Crypto Review - Page 46

July 20, 2023

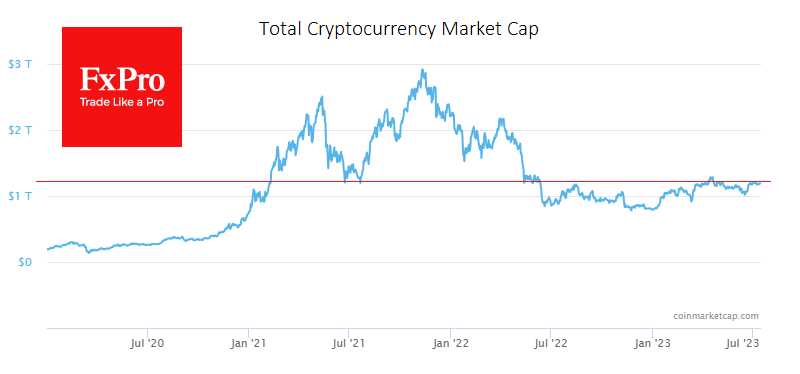

Market picture Crypto market capitalisation reached 1.218 trillion, up 1.1% in the last 24 hours. Altcoins are growing across the board. Although the momentum is far from euphoric, it is more like interest in the market. And this is particularly.

July 18, 2023

Market picture Crypto market capitalisation fell 0.8% overnight to $1.20 trillion. Bitcoin loses 0.9%, Ethereum – 1.7%, while top altcoins performance varies from -5.8% (Solana) to -0.3% (BNB).

