The Dollar sticks to its weakness for good

September 18, 2020 @ 11:46 +03:00

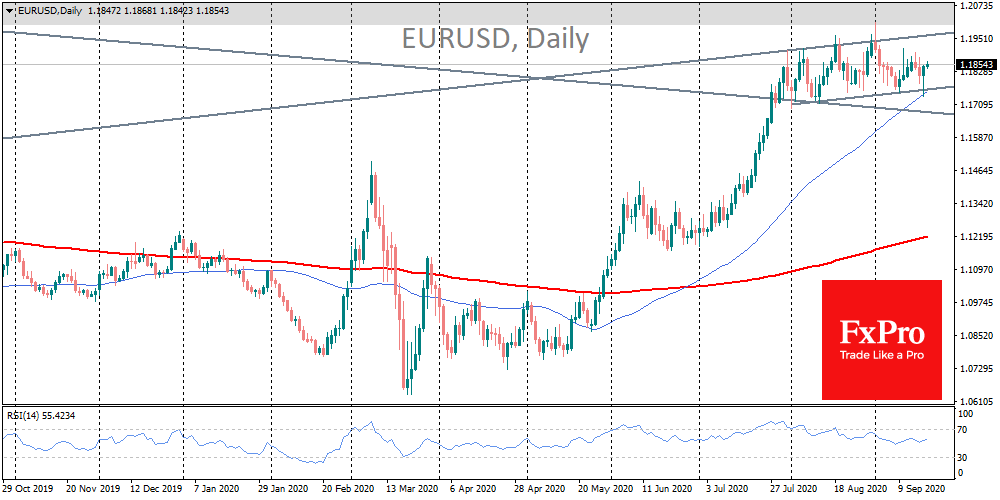

As we noted previously, the impulse for the strengthening of the US currency has proved to be very unstable. The dollar index has turned down many times since late July from 93.60 over the last month and a half. Yesterday was no exception. For EURUSD the support lies at 1.1750.

Both the dollar index and the EURUSD pair changed the trend sharply after touching the 50-day average. This behaviour is a sign of investors’ desire to stay within the short-term trend, i.e. within the weakening USD trend.

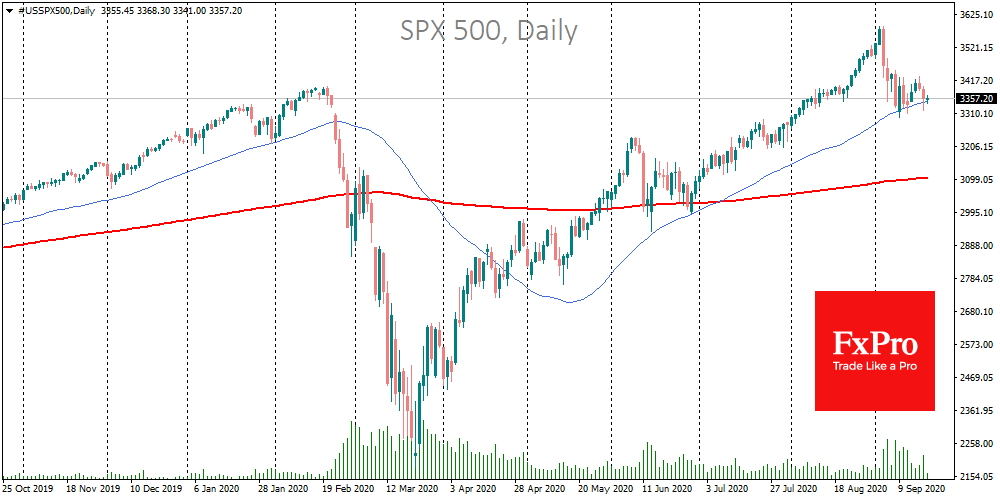

The gold rate, as well as the S&P 500 and Dow Jones, are similarly supported after a dip to their respective 50-DMA.

The dynamics of Asian markets, where the Dollar is also under pressure, deserve equal attention. The USDJPY has been steadily declining since the beginning of the week, losing 1.5% until now.

The Chinese yuan has not been able to rebound, remaining at 6.75, a low since May 2019. This is evidence of the strong inflow of funds into the Chinese economy. The rising rate of the national currency is perceived as a negative for the export-oriented economy. However, one should not confuse the impact of the exchange rate on developed and emerging economies.

For the latter, the stability of the national currency is an essential factor in supporting the financial market. Firstly, it is a manifestation of healthy capital inflows through export. Secondly, it is a sign of confidence in the local population and business in the national economy. As insiders in companies, they recognise the nuances of the real situation, unlike outsiders.

Capital in developed countries is flowing quite rapidly to the stock market, which is what we have seen today. Signs that the renminbi has escaped a downward turn is causing a sharp recovery in the Chinese markets on Friday.

This pattern is also working in the long term. The weakening dollar is feeding interest in risk assets, supporting both the US market and global markets in general. Assuming that this trend continues to weaken and that there is an overall increase in demand for risk assets, we would not be surprised if EURUSD could soon move beyond 1.2000.

On stock markets, EM would try to catch up with the US technology sector. As this race is based not on the new reality of the quarantined world but a broader recovery, the growth leaders promise to share success with cyclical companies.

The FxPro Analyst Team