The Crypto market clears the way for growth to new heights

October 26, 2021 @ 14:49 +03:00

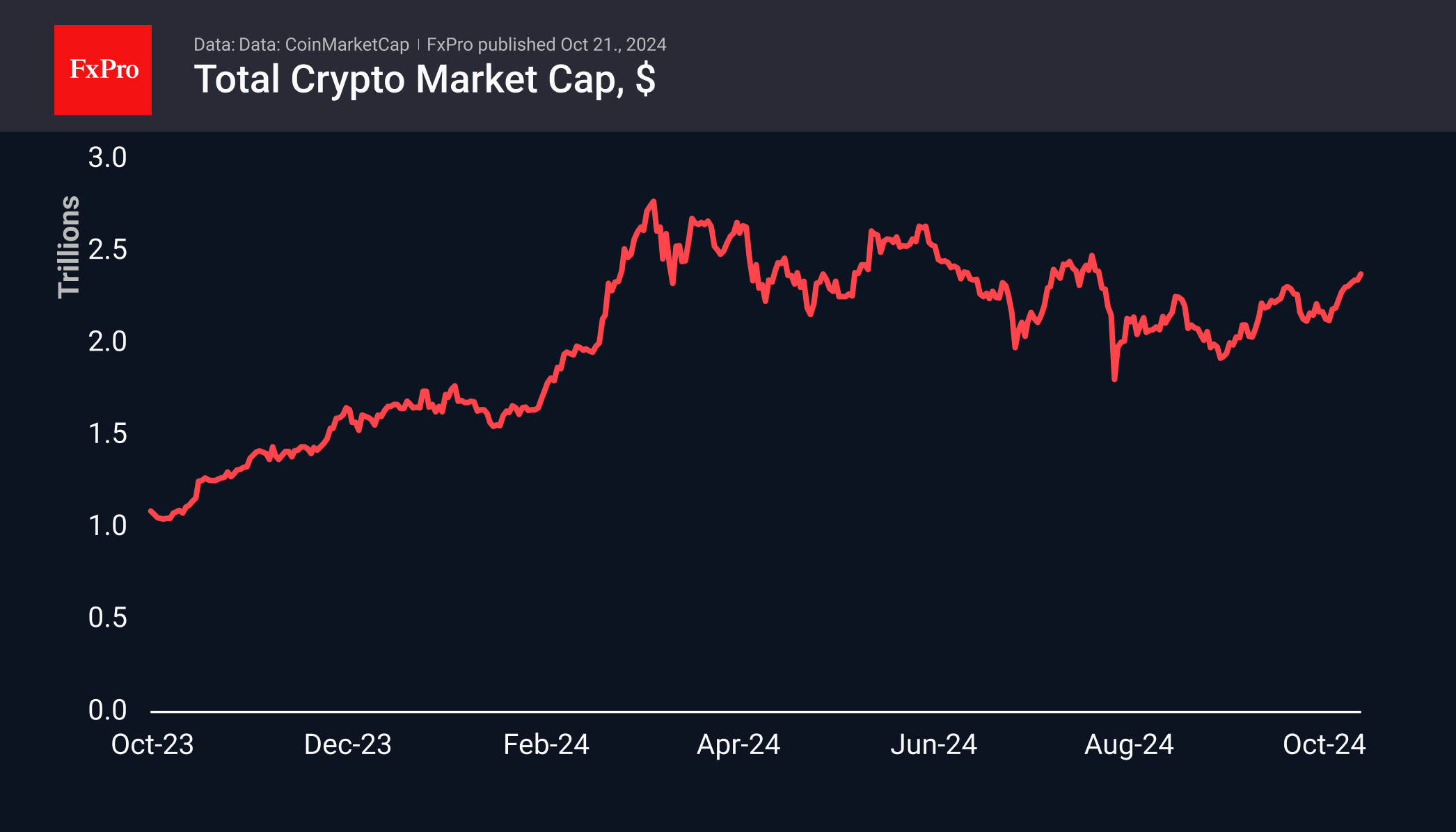

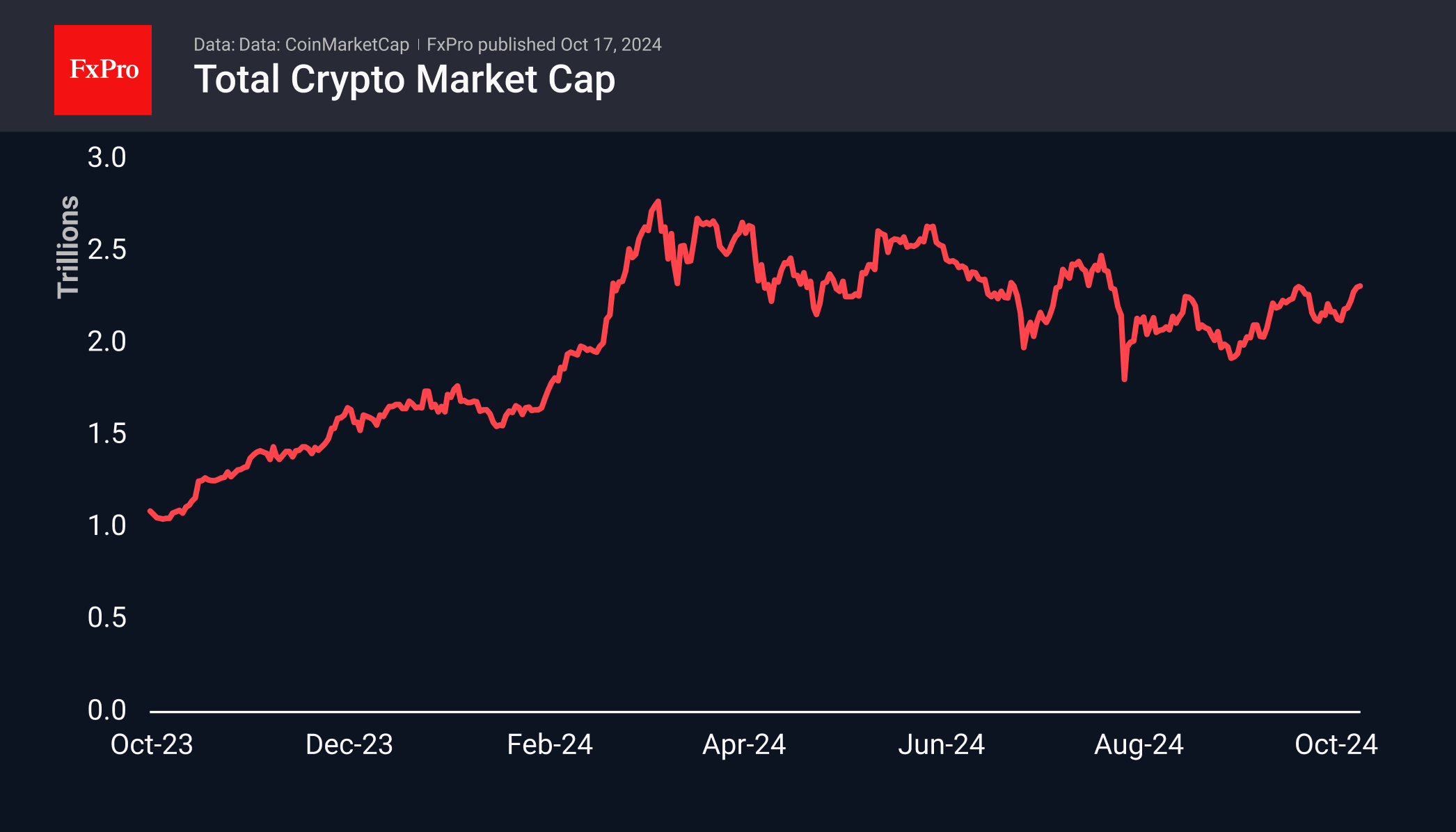

