Crypto Review - Page 60

September 20, 2022

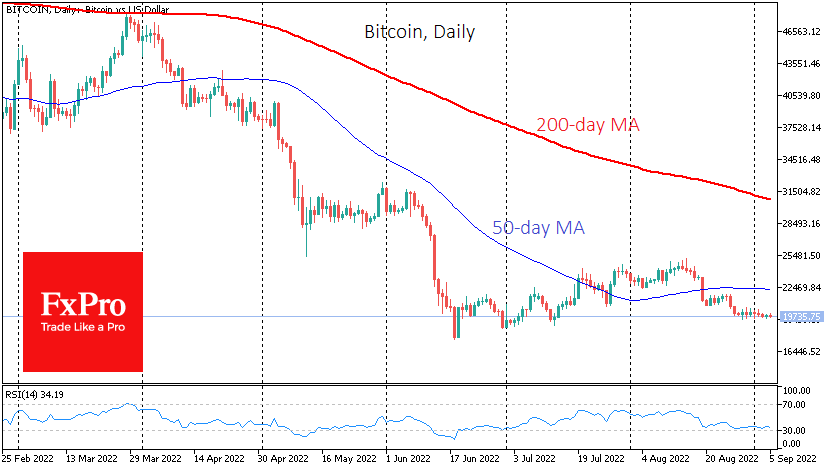

Market picture Bitcoin has changed little over the past 24 hours, trading at $19.4K on Tuesday at the start of the day. The initial fall was neatly redeemed during active European and US trading amid a rebound in stock indices..

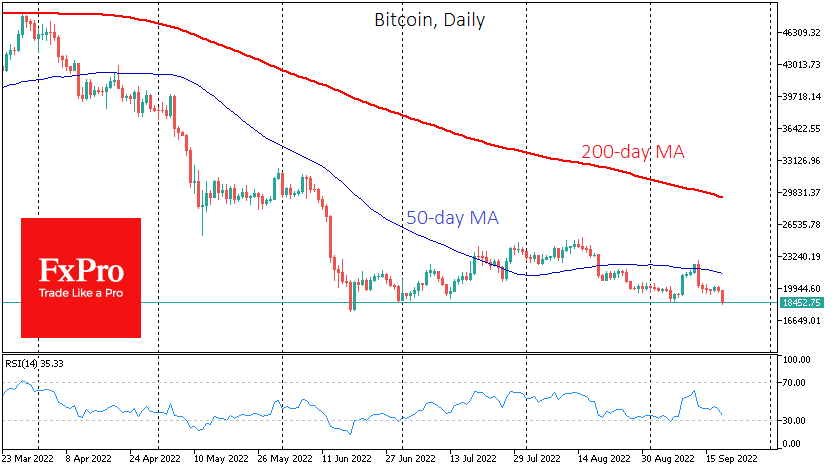

September 19, 2022

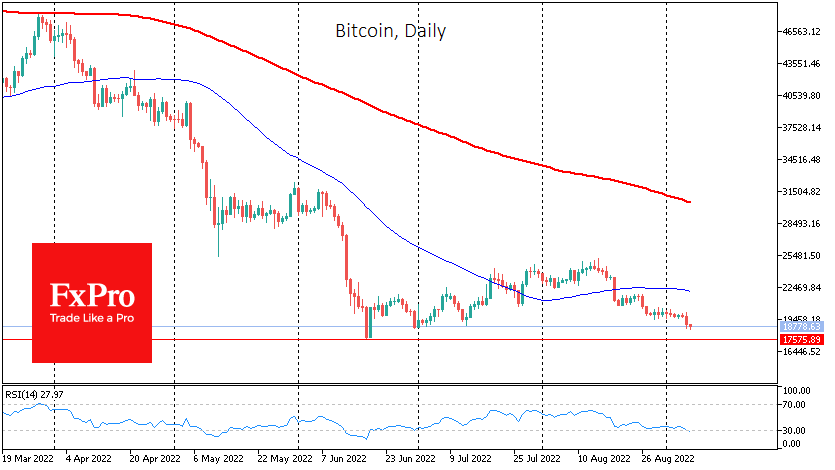

Market picture Bitcoin is down 8.8% over the past week, ending near $19,700. The losses continued to pile up on Monday, decreasing the price to $18.5K (-7.77% in 24 hours). Ethereum collapsed 25% to $1300 in exactly one week. Top.

September 16, 2022

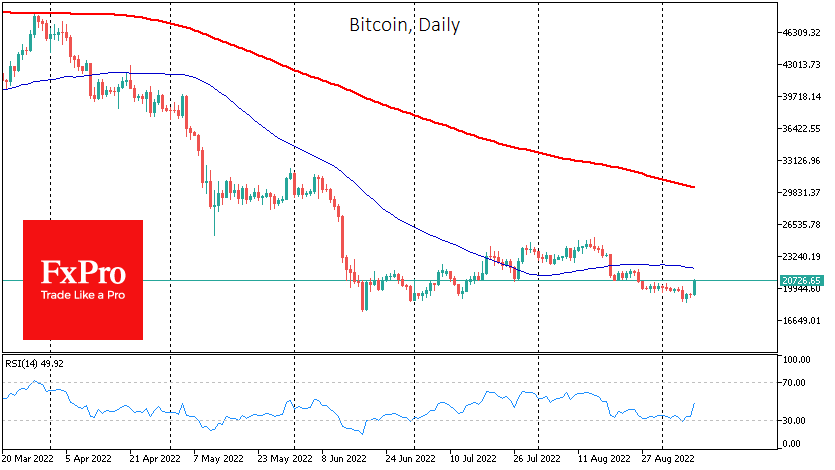

Market picture Bitcoin has lost 1.6% over the last 24 hours to $19,777 amid renewed pressure on risk-sensitive assets. BTC remains just under the critical $20K round level, where it got support for the past three months. Ethereum lost the.

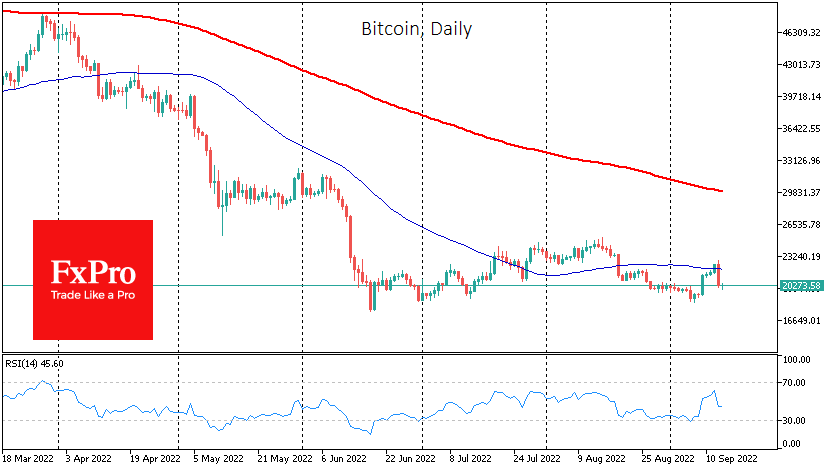

September 14, 2022

Market picture Bitcoin collapsed 9.6% on Tuesday, ending the day near $20.2K, which remains on Wednesday morning. Ether is losing 6.4% overnight to $1610. The most significant altcoins took a heavy hit, losing between 4.6% (BNB) and 13% (Solana), but.

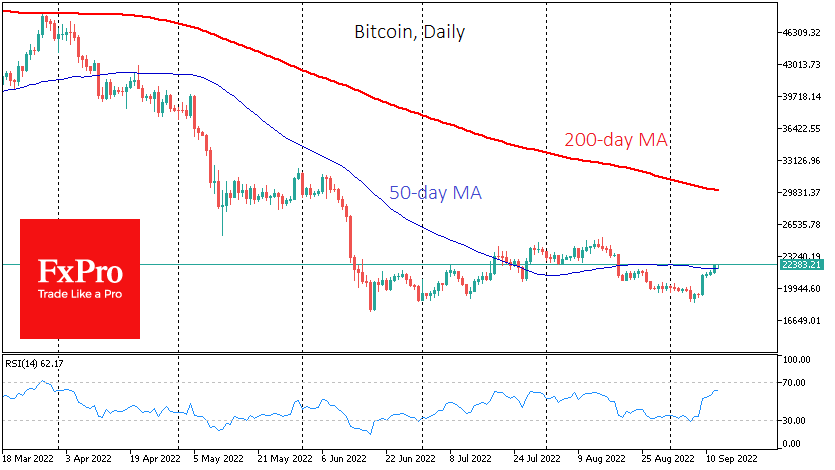

September 13, 2022

Market picture Bitcoin rose 2.6% to $22,300 in the past 24 hours amid rising stock indices and a weaker US dollar. Ethereum lags the market, losing 0.7% to $1715. Top altcoins performance ranged from -1.5% (Cardano) to +10% (Solana). Total.

September 12, 2022

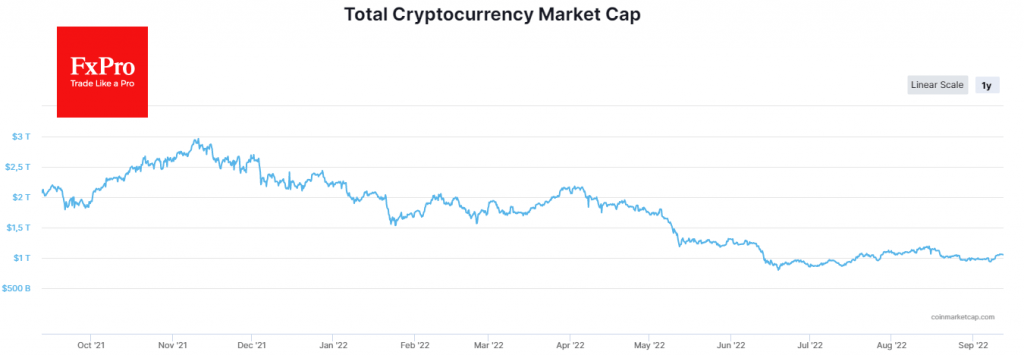

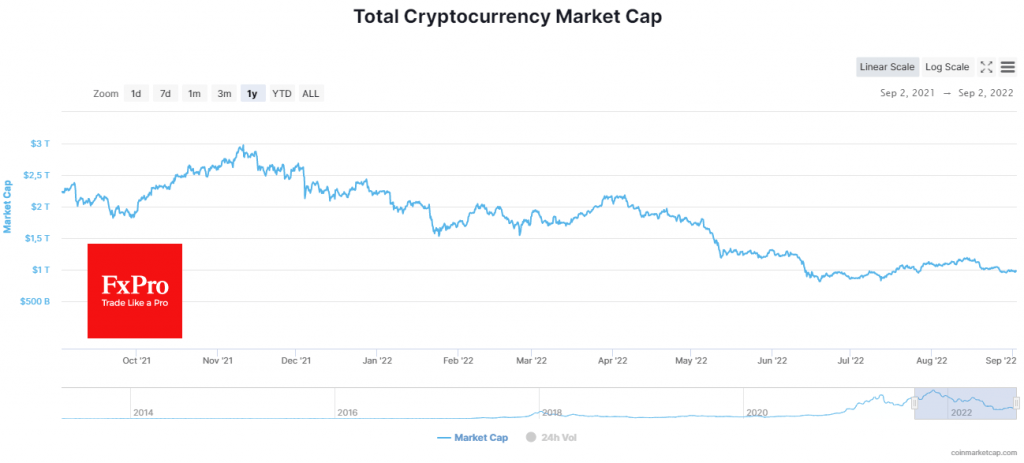

Market picture Bitcoin has added 10% in the past seven days, trading at $21.7K. Ethereum jumped 10.3% to $1730. Top-10 altcoins add between 1.5% (Polkadot) and 9% (Solana). Total cryptocurrency market capitalisation, according to CoinMarketCap, rose 7.9% for the week.

September 9, 2022

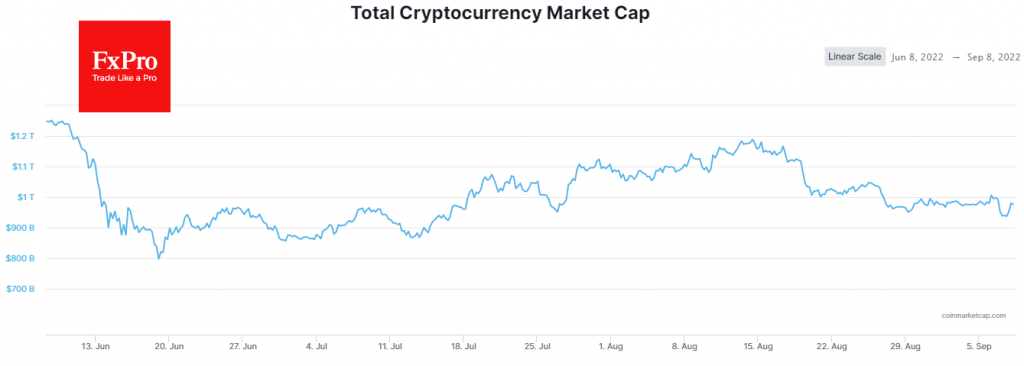

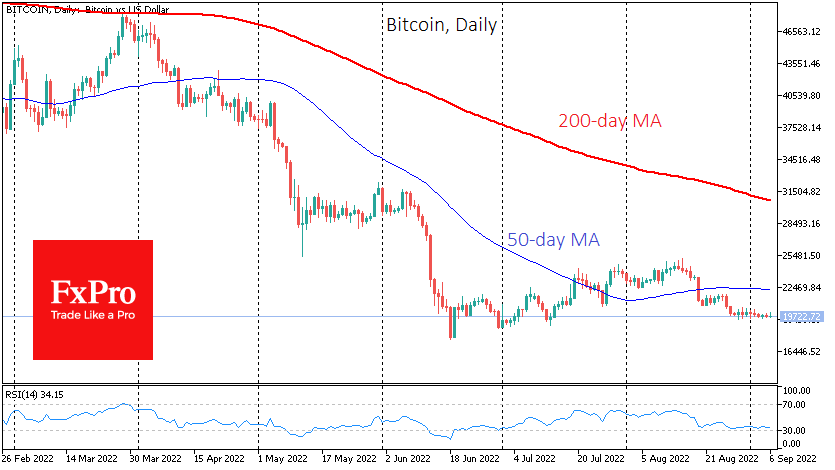

Market picture Bitcoin was little changed on Thursday, ending around $19,400, but added more than 7% on Friday morning. So, in a period with relatively low liquidity, the BTCUSD has won back over two weeks of a slow slide down.

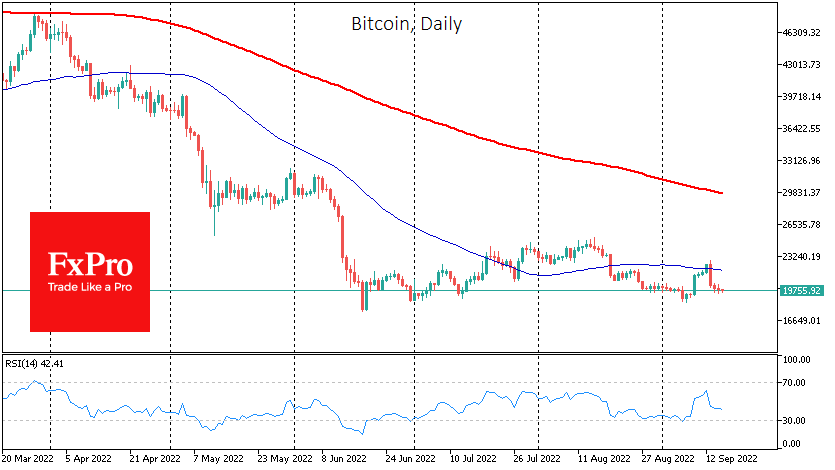

September 8, 2022

Market picture Bitcoin has rebounded 3% in the last 24 hours to $19.3K. On Wednesday, it updated 2.5-month lows just above $18.5K before getting buyers’ support. Ethereum almost bounced back from its last dip, adding 8% to $1640. The entire.

September 7, 2022

Market picture Bitcoin lost more than 5% to $18.8K in 24 hours, ending an extended lull. Ethereum loses more than 8.5%, falling to $1520. The crypto market’s capitalisation is down 5.8% to $940B, according to CoinMarketCap, which is in line.

September 6, 2022

Market picture Bitcoin was down 0.7% on Monday, ending at around $19,750. BTC had a quiet day, trading just below the round level $20K amid a US holiday that reduced trading activity. Ethereum continued to gain weight, adding 4.4% in.

September 5, 2022

Market picture Bitcoin declined 0.4% over the past week, ending at around $19,900 without experiencing any significant movement during that time. For now, we can only say that the crypto market is wagering on the strengthening of the dollar, and.