The battle of trust between the dollar and crypto

November 11, 2021 @ 18:44 +03:00

It could very well be that yesterday we saw the start of a crucial battle for confidence in the financial system. The acceleration in US price growth to 6.2% y/y first was taken as a loss of control by the Fed over inflation. More accurately, assessments by speculators and small players as to what the market would think of this.

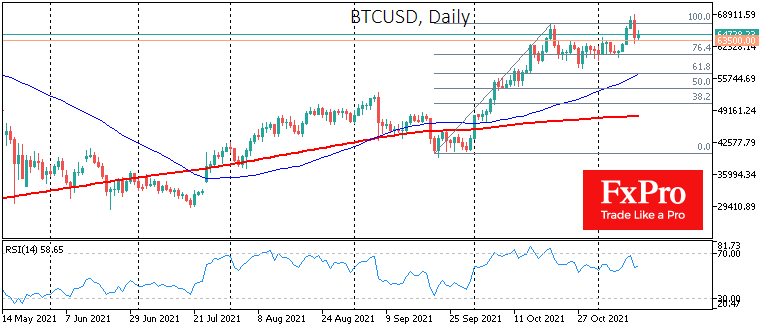

As a result, we saw a powerful rally in cryptocurrencies and precious metals, which added more than 2% shortly after the data release. Bitcoin set a new all-time high of $69K. Buying non-inflationary assets was investors’ first reaction to US price data. This reaction put the US on par with emerging markets, from which investors are fleeing on signs that the central bank is failing to curb prices.

A sustained reaction of this type would have had far-reaching consequences. However, towards the close of the US session, the debt market began to lay down more decisive and speedy Fed rate hikes, which triggered a strong capital inflow into the Dollar and reversed the initial reaction. In effect, this is bad news for bitcoin. At least for now.

At the close of the US session, BTCUSD found itself pushed back to the $64.5K area, 6.5% below peak, where it will consolidate in a narrow range. The fall in the major altcoins was commensurate, but given the initial surge, the losses over the day are not that great – 3% for BTC, -1.5% ETH and -2.2% for total cryptocurrency capitalisation.

Perhaps in the coming days, we will have to find out which side is right. At the end of the day on Wednesday, traditional financials should still win. The sell-off in cryptocurrencies and the Dollar’s highs against a basket of major currencies for more than a year speaks to the belief of “deep pockets” that the Fed has enough gunpower to fight inflation, and it will use it.

The FxPro Analyst Team