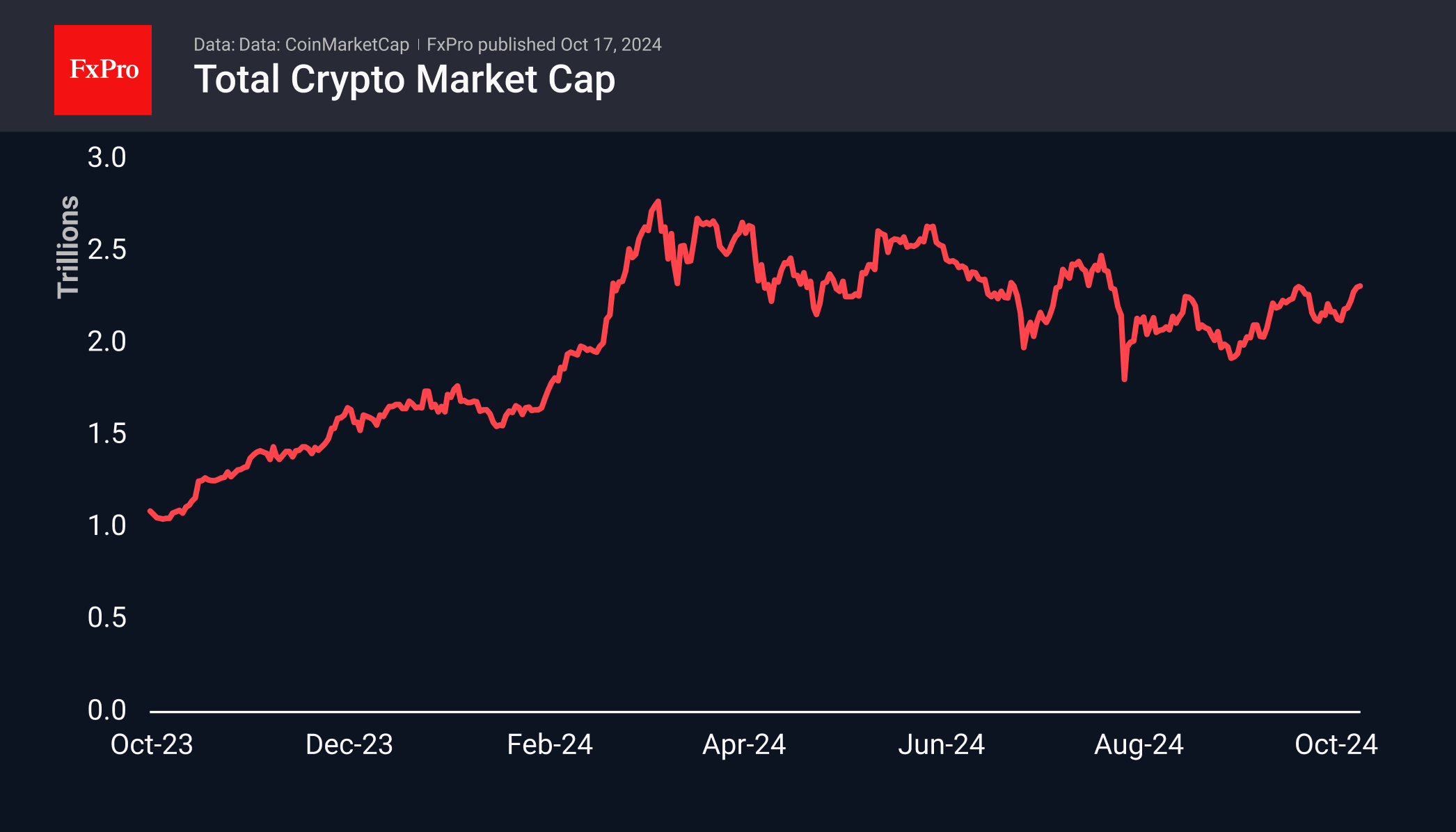

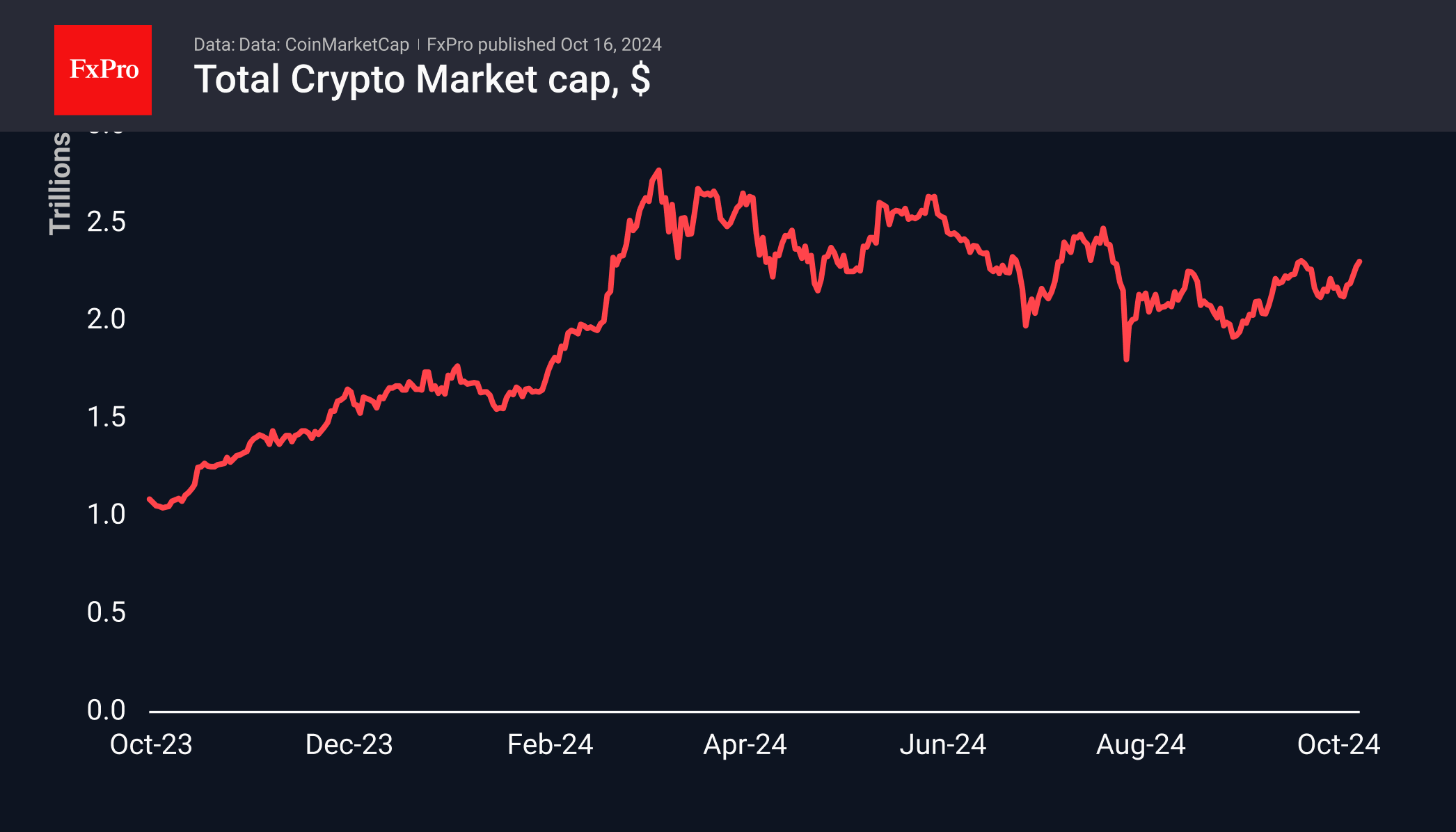

The crypto market capitalisation rose 0.55% over the past 24 hours to 1.134 trillion. Late Wednesday afternoon, another attempt was made to break above 1.14 trillion, following the US stock market rally on the government debt ceiling news. However, it has so far failed to stay in this territory.

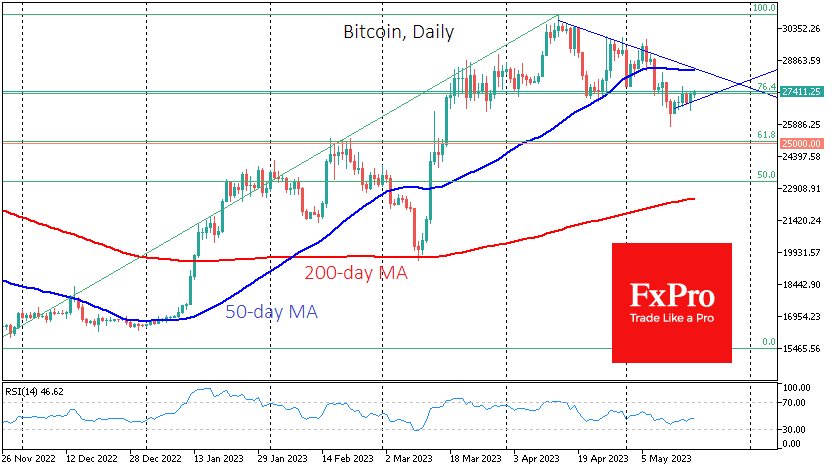

Bitcoin is up 0.7% at $27.2K, staying within the recovery trend that has been in place since the 12th. However, this recovery is painfully slow, and local resistance at $27.5K, which has been supporting since late March, remains in place.

According to Santiment, large Bitcoin holders continue accumulating BTC – over the past five weeks, cryptocurrency holdings have increased by nearly 85,000 BTC ($2.3 billion). Santiment believes Bitcoin is now in a consolidation phase before a new surge.

News background

The stock and cryptocurrency markets will collapse if the US defaults, says Mike McGlone, senior strategist at Bloomberg Intelligence. He is bearish on cryptocurrencies but bullish on gold.

Lightning Labs, the developer of the Lightning Network, announced the release of Taproot Assets Protocol v 0.2, which avoids potential delays in transaction processing due to congestion on the Bitcoin network.

The UK Parliament has proposed regulating cryptocurrencies as gambling. Crypto assets can potentially be used for fraud and money laundering, posing a high risk to consumers and the economy.

Tether’s issuance team has decided to invest up to 15% of its net profits in Bitcoin monthly to diversify its reserves. It has already invested $1.5 billion in BTC. The bulk of USDT’s collateral is still in short-term US Treasuries.

According to a Bloomberg survey, only 31 of the top 60 cryptocurrency companies have successfully undergone external financial audits or confirmed reserves. Many auditors are reluctant to work with cryptocurrency companies or need more expertise.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks