The crypto market is in a dilemma

September 27, 2023 @ 10:59 +03:00

Market Picture

Despite the storm in the equity markets, the crypto market remains subdued, losing only 0.3% in 24 hours to $1.045 trillion. The Crypto Market Fear and Greed Index is dipping into “fear” territory. The crypto market did not suddenly become a safe haven. Still, it only temporarily turned out to be of no interest to active speculators, as the movements of shares of technology giants and government bond prices now attract their primary attention.

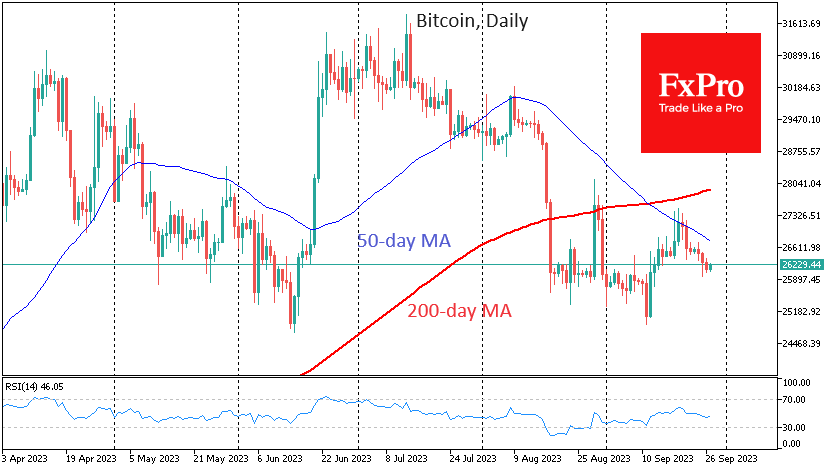

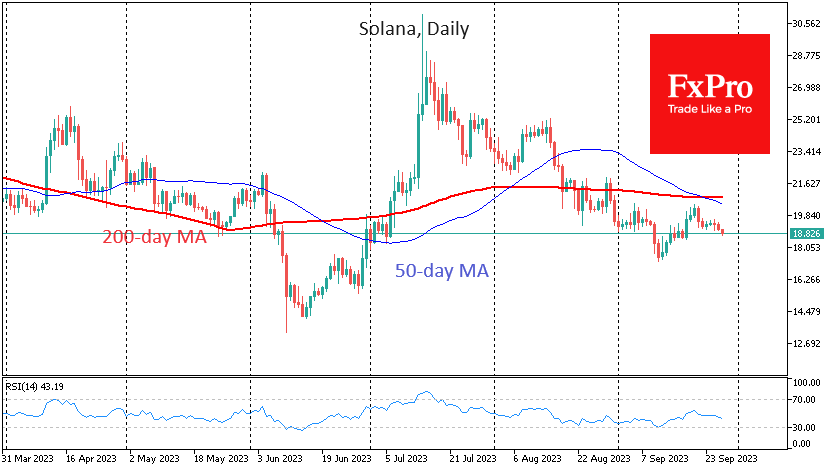

Bitcoin is trading near $26.2K on Wednesday morning, ending Tuesday with another decline. We don’t see the selling accelerating, but for now, it’s going on many popular coins like Ethereum, XRP and Solana all at once.

According to CryptoQuant, bitcoin spot trading volume fell to 2018 values last week. The number of transactions has fallen more than 40 times since March.

At the same time, the number of hodlers who view cryptocurrencies as an investment but do not transact in them is on the rise. According to Bitfinex, bitcoin is in the period with the lowest volatility in the history of the asset. The crypto market is clearly in a quagmire.

Perhaps, before the revival of interest in the market, we should see a final frontal liquidation of long positions. But only with a sell-off in the stock and bond markets on worries about stocks and bonds, not with the bankruptcies of large crypto companies.

News background

The SEC opposed the sale of Celsius assets on the Coinbase, citing ongoing litigation against the latter.

98% of Celsius’ bankruptcy-affected creditors supported the crypto lending platform’s reorganisation plan, under which they would recover some assets and get a stake in the new company.

The UK’s Financial Conduct Authority (FCA) has sent cryptocurrency companies a “final warning”, accusing them of not wanting to comply with new rules on advertising digital assets in the country. The deadline for advertising compliance was recently extended to 8 January 2024.

One of the world’s largest financial corporations, Hong Kong-based HSBC, announced that its customers can now pay for their loans using five types of digital assets. The financial group is ready to accept payment in BTC, ETH, XRP, SHIB and DOGE.

Shanghai’s Second Intermediate People’s Court recognised the first cryptocurrency as a “unique and irreproducible” digital asset, affirming its value at a legal level.

The FxPro Analyst Team