July 14, 2023

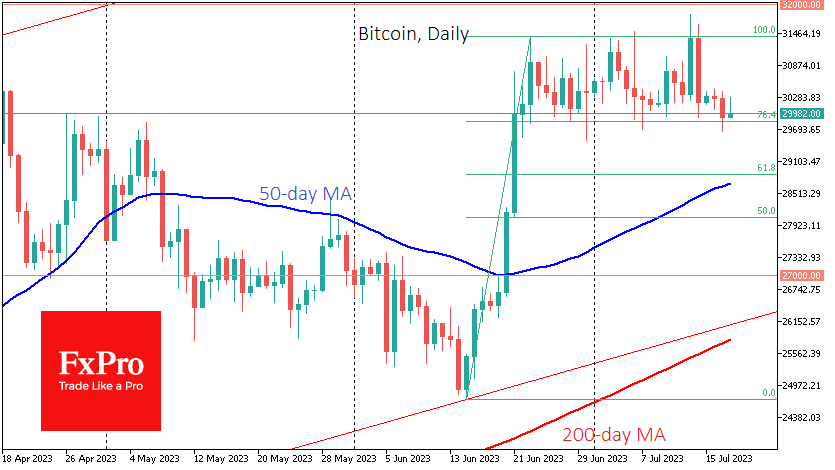

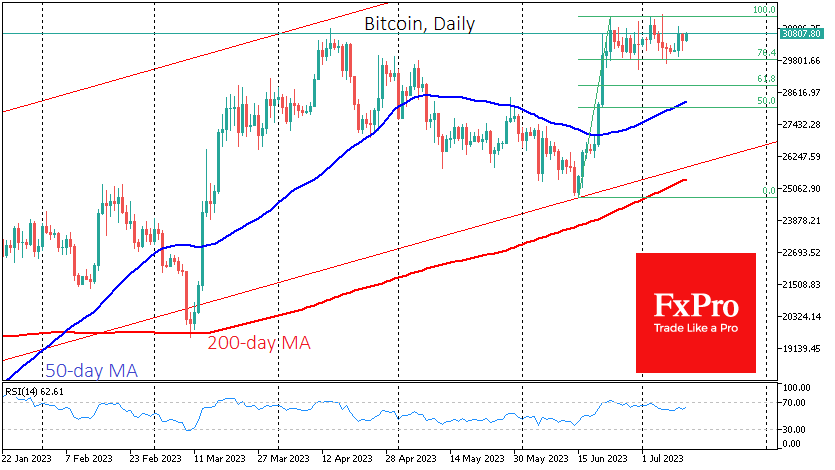

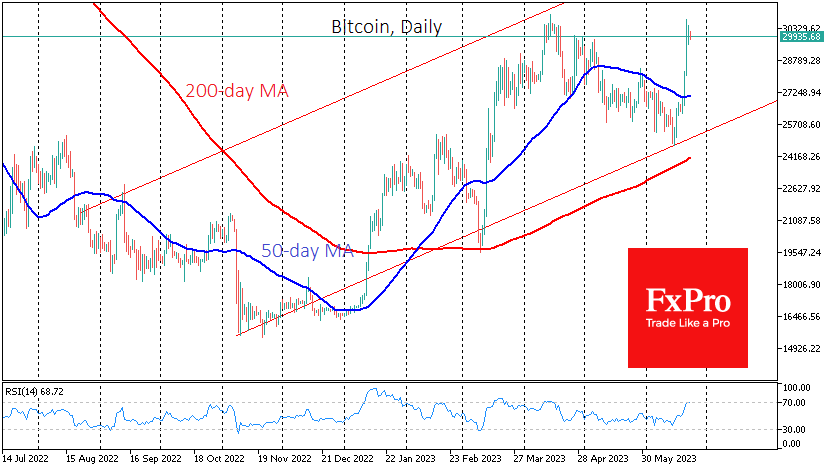

Market picture Crypto market cap rose 5.5% in the last 24 hours to $1.25 trillion, a level last seen briefly in April. After touching this level, the market gained strong support from June 2021 to June 2022. But since June.

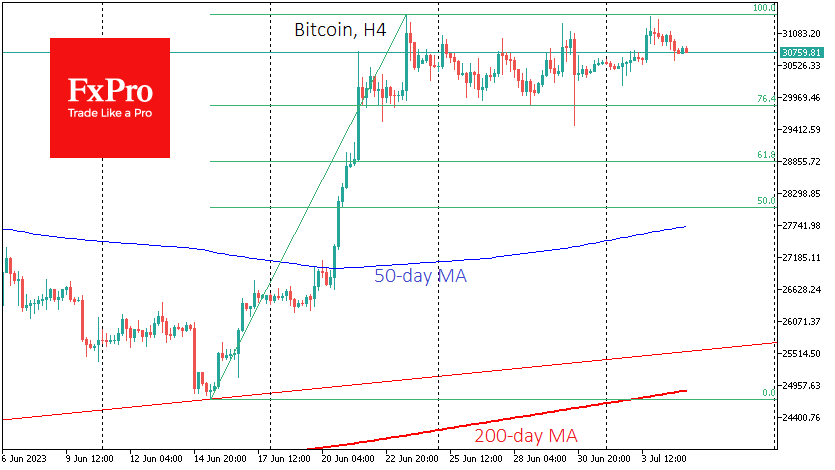

July 12, 2023

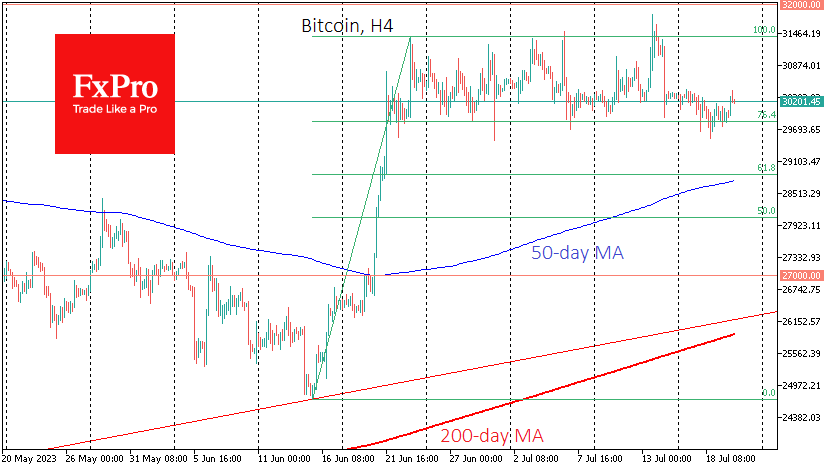

Market picture Crypto market capitalisation rose by 0.5% on the day, approaching 1.2 trillion. The trend of capitalisation growth has been in place since the beginning of the week. Although the bulls’ attempt to accelerate has failed to gain traction,.

July 11, 2023

Market picture The crypto market cap rose 1.75% over the past 24 hours to $1.19 trillion, outperforming Bitcoin and Ethereum’s 1.5% growth over the same period. Among the top altcoins, Solana (+5.7%), BNB (+6%) and Polygon (+9.4%) are outperforming the market..

July 10, 2023

Market picture Crypto market capitalisation has fallen 3% over the past seven days to $1.17 trillion. The Fear and Greed Index is at 56 (greed), having corrected from 62 a week earlier. Capitalisation has stabilised at $1.20 trillion in the.