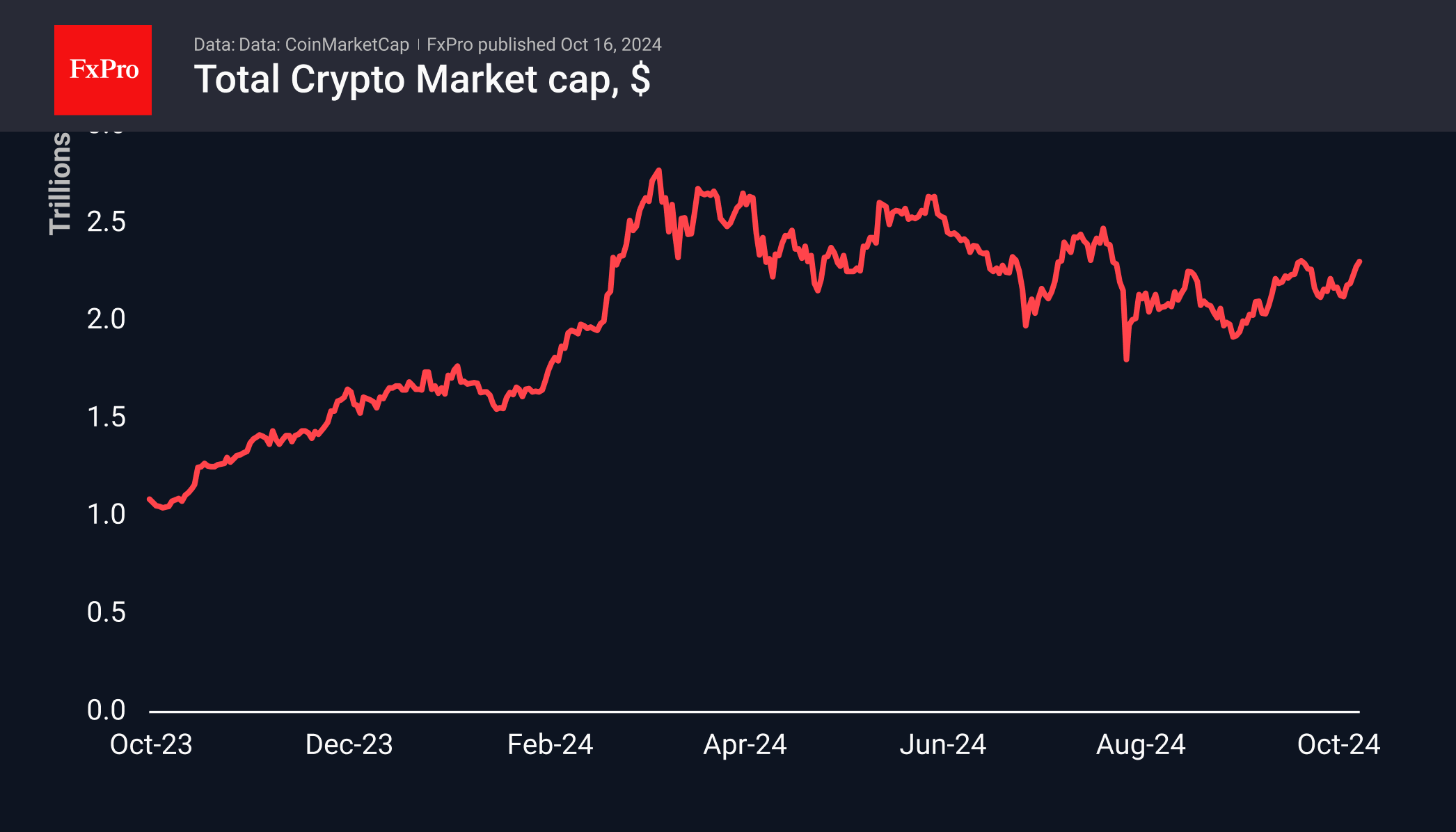

The crypto market continues to be in a positive frame of mind with a total capitalisation of around $2.6 trillion. Bitcoin received support earlier in the week on a decline to $60K but failed to take the upside path steadily. Probably, volatility may increase as the price moves out of the $60-65K range.

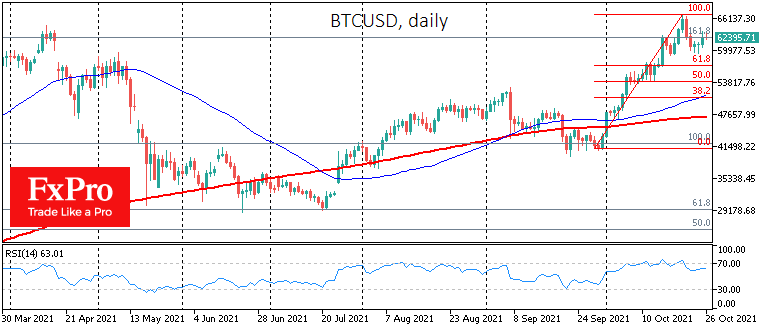

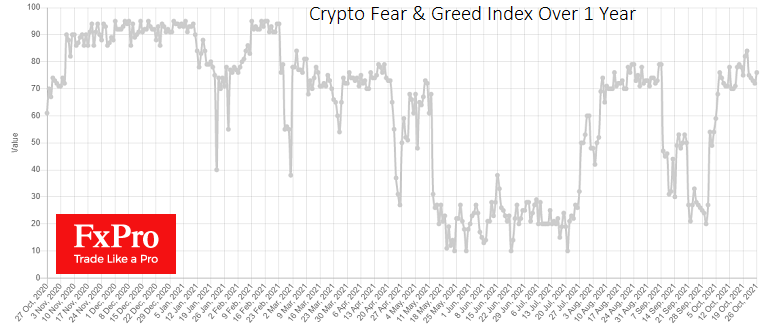

Bitcoin continues to be a market mover and can confidently be taken as a barometer of sentiment. The cryptocurrency Greed & Fear Index is back in extreme greed mode at 76. The daily chart’s RSI index for the BTCUSD pair is some distance away from the overbought zone at 62.

Technically, bitcoin’s correction at the end of last week removed some of the local overbought areas after the rally since late September. For bulls, this opens opportunities for a build-up of buying with potential targets at $83K. However, looking further ahead, Bitcoin is just beginning new upside momentum, targeting the $95-100K area. Until those levels, we may not see a prolonged and significant pullback.

Several Bitcoin-ETFs were launched last week, which had a very successful start and supported sentiment in the crypto market. A few more may be launched this week, which should keep the overall positive sentiment in the market.

Of course, this factor cannot support the crypto market forever, and soon we will start to see the impact of other events.

One such event could be the start of compensation payments from the infamous Mt Gox exchange. Lenders have approved a compensation plan, and there is 150K BTC in the fund for this purpose. This is a massive number of coins, and many who received such compensation will sell theirs.

The first thing to consider here is the many times the price of bitcoin has risen since the hacking of the exchange. At one time, Kobayashi, the exchange’s asset manager, became a central player in the crypto market; this could likely happen again.

While Bitcoin’s price is near an all-time high anyway, the network’s processing power has never recovered to its peak in mid-May. The move by Chinese miners to Kazakhstan is probably over, for the most part, making the country the world’s No. 2 in terms of hash rate. If the local authorities do not oppose the miners’ work, the capacity will continue to build up there already.

Many factors point to the likelihood of continued price increases, which could begin to stimulate the strongest FOMO in the crypto market history.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks