Crypto Review - Page 24

October 15, 2024

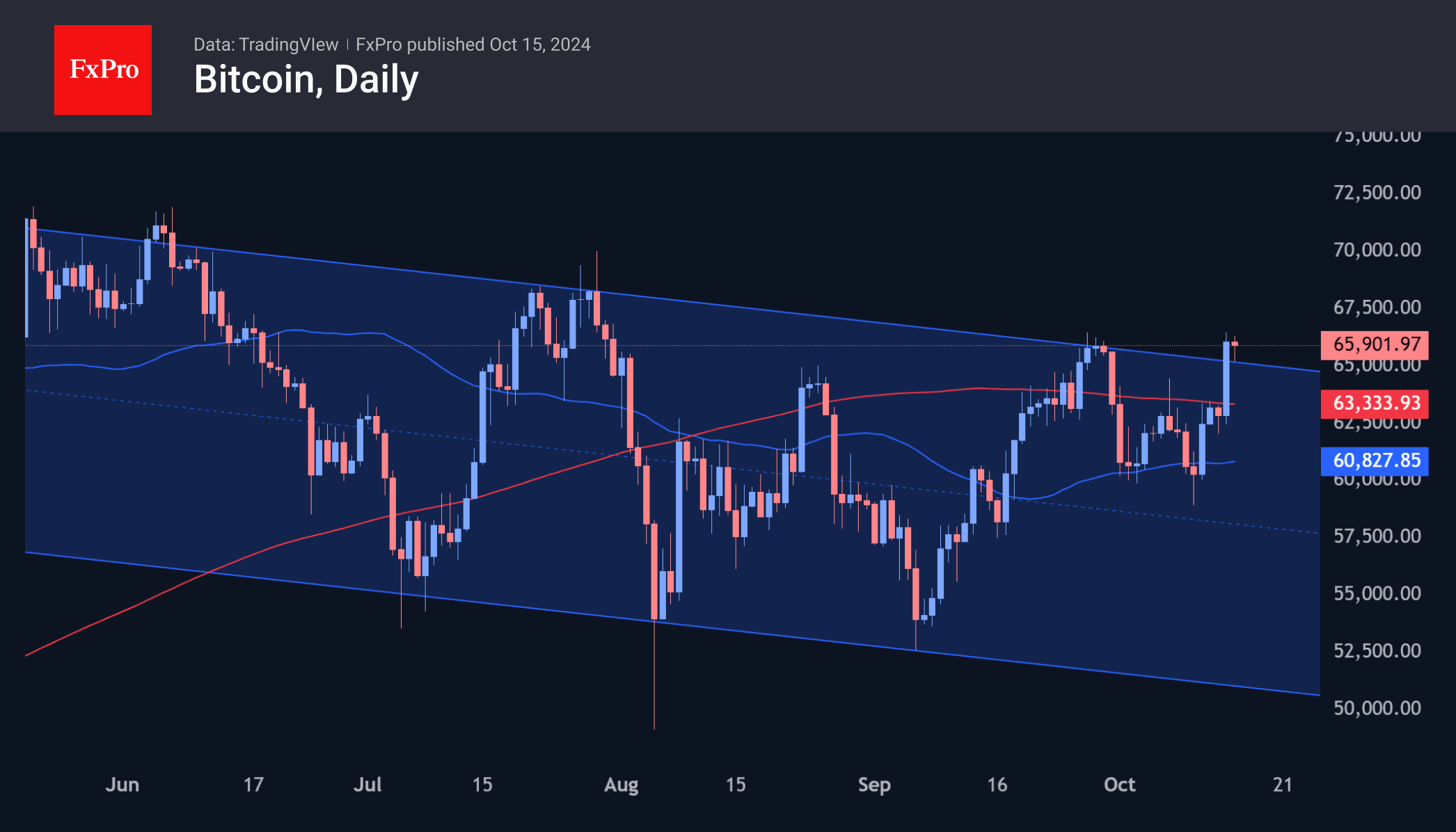

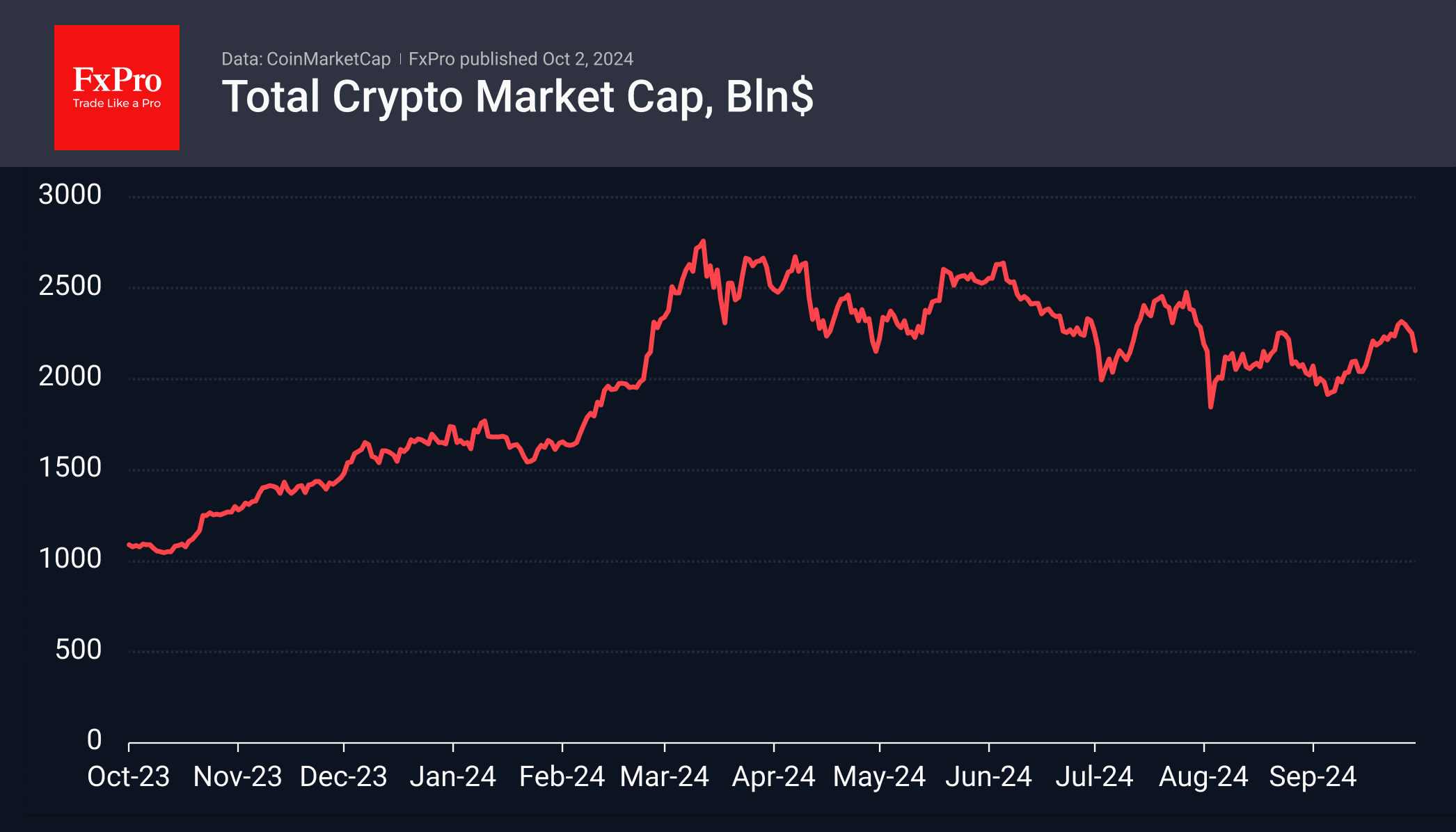

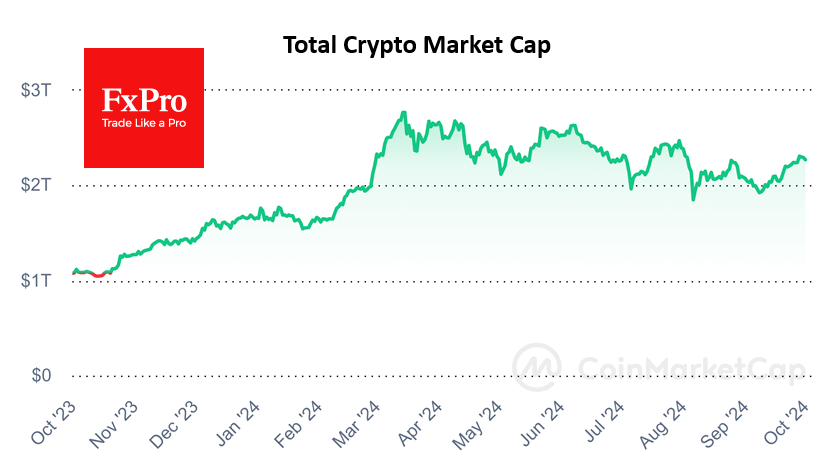

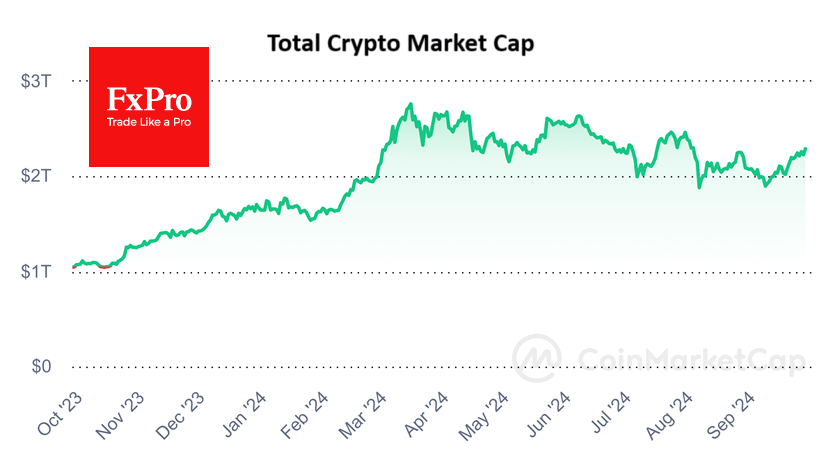

The crypto market reached $2.28 trillion, with Bitcoin trading above $66.5K. Chinese stimulus measures and UAE's approval of a stablecoin are driving factors.

October 14, 2024

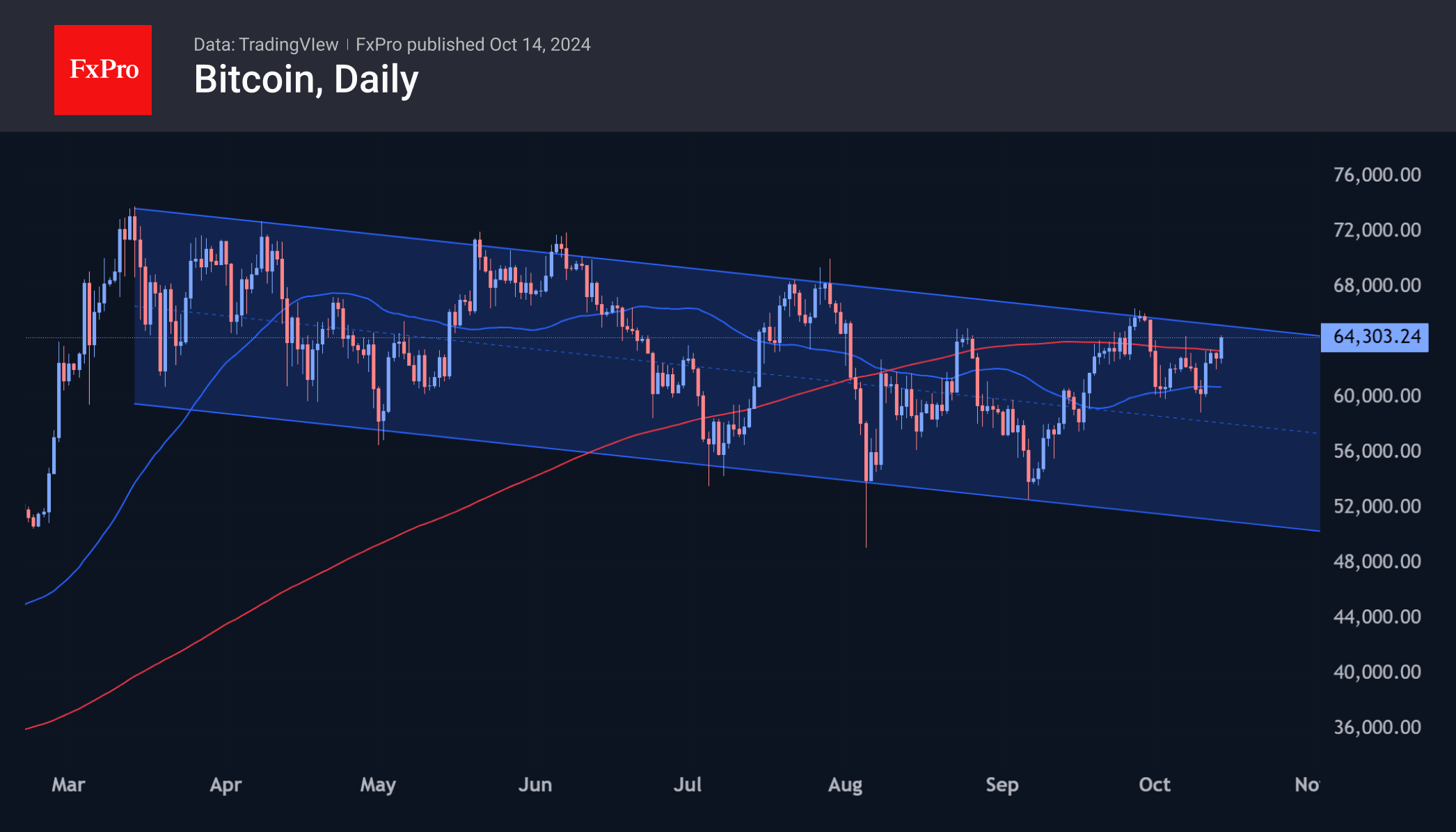

The crypto market is sitting at $2.23 trillion, roughly back to levels of a week earlier. Bitcoin broke above the $64K mark on Monday morning, accelerating intraday gains after breaking through its 200-day MA. Ethereum climbed to $2,500

October 11, 2024

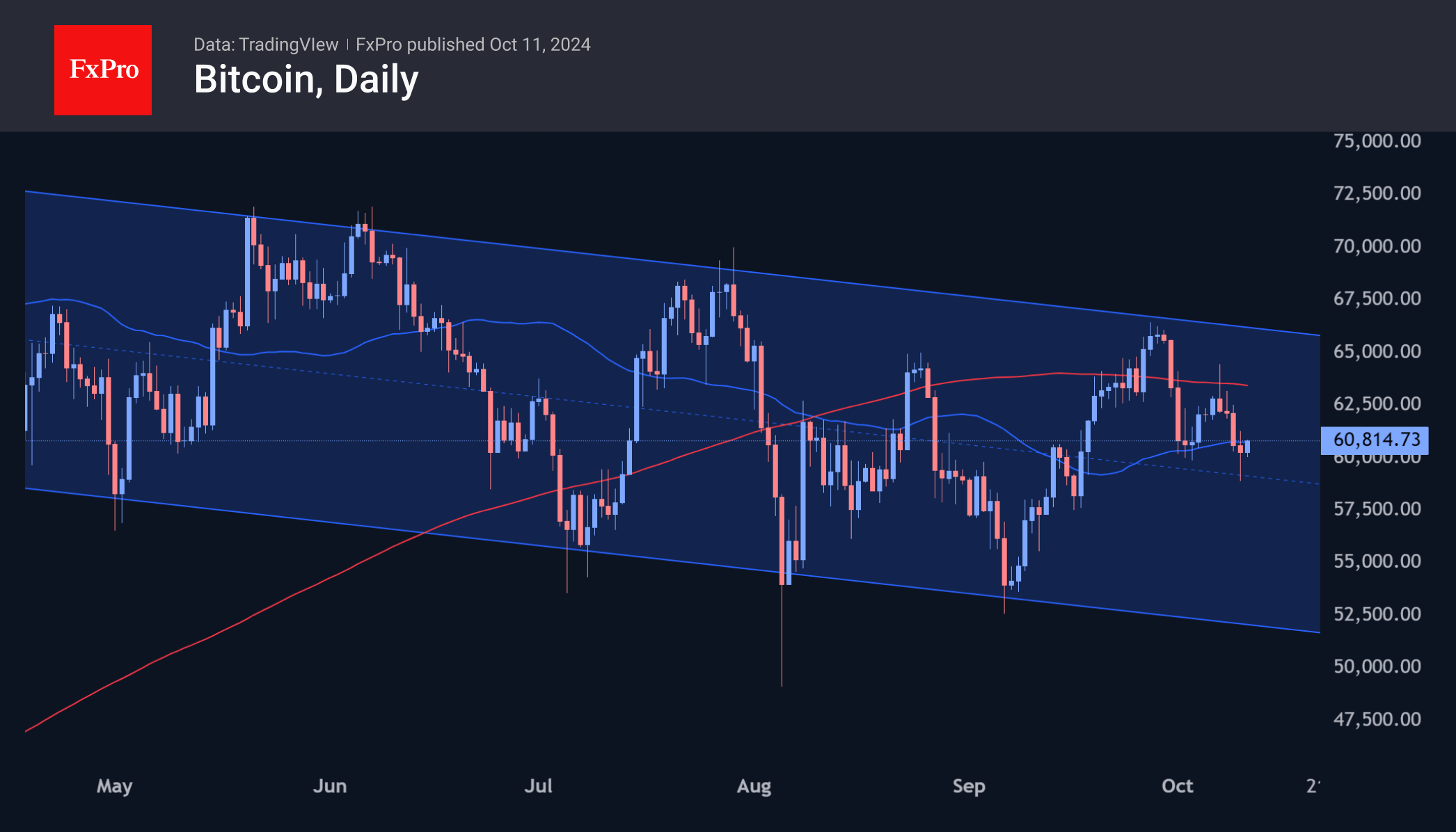

During this week, Bitcoin's intraday momentum has been dominated by declines during the US session. Ethereum has failed to break away from 200-week MA for 9th week.

October 9, 2024

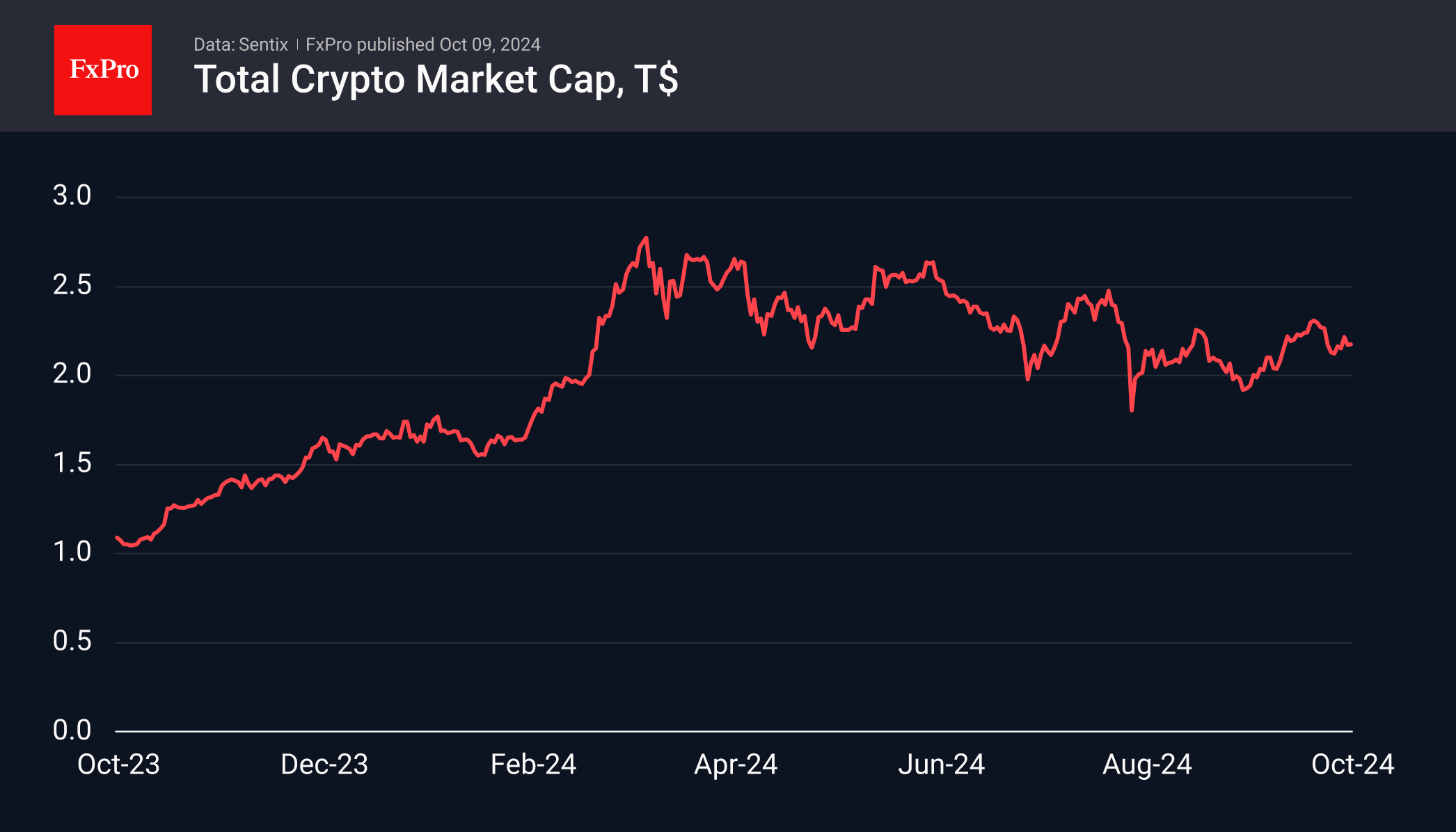

The crypto market has stabilised around the $2.17 trillion level where it was a week and a day ago. Bitcoin sandwiched between the 200-day MA above and the 50-day MA below.

October 8, 2024

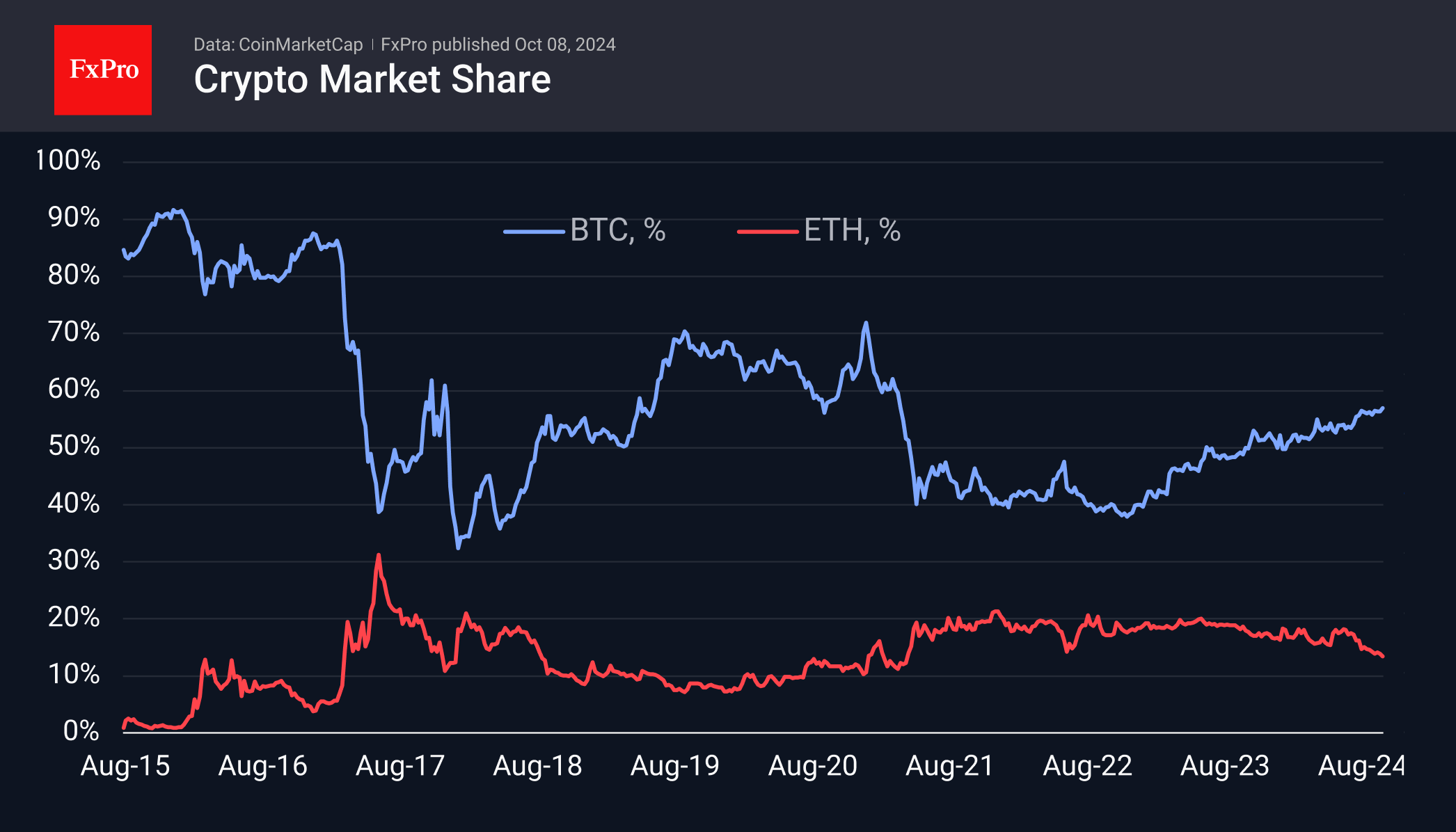

The crypto market rolled back 1.8% in 24 hours to $2.17 trillion due to a reduction in risk appetite. Bitcoin has been gaining crypto market share during such periods.

October 7, 2024

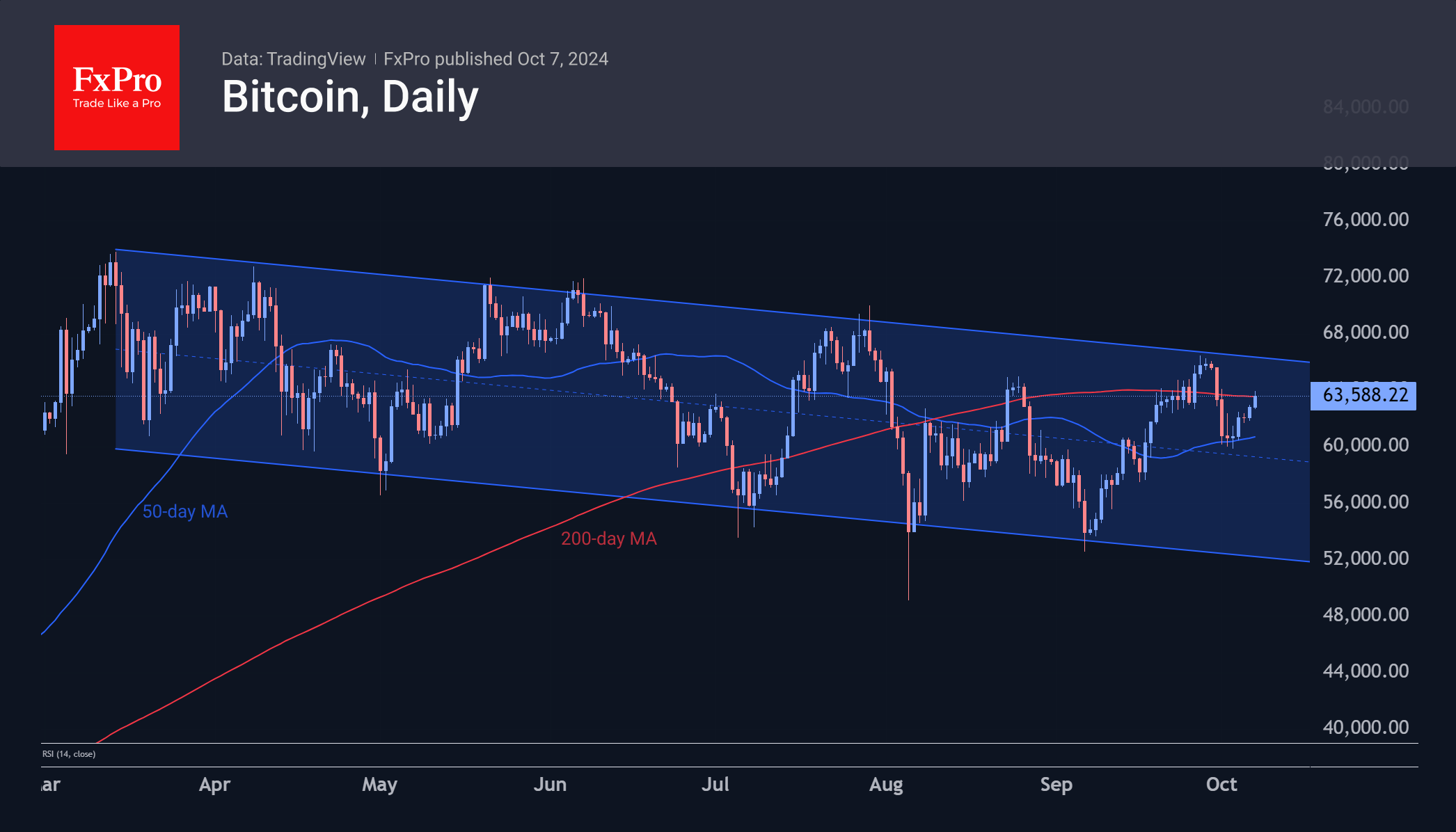

The crypto market is down 3% for the week, but positivity has returned since Thursday when Bitcoin found support at the $60, K level and bounced off the 50-day MA. Ethereum is in a weaker position, approaching the 50-day MA from below.

October 4, 2024

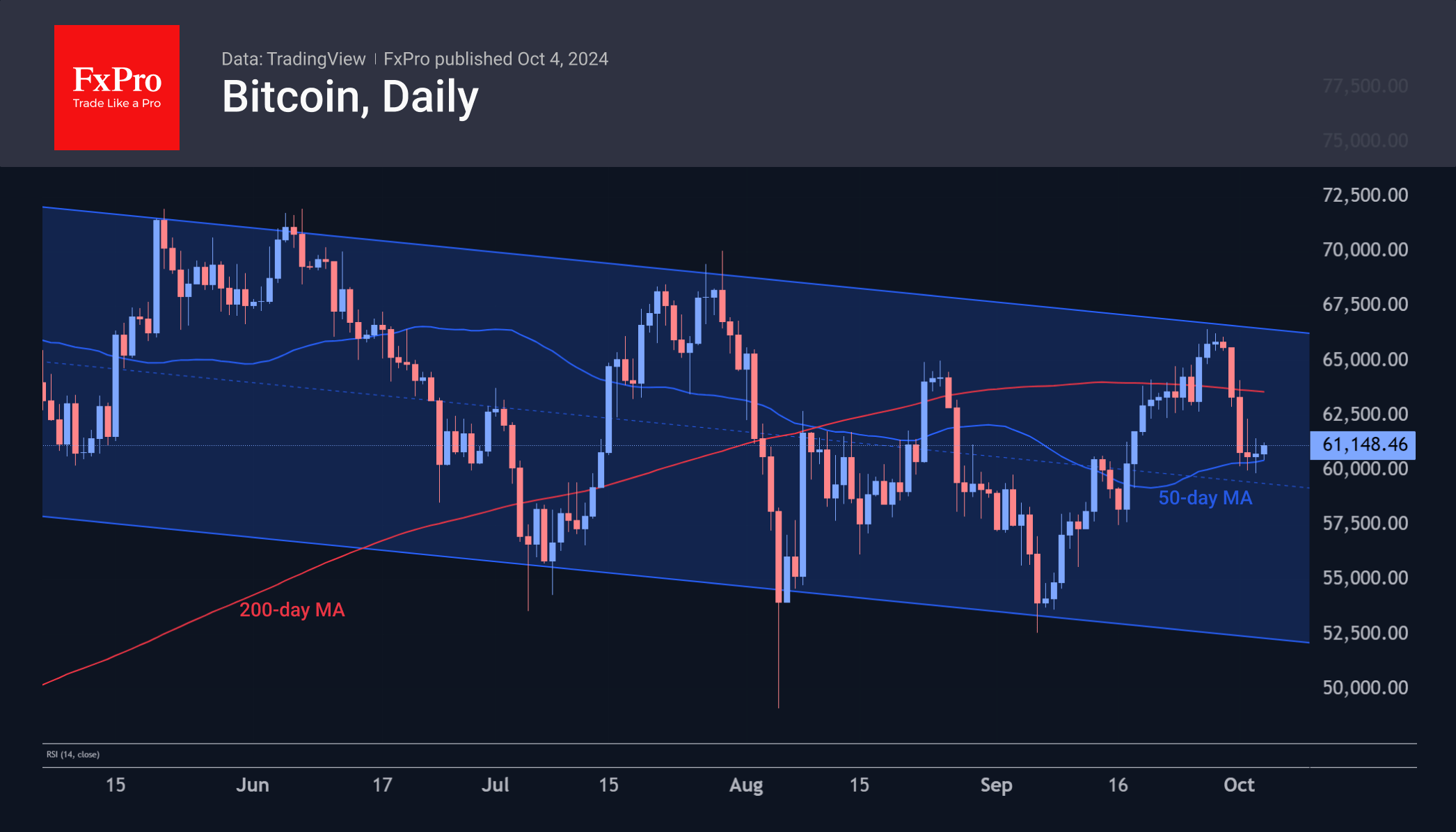

The crypto market has significantly slowed its decline. Bitcoin remains just above its 50-day MA while Ethereum is trading near the bottom of its range.