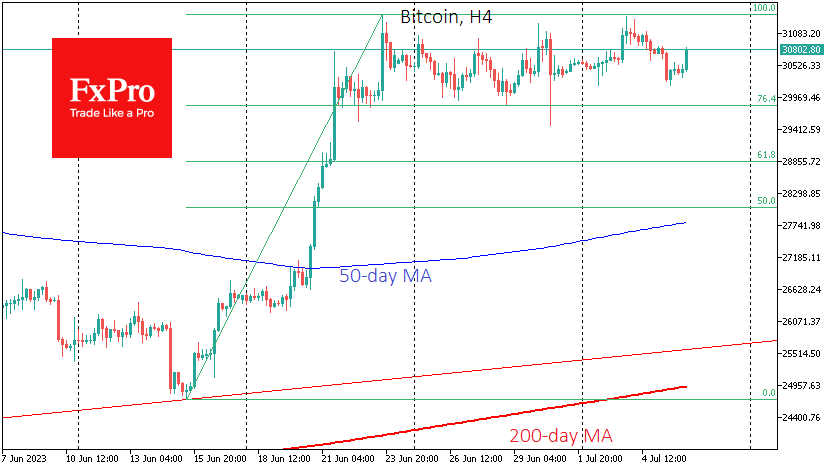

July 6, 2023

Market picture The cryptocurrency market lost another 0.5% of its capitalisation overnight, to 1.2 trillion. Most losses came on Wednesday afternoon, while capitalisation has risen since Thursday morning. Since last May, the market has failed to develop growth when it.

July 5, 2023

Market picture Cryptocurrency market capitalisation fell 0.7% over the past 24 hours to $1.21 trillion, remaining near its peak since late April. The Cryptocurrency Fear and Greed Index retreated from 64 to 61 by early Wednesday afternoon, staying in “greed”.

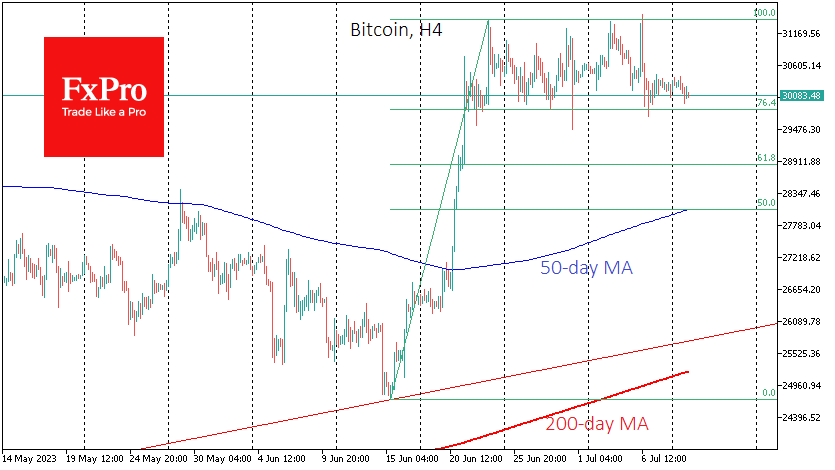

June 28, 2023

Market picture Cryptocurrency market capitalisation fell 0.2% over the past 24 hours, losing ground since the start of the day on Wednesday but remaining within the range of $1.16-1.20 trillion since last Thursday. The market remains in a “Greed” mood,.

