Crypto Review - Page 73

January 17, 2022

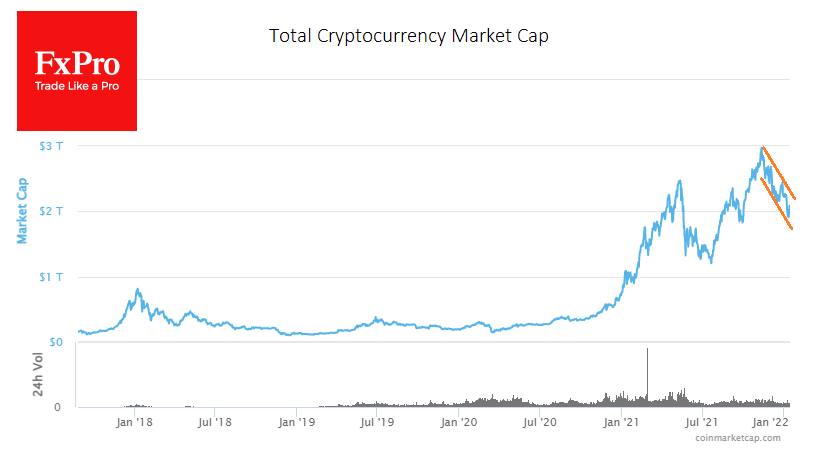

The Cryptocurrency Fear and Greed Index has been cruising between 21-23 for the past seven days – in the extreme fear territory, finding itself in the middle of that range on Monday. Meanwhile, the value of all coins tracked by.

January 14, 2022

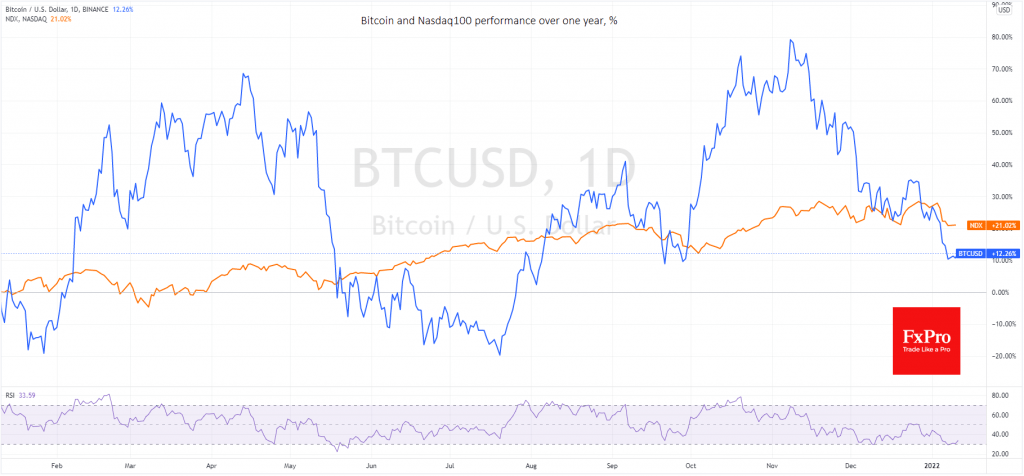

Pressure on US tech stocks was a major leitmotif in US trading yesterday, dragging cryptocurrencies down. Crypto market capitalisation adjusted 1.1% overnight to $2.05 trillion. Bitcoin is losing 2% overnight, down to $42.8K and ether is losing about 1.5% to.

January 13, 2022

The value of the cryptocurrency market rose almost 3% over the past 24 hours to 2.07 trillion. Exceeding the psychologically important circular mark pulled demand for coins outside the top 10. Separately, bitcoin enjoyed demand from the pull into risky.

January 12, 2022

The crypto market has again surpassed $2 trillion, adding almost 2.7% in the last 24 hours. Bitcoin, meanwhile, has not kept pace with the rise in altcoin prices: BTC strengthened by 1.45% against a 4% rise in ETH, while other.

January 11, 2022

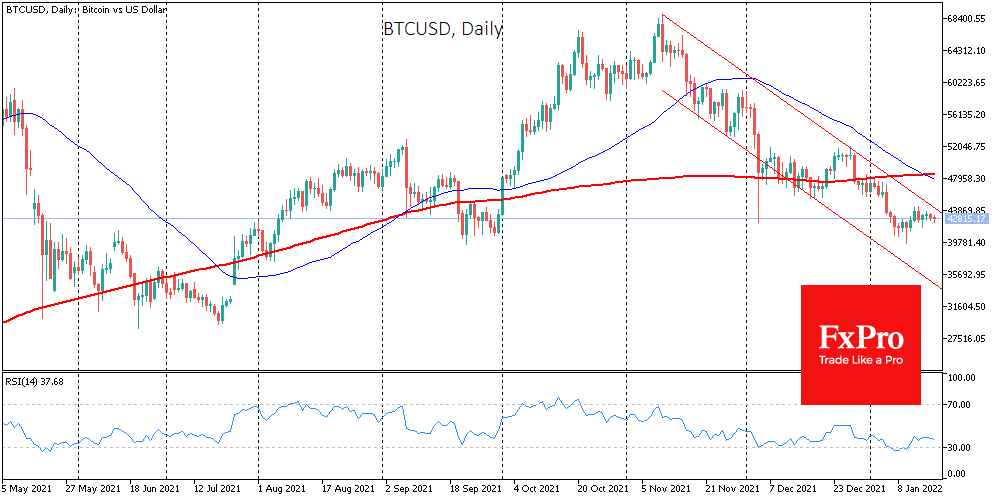

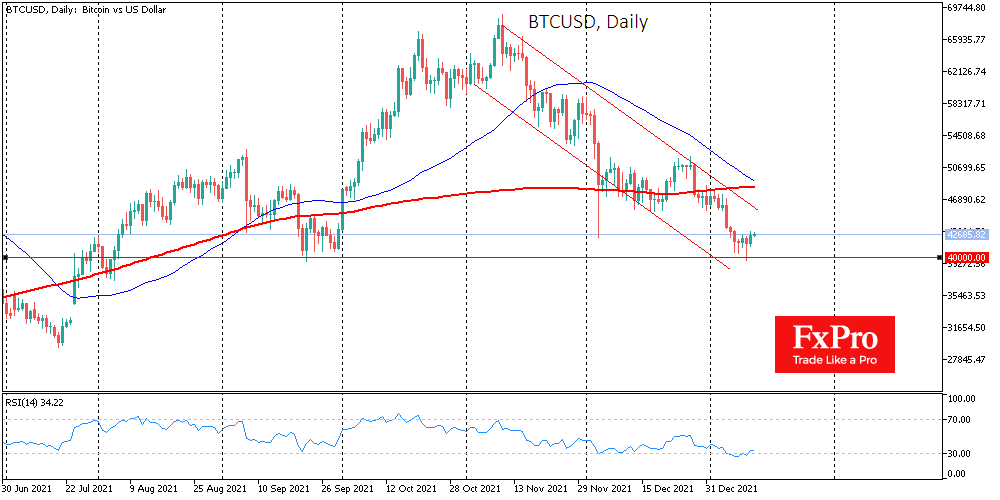

On Monday, we saw colourful confirmation of how much stock market dynamics are affecting Ether and Bitcoin. Following the intraday fall of more than 2% in the Nasdaq, the top two cryptocurrencies surrendered their psychologically important levels, retreating at $.

January 10, 2022

The cryptocurrency market received moderate support from retail buyers over the weekend. Over the past 24 hours, the capitalisation of all coins rose 0.22%, according to CoinMarketCap, approaching $1.97 trillion. The top altcoins lost 11-19% over 7 days but found.

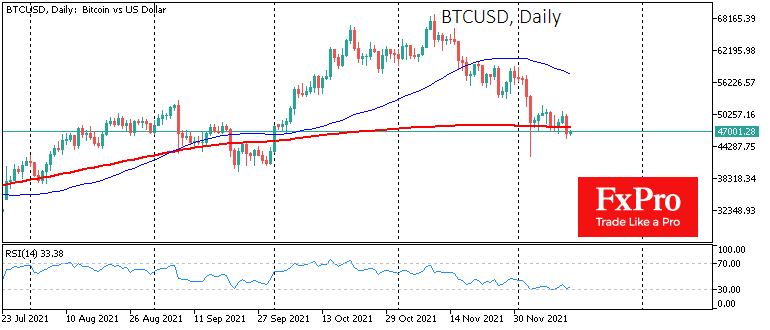

December 22, 2021

The cryptocurrency market has gained another 1.8% over the past 24 hours, bringing its total capitalisation to $2.28 trillion. The index has been choking on growth for the past three weeks at the $2.3 mark, so further rise promises to.