October 3, 2024

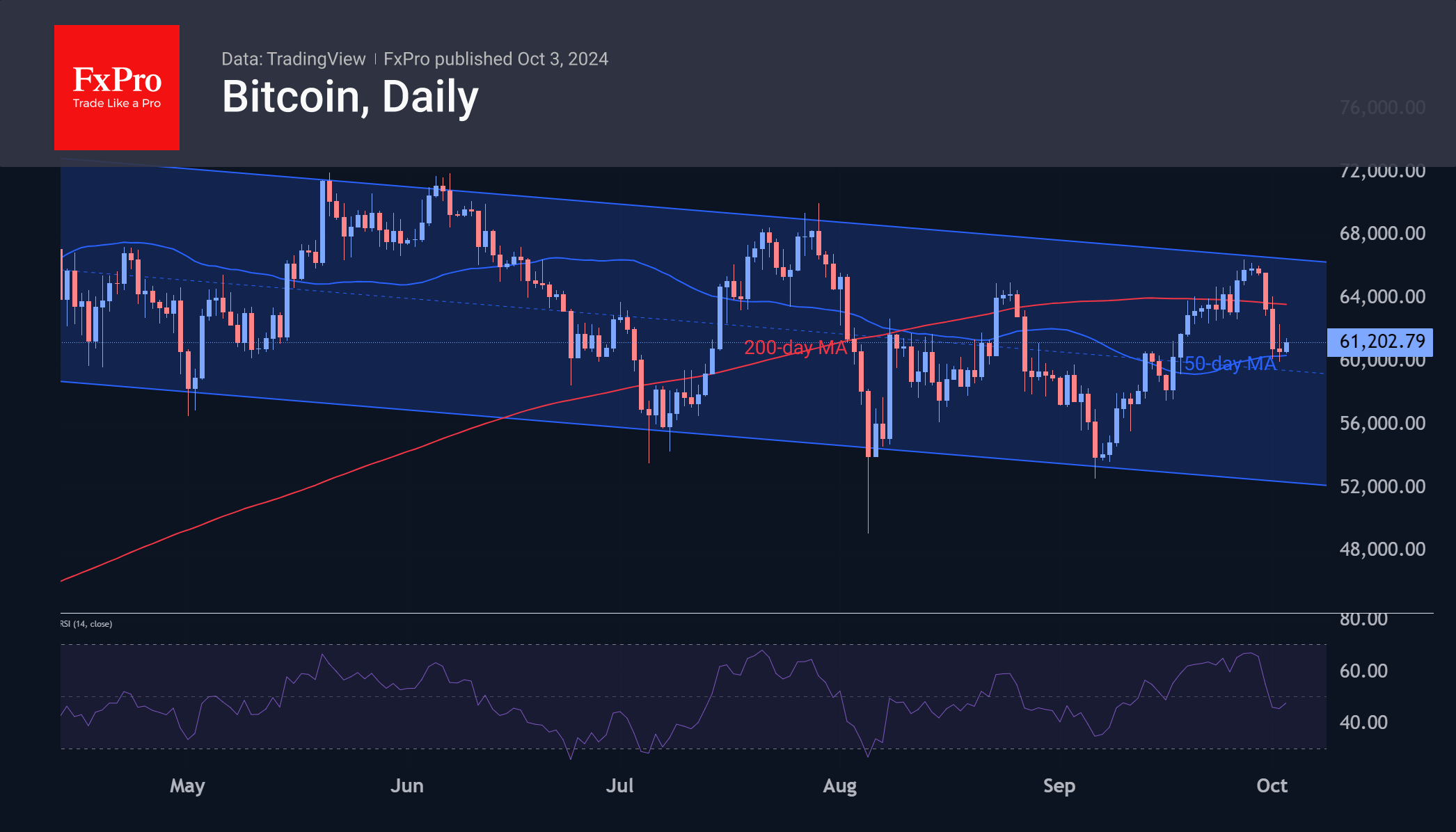

The crypto market lost 1.44% of its capitalisation in 24 hours to $2.13 trillion amid a rising dollar and declines in risky assets. Bitcoin found support at $60K, but XRP continues to fall, having lost around 20% in four days.

October 2, 2024

The crypto market lost 4.2% of its cap in the last 24 hours to $2.16 trillion amid risk aversion over Iran's missile attack on Israel. Bitcoin collapsed below the $61K level, losing around $3,000 (almost 5%) as selling intensified on technical factors.

October 1, 2024

Market picture The cryptocurrency market shed a further 0.7% of its capitalisation in 24 hours to $2.26 trillion, coinciding with a strengthening of the dollar and a short-term fixation in gold as markets reacted to Powell’s hints that the Fed.

September 30, 2024

The crypto market started the week on a defensive note, losing 1.2% of its cap in 24 hours, but is still up 3% on the week. Bitcoin is down 2.6% at $64.0K, but remains close to completing its best September since 2012, having added over 11% since the start of the month.