June 27, 2023

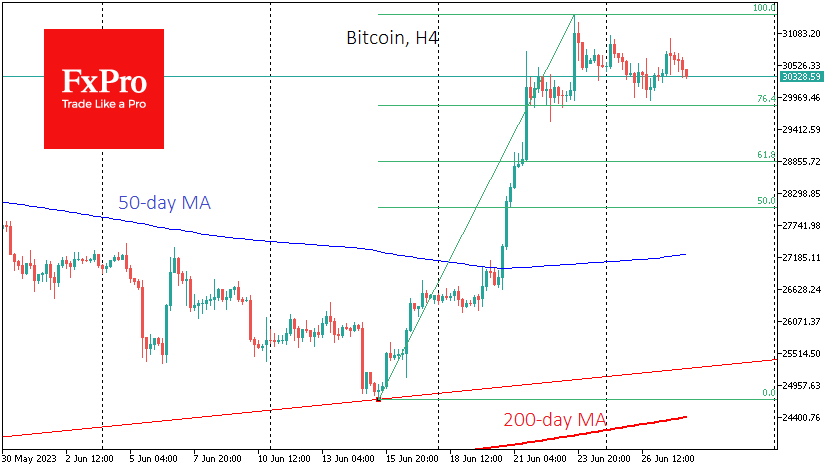

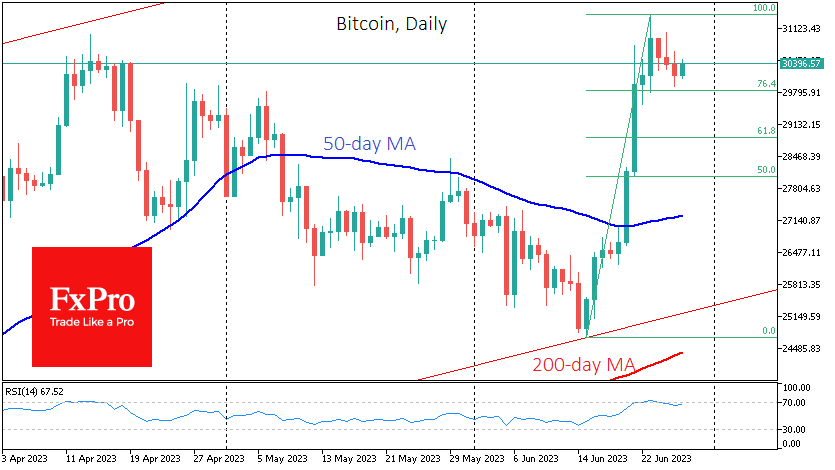

Market picture The crypto market cap is down 0.75% over the last 24 hours to $1.178 trillion in what looks like cautious profit-taking after rallying from mid-month under pressure from stock index movements. Bitcoin found support below $30K on Monday.

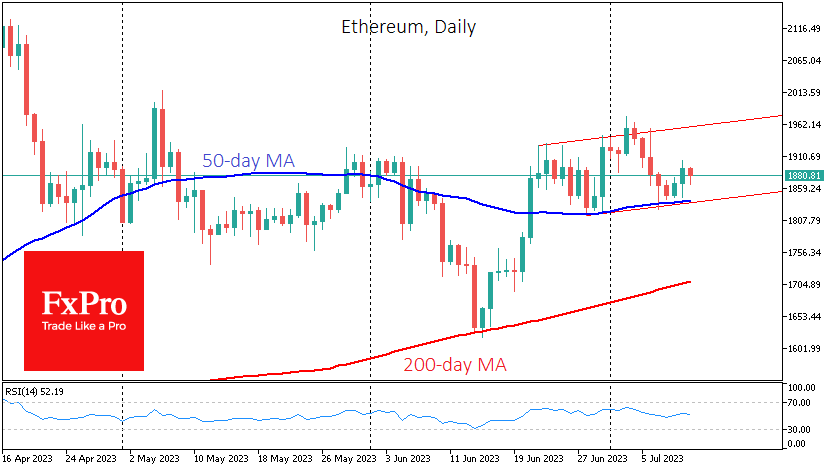

June 26, 2023

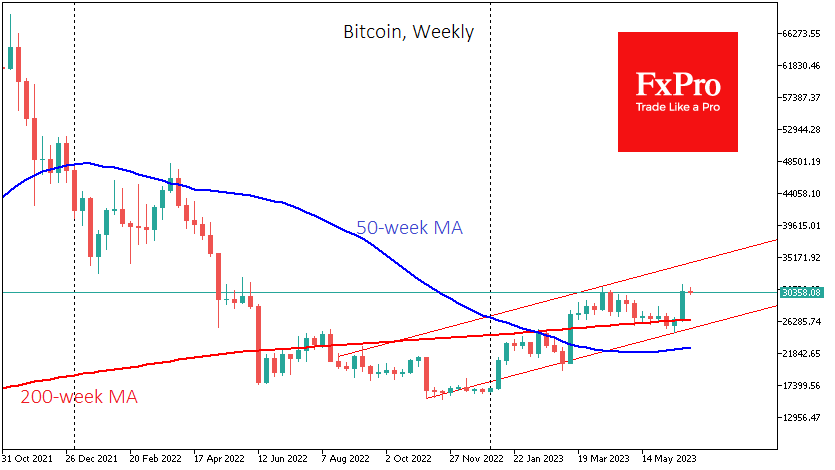

Market picture The total capitalisation of the crypto market rose 10.8% over the week to $1.184 trillion, according to CoinMarketCap. Bitcoin rose 15% over the week to close at $30.4K. Ethereum gained 9.5% to $1890. Other leading altcoins in the.