The Crypto Maintains Its Equilibrium

October 09, 2024 @ 11:13 +03:00

Market picture

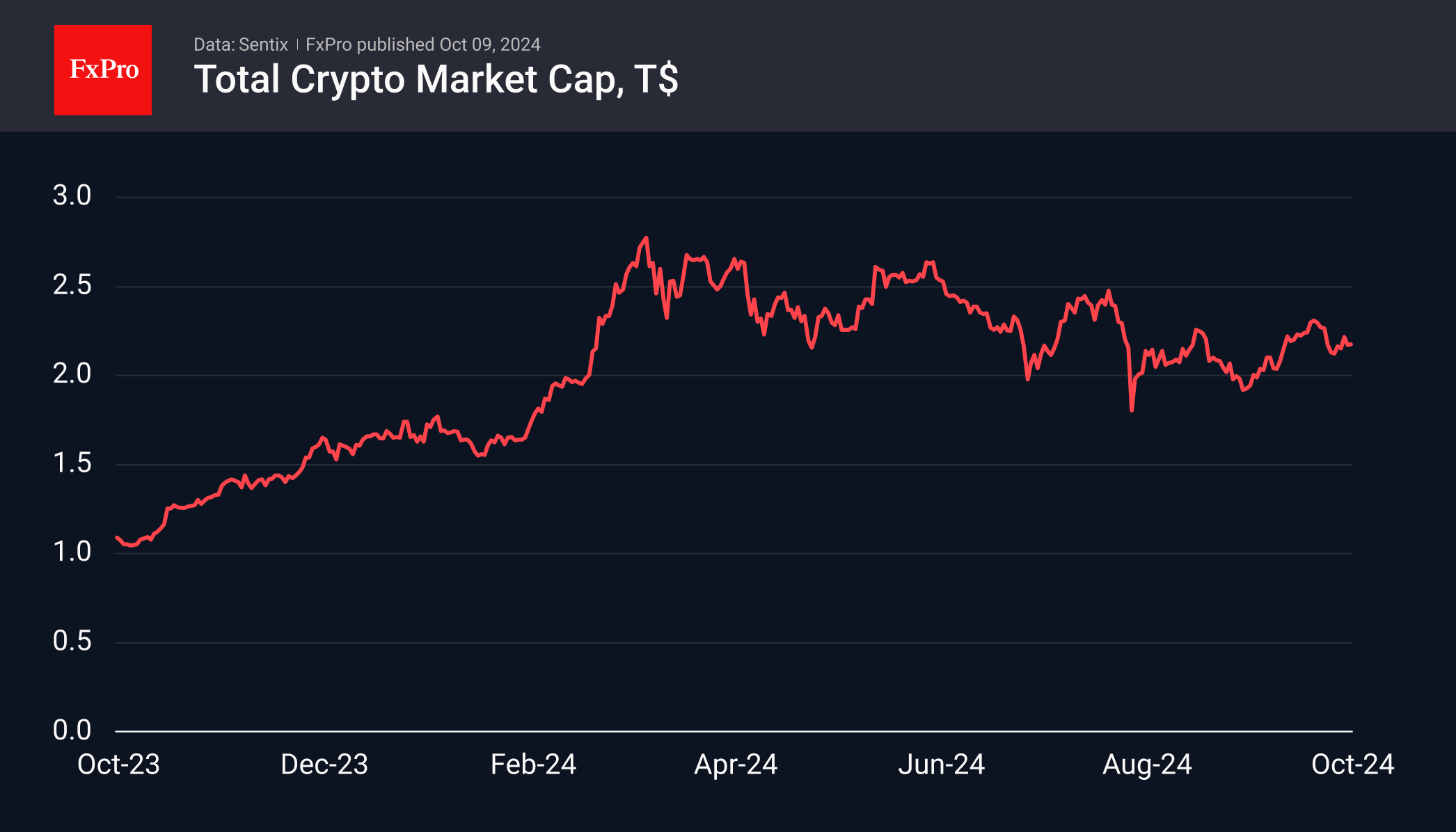

The cryptocurrency market has stabilised around the $2.17 trillion level where it was a week and a day ago. The sentiment index has remained in the 49-50 (neutral) range for the fifth day, which contrasts with the near ‘extreme greed’ sentiment in the stock market. This wariness among crypto investors has often heralded stock market sell-offs. Still, this time, it could be due to sell-offs in China and expectations of new signals on the Fed’s monetary policy.

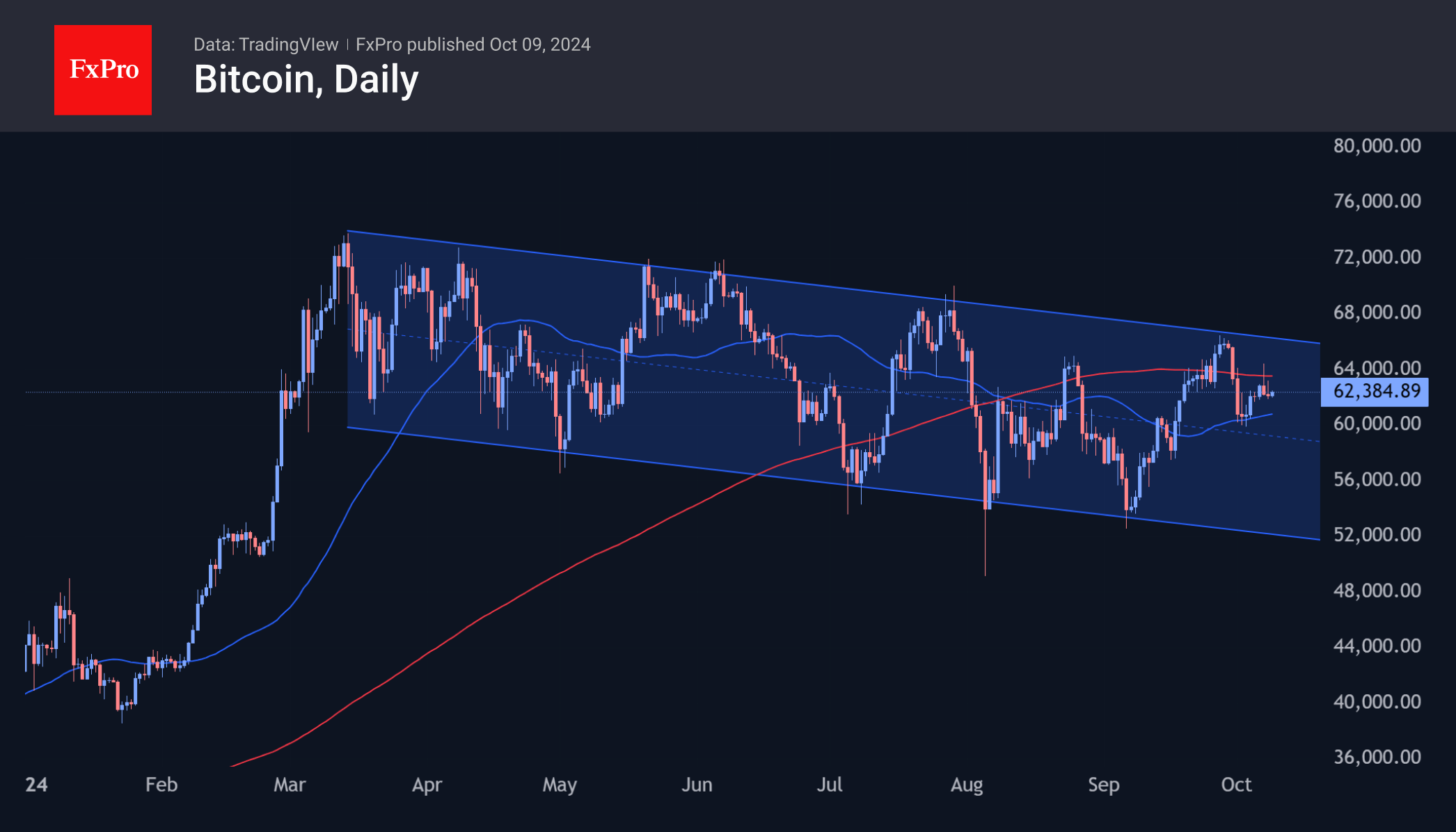

Bitcoin’s price has changed little over the past 24 hours, remaining at $62.4K, sandwiched between the 200-day moving average above and the 50-day below. Potential triggers to break out of this range could be Fed minutes or US inflation data if they lead to a reassessment of expectations in traditional markets. A technical signal could be a move out of the range delineated by the mentioned moving averages at $63.6K and $60.8K, with the potential for further movement towards a breakout.

News background

According to Bitfinex, Bitcoin’s decline from $66,500 to $60,000 last week is a ‘healthy rebuild’ that reduces the risk of a ‘sudden drop’ in the coming days and weeks.

Matrixport expects that miners’ shares may rise as their revenue stabilises after falling and lagging Bitcoin’s momentum. The daily revenue of publicly traded mining companies fell from $70 million to $31 million after the April 2024 halving.

The US Supreme Court has granted permission to sell 69,370 Bitcoins previously seized from the darknet site Silk Road. US authorities declined to comment on whether they plan to sell the bitcoins on the marketplace.

A court in the US has approved a plan to distribute payments to creditors of the collapsed FTX exchange. About 98% of creditors will receive more than $6.8bn in fiat within 60 days of the plan taking effect.

The Crypto.com exchange filed suit against the SEC after receiving a Wells notice. The agency is using the notice to report violations of the law, which is the basis for the planned civil suit.

According to Politico, Robinhood’s general counsel, Dan Gallagher, is the leading candidate to head the SEC if Donald Trump wins the U.S. presidential election. Other contenders include former CFTC Chairman Chris Giancarlo, SEC Commissioner Hester Pearce and former agency general counsel Robert Stebbins.

The FxPro Analyst Team