December 21, 2021

Cryptocurrency market capitalisation rose 3.7% in the last 24 hours, again reaching $2.24 trillion, with almost the entire top 100 coins in green over the past 24 hours. The Cryptocurrency Fear and Greed Index has added 2 points to 27..

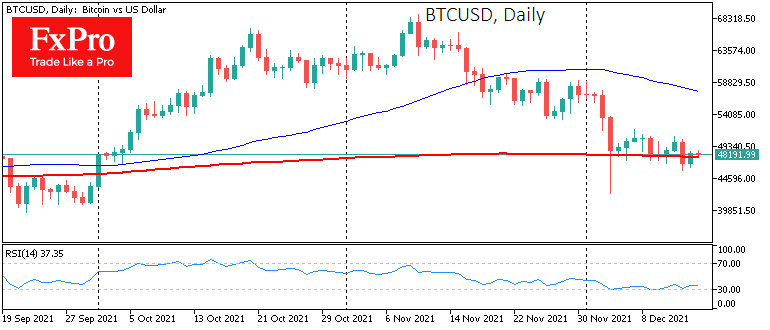

December 20, 2021

The crypto market’s capitalisation has fallen 2.8% in the last 24 hours to $2.166 trillion. Methodical pressure on the significant coins persists along with wary trading in traditional equity markets. The bitcoin price has been losing 2.5% in the last.

December 16, 2021

Over the past 24 hours, total crypto market capitalisation rose by 2.1% to $2.24 trillion, recovering to the levels at the start of the week. Yesterday, the figure was close to the $2.0 trillion mark, but demand for risk assets.

