The crypto market is trying to break the downtrend

December 10, 2025 @ 12:39 +03:00

Market Overview

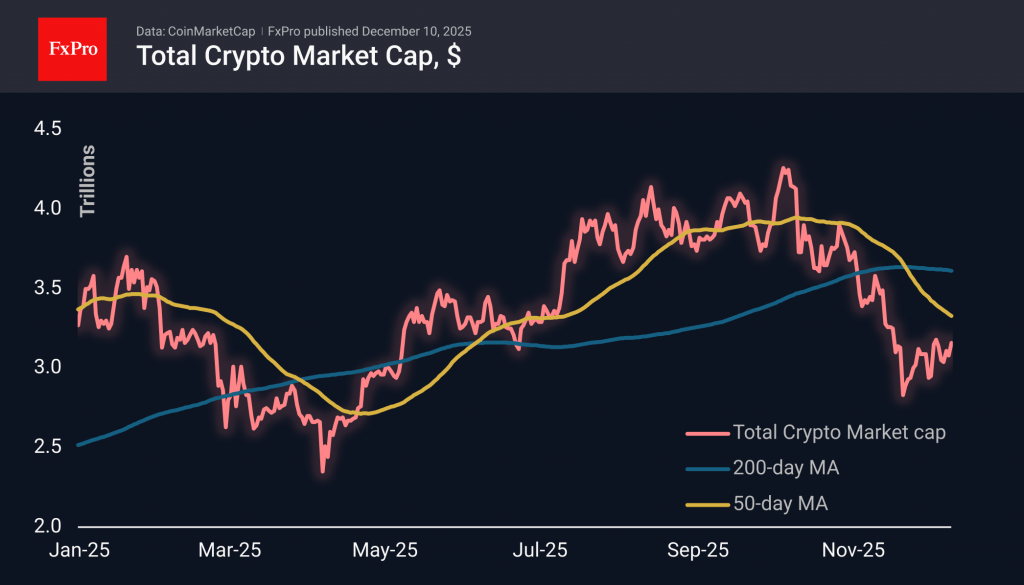

The crypto market cap increased by 2.5% to $3.16T following Bitcoin’s surge, surpassing the previous local maximum of over $3.21T. Strictly speaking, we have observed a series of higher local highs and lows since 21 November. Moreover, the market is moving beyond the medium-term downward range that has dominated since early October. However, to definitively classify the rebound as the start of capitalisation growth, it needs to surpass $3.32T, which is 6% above current levels.

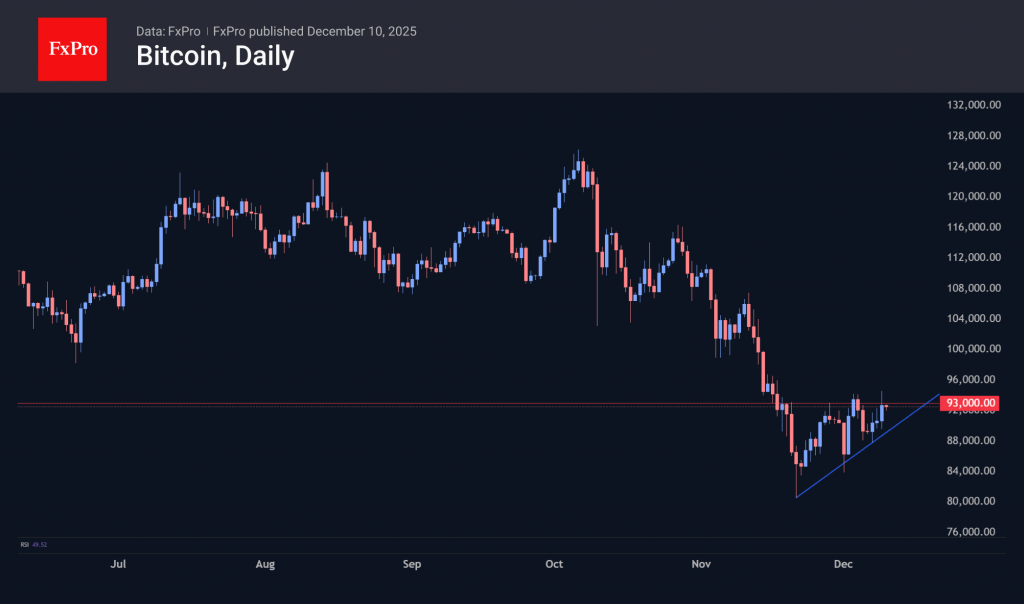

Bitcoin soared to $94.5K at the end of the day on Tuesday, when a slight short squeeze occurred following a rebound from the short-term uptrend support line. However, the momentum did not develop further, and the price retreated to the $92.6K area, close to the horizontal resistance line of the past three weeks. The critical question now is whether the market will be able to consolidate above this level and establish an upward range. The cryptocurrency market remains hesitant to take active steps ahead of the Fed’s rate decision.

News Background

In the coming weeks, the crypto market should prepare for increased Bitcoin volatility and fluctuations in the range of $84K to $100K, according to QCP Capital.

The ‘Santa rally’ may not happen, according to Bloomberg Intelligence strategist Mike McGlone. He predicts that Bitcoin will trade below $84K by the end of the year.

Standard Chartered has lowered its Bitcoin forecast for the end of this year from $200K to $100K. The bank’s long-term forecast remains at $500K, but now for 2030 instead of 2028. Standard Chartered believes that crypto winters are a thing of the past.

The US Commodity Futures Trading Commission (CFTC) has launched a pilot programme to use cryptocurrencies as collateral in derivatives markets. In the first phase, the list of eligible assets for collateral will include Bitcoin, Ethereum, and the stablecoin USDC.

On 1 January, the DAC8 directive implementing the Crypto-Asset Reporting Framework (CARF) will come into effect in the European Union. Crypto exchanges, brokers, and custodial services will start transferring data on user transactions to the tax authorities of the countries where their clients are resident.

The FxPro Analyst Team