The light greed of the crypto market

August 26, 2024 @ 10:30 +03:00

Market picture

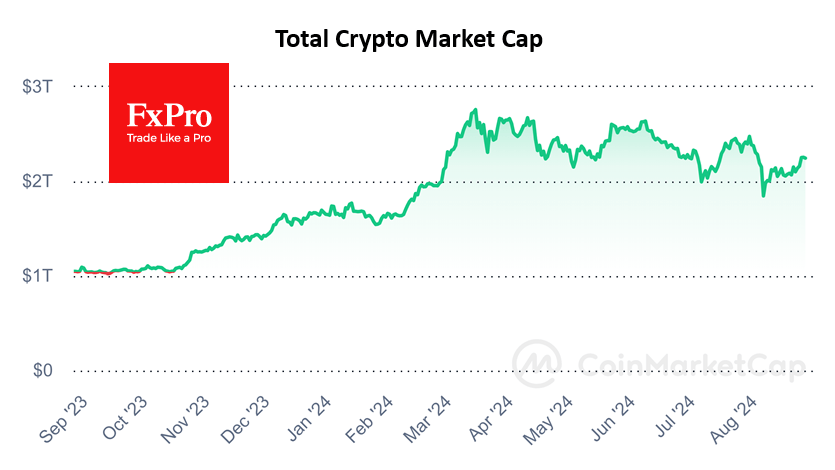

Since Friday, the crypto market has been in a mood of easy greed, as evidenced by the corresponding index, which reached 55 on Monday, close to levels at the beginning of the month. Market capitalisation has also returned to $2.25 trillion, the highest since August 2.

A decisive breakthrough came on Friday when Fed Chairman Powell supported optimism in global financial markets, tipping the scales in favour of the bulls. The cryptocurrency market has managed to overcome the local resistance of the past few weeks and is likely to head towards the upper end of the range, now nearing $2.35 trillion.

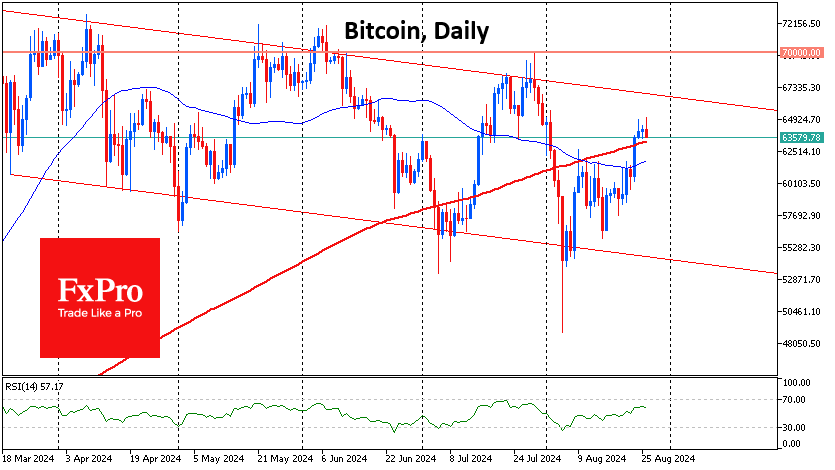

Bitcoin broke above both its 50- and 200-day moving averages on Friday and briefly touched the $65,000 level on Saturday and Monday morning. The bulls will need to confirm this breakout by holding above $63.0K on Monday.

Toncoin is stabilising at nearly $5.66 after losing more than 15% on the news of Pavel Durov’s arrest. Technically, the coin is consolidating near its 200-day moving average, which is acting as local support. In our view, there is a high probability of a deeper dive to the $4.3 (200-week) or even $2.5 (April 2022-February 2024 resistance area).

News background

Data from CryptoQuant and major options exchange Deribit signalled moderate optimism in the crypto market. Bitcoin reserves on centralised exchanges fell to multi-year lows in August.

According to SoSoValue data, total weekly inflows into Bitcoin-ETFs totalled $506.4 million, the highest in 4 weeks. Cumulative inflows since the BTC-ETF was approved in January rose to $17.88bn.

In contrast, the Ethereum-ETF has seen a negative trend, with outflows of $44.5 million for the week after outflows of $14.2 million previously. Net outflows since product approval have risen to $464.7 million.

According to Spot On Chain, the non-profit Ethereum Foundation moved 35,000 ETH ($94 million) to cryptocurrency exchange Kraken, the largest Ethereum Foundation transaction this year.

Ethereum’s Dencun update, activated in March, has led to an increase in bots’ activity and failed transactions on Layer 2 networks, according to Galaxy Digital.

The FxPro Analyst Team