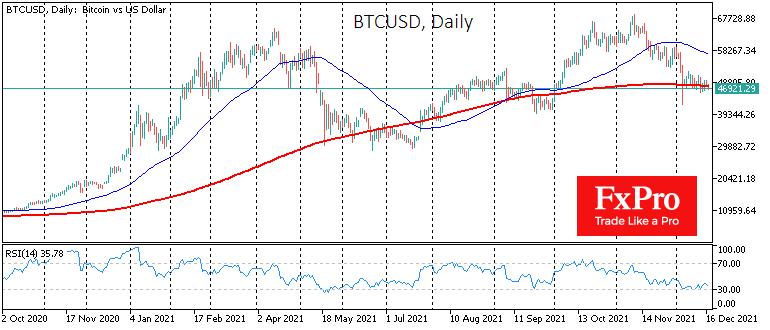

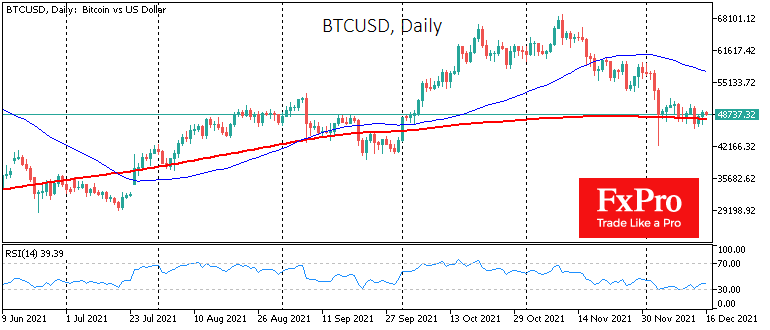

December 15, 2021

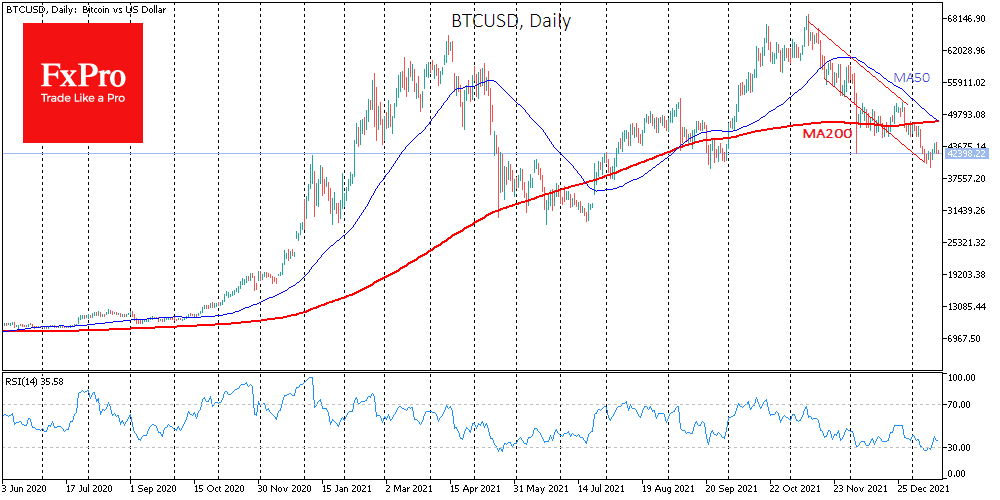

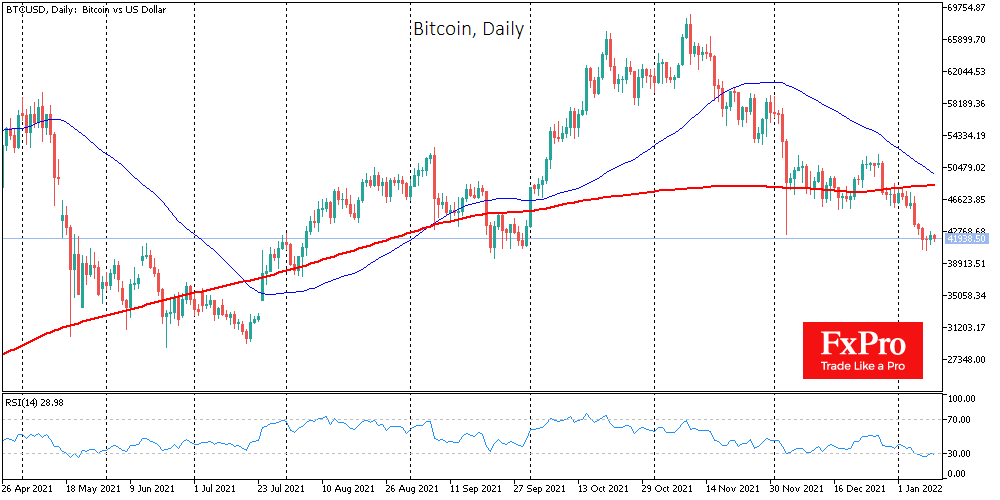

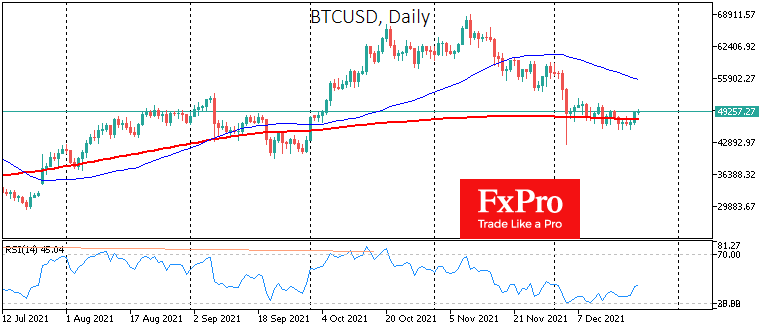

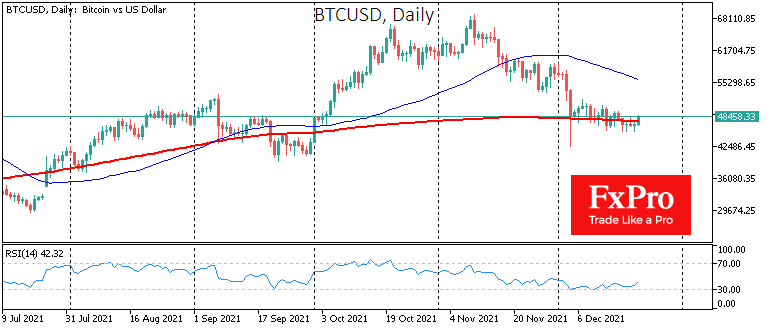

Bitcoin continues to cling to its 200-day simple moving average, calming the entire crypto market. In the past 24 hours, the total value of all cryptocurrencies rose 3.3% to $2.19 trillion. The Fear and Greed Index rose 7